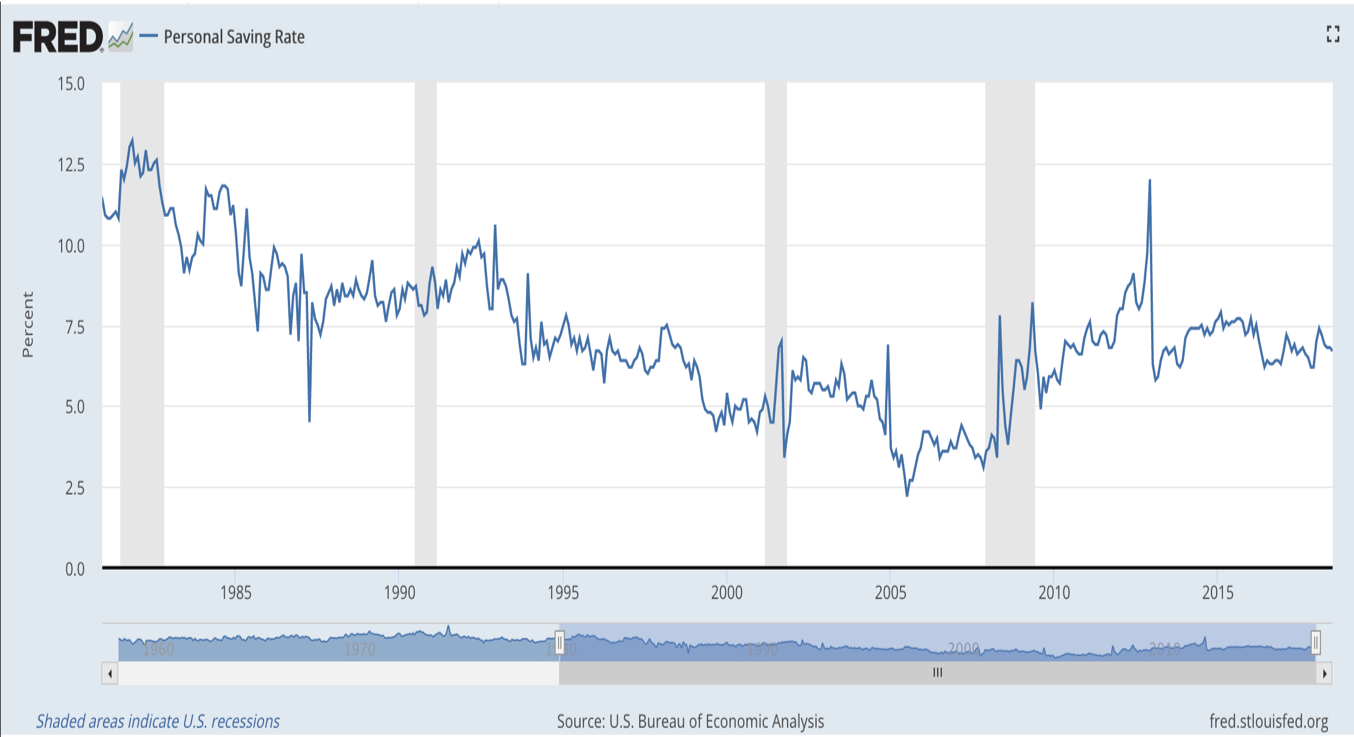

As shown below, the average US saving rate fell from 13% of disposable income in 1981 to 2% by 2005, as US housing prices peaked (and people naively bet everything they could borrow on home prices perpetually leaping faster than the rate of inflation). As the US realty bubble burst and prices fell in 2006 (followed by the stock and corporate debt bubble implosion in 2007-09), the household saving rate moved higher, before stalling around 6% since 2013 even with cyclcial highs in employment and income.

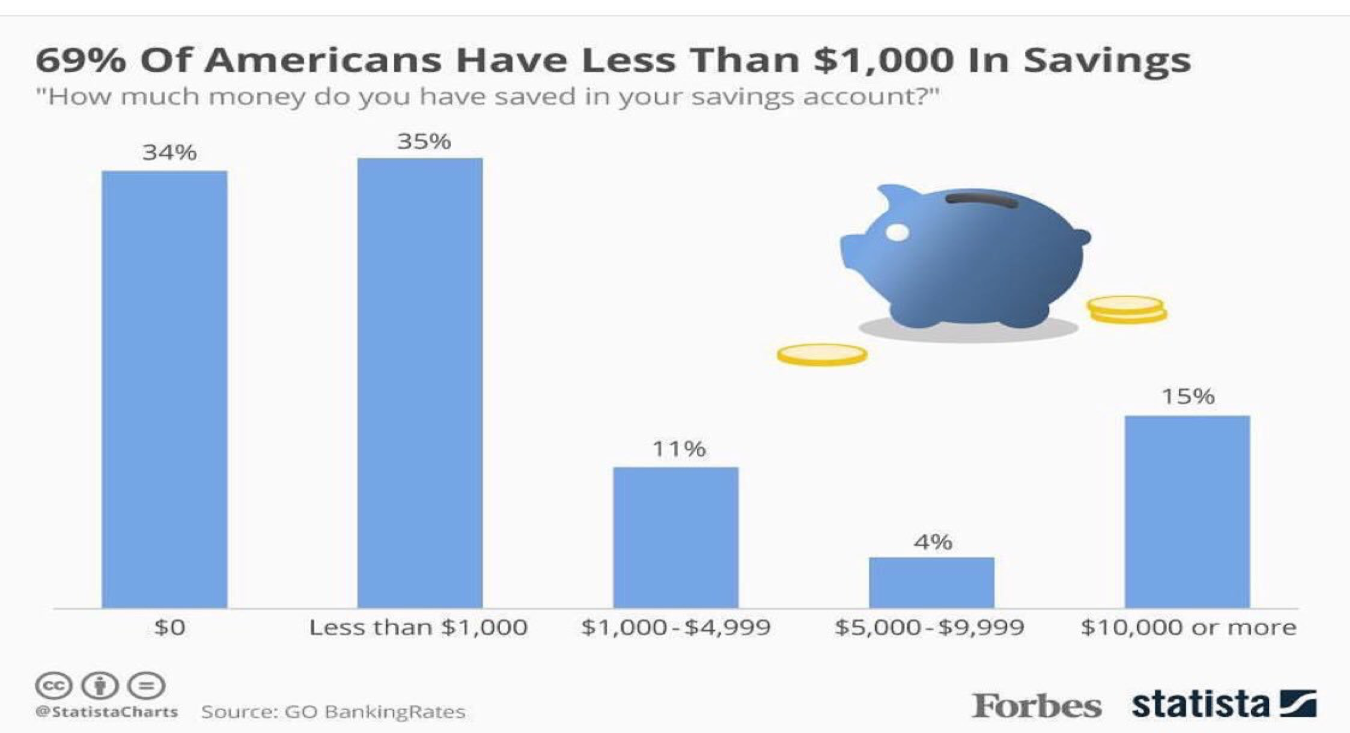

Today, 69% of American adults report less than 1k in liquid savings as shown here.

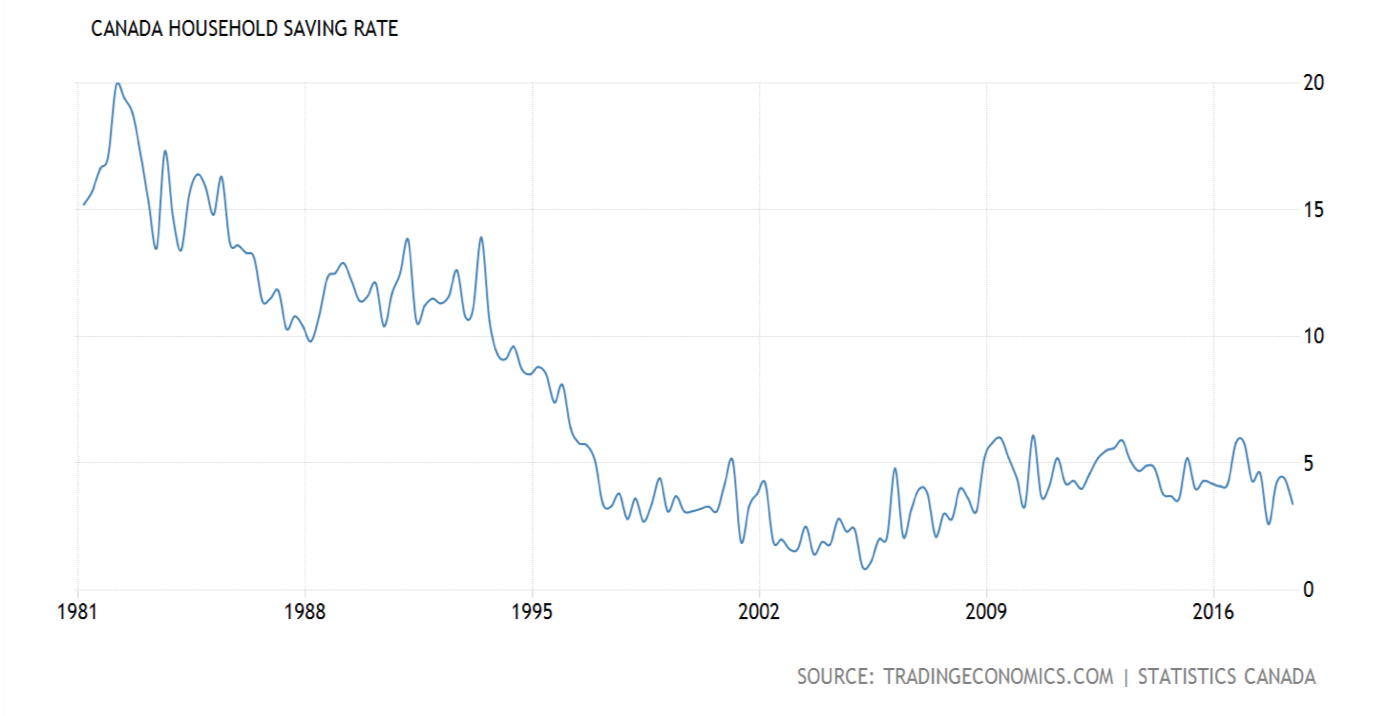

And Canadian stats are not better. As shown below, Canadian savings rates also fell from near 20% of disposable income in 1981 to about 2% by 2005, and remain less than 5% today as Canadians have also naively bet every dime they could muster on perpetually leaping property prices.

Unaffordable housing along with record household debt and muted wage growth over the last decade, have left little disposable income to accumulate as retirement savings or education savings for our children. Hence why young people have become increasingly indebted before they even enter the workforce, making it harder for them to start businesses, buy assets (from downsizing boomers) and start families (future consumption units) of their own.

The gamble-our-way-to-prosperity mentality is self-defeating and the deficits continue to mount. The solution is to focus on lowering debt, risk exposure, and expenses so that we can increase net savings, productive investment and financial stability. A drop in present personal consumption and speculation is necessary in order to enable future spending ability.

Some insightful stats are highlighted in the below segment:

As of January 2017, the average retiree receives $1,360 a month from Social Security. That’s $16,320 a year. About one-third of adults over 65 also collects a pension, but it’s not a large amount of money. The median private pension was only $9,376 a year, according to the Pension Rights Center (state, local and federal pensions were higher).

And those are the lucky ones. Anyone looking to collect more is going to need to rely on their personal savings. That gets me back to the 401(k) and IRAs. That 65-year-old with a median $64,811 in his 401(k) would pull out a little more than $3,000 a year assuming he or she will live at least 20 years more.

Even with stocks at new highs, there’s still a lot to be done on retirement savings, says Pisani from CNBC.