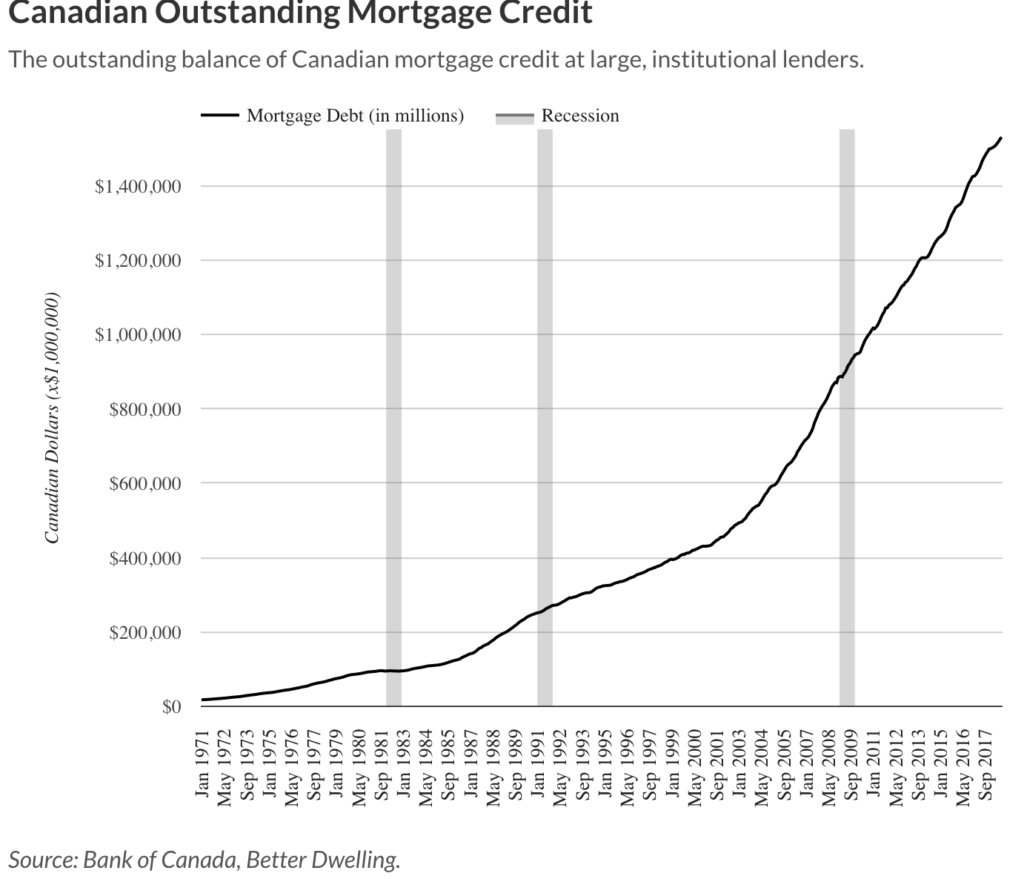

When you have a decade of recklessly low interest rates along with lax-lending and borrowing, it should be no surprise that Canadian mortgage growth went pretty much parabolic since 2008 (as charted below). It should also not surprise that Canada is now encumbered with some of the most over-valued, unaffordable real estate in the world, along with debt-laden households that can barely make ends meet, never mind save or invest for the future.

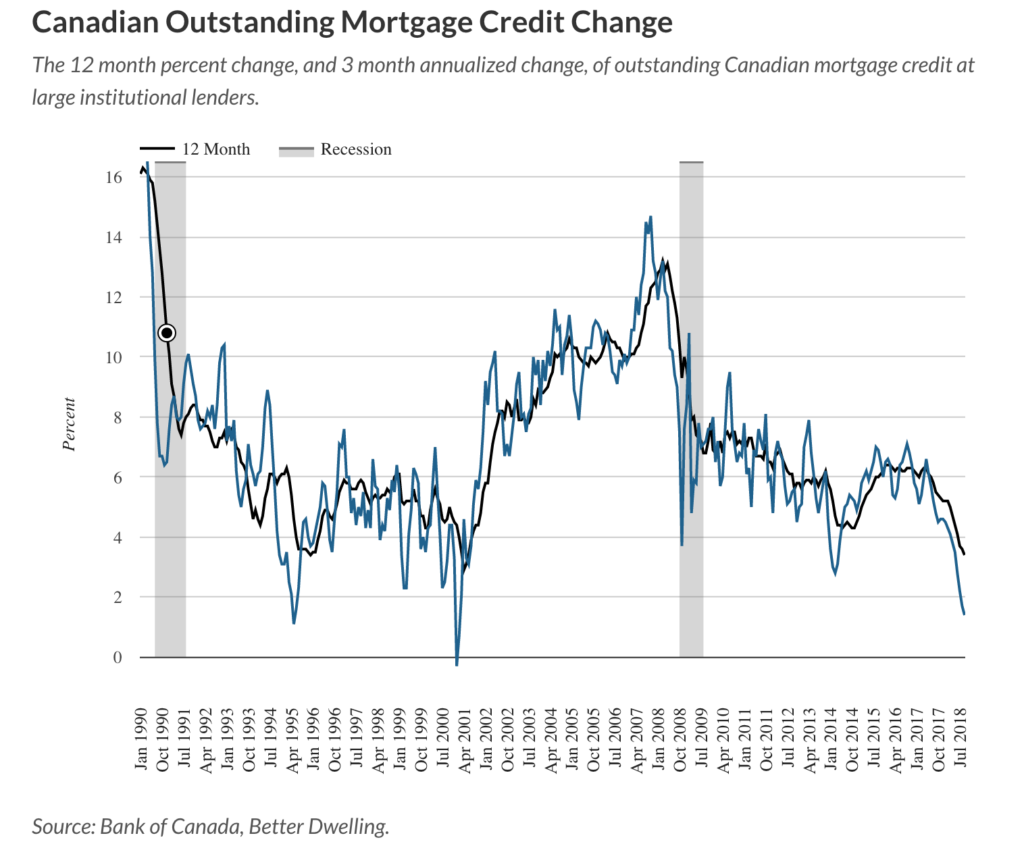

And, when interest rates can’t go any lower and trend up even modestly, we should also not be surprised to see this: “Canadian Mortgage Growth Falls To The Lowest Level Since The Dot-Com Crash” as shown below.

And, when interest rates can’t go any lower and trend up even modestly, we should also not be surprised to see this: “Canadian Mortgage Growth Falls To The Lowest Level Since The Dot-Com Crash” as shown below.

When we know that Canadian household consumption and realty investment have accounted for more than 90% of the nation’s economic growth since 2009, and those sectors are now retreating along with global demand and oil prices, we should be prepared for a synchronous drop in property prices, government taxes, capital expenditures, employment, household spending and financial markets all at once. Who’s ready for it?