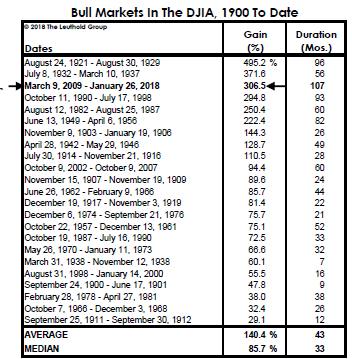

Tomorrow the S&P 500 will celebrate 3452 days or 115 months since its bear market low of 676 on March 9, 2009–officially now the longest expansion since 1900. This table from Leuthold Group sum marizes all the expansion cycles since 1900 up to January 26 2018. Since then of course, the US stock market expansion has continued a further 7 months to reach tomorrow’s 115 month record.

marizes all the expansion cycles since 1900 up to January 26 2018. Since then of course, the US stock market expansion has continued a further 7 months to reach tomorrow’s 115 month record.

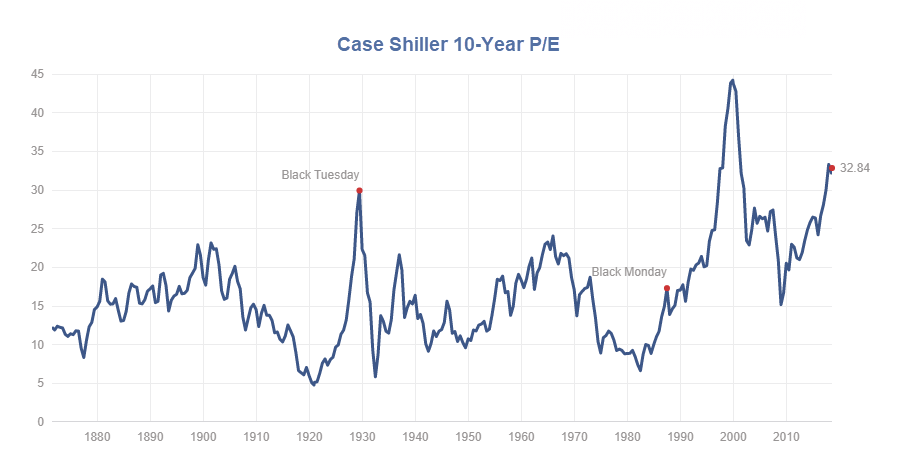

Pundits are arguing about whether or not market corrections of less than 20% in 2011 and 2016 should be rounded up to count as breaks in this remarkable run (more here). But in reality, secular bull and bear periods turn not on price but on valuation. And on the basis of valuation, the recent expansion is one for the ages, as shown below in this chart of the Case Shiller 10-year smoothed price to earnings ratio for US stocks since 1870. Today’s 32.84 reading remains in rare and infamous company–above the 1929 peak and below the all time tech-mania top of 2000.

While extended Fed largesse, setting aside mark-to-market accounting, cost cutting, under-investment in long-term assets and share buybacks have all enabled S&P 500 earnings (net income per share) to surge 300% since 2009, total revenue growth for the same companies was just 30% over the same time frame. Hence, on a price to sales basis, S&P 500 stocks are now trading at a manic 2.2x revenue, and even higher than in 2000.

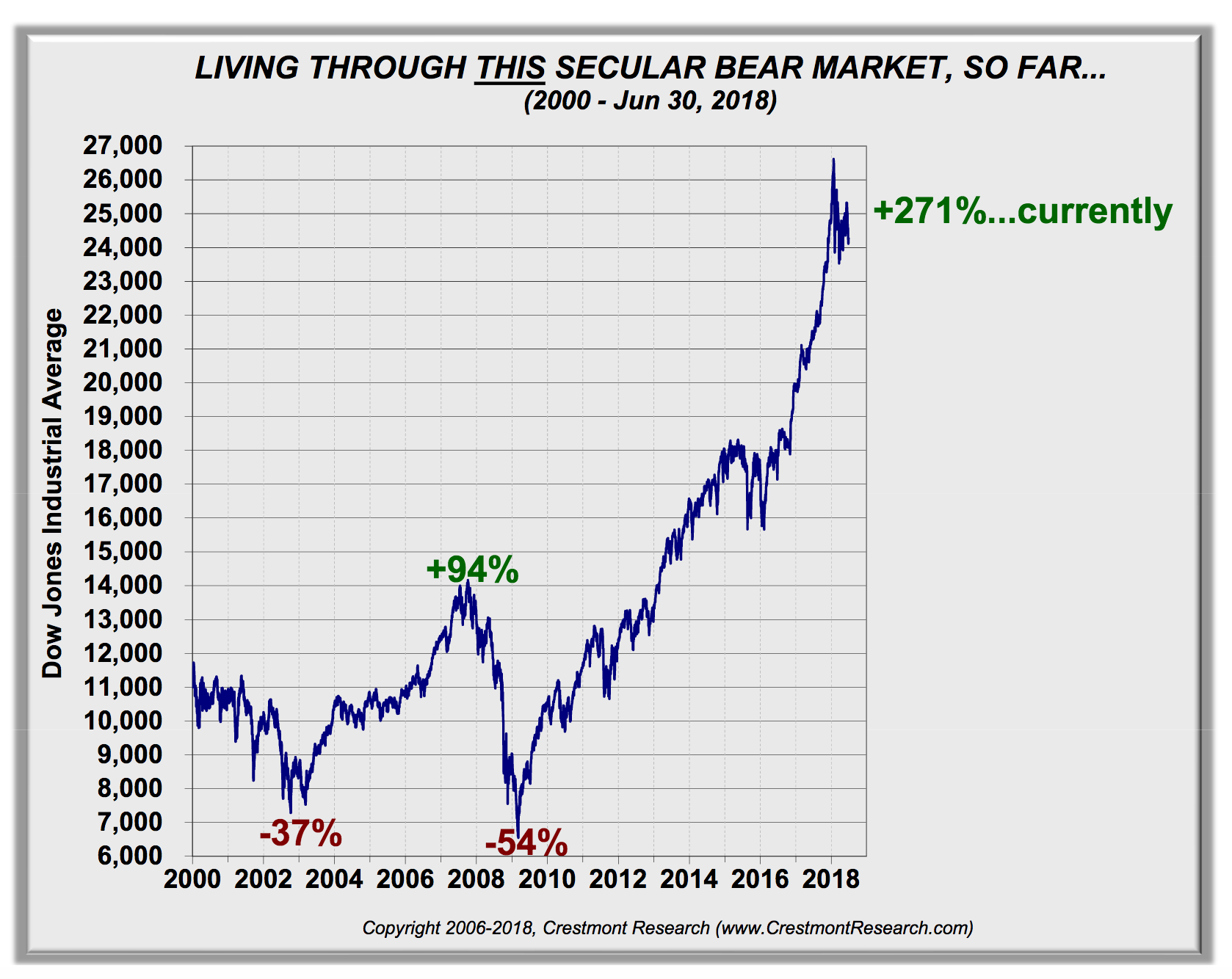

These eye-popping multiples, along with a dividend yield under 2%, all suggest that equity markets are nearing the end of the second cyclical expansion within the secular bear that began from peak valuations in 2000, and are next due for the third cyclical mean reversion within that secular bear. See more here in Ed Easterling’s work at Crestmont Research.com as well as his chart on left showing the Dow price cycles from January 2000 to the end of June.

that secular bear. See more here in Ed Easterling’s work at Crestmont Research.com as well as his chart on left showing the Dow price cycles from January 2000 to the end of June.

While it’s hard for most to imagine, a decline of about 70% from current levels would take this index back to its long-term support in the 7000 range. This magnitude of retrenchment would be in keeping with the past secular mean reversion periods that brought lower lows with each cyclical downturn and finally ended in below average valuations and above average dividend yields that then launched new 15-20 year secular bull (multiple expansion) periods thereafter.

No profit or economic expansion can continue indefinitely because its life blood–credit growth–is inherently finite in its tie to revenue and wage growth. With the latest profit and multiple expansion already much longer than most, peak profits and peak equity valuations are a foreboding combination.

Although long-always proponents and products–that were decimated in the 2000-03 and 2007-09 retrenchments–are declaring themselves genius once more, the truth is that the final verdict on who retains lasting financial progress from this record long expansion will not be known until the next bear market ends. From there we will all take our marks.