Excellent article from Economist Stephen Roach on 30 years of destructive monetary policy and the short-term asset pain that is necessary in order to restore longer-term strength and stability. See: In defense of the Fed. Here! Here!

Predictably, the current equity market rout has left many aghast that the Fed would dare continue its current normalization campaign. That criticism is ill-founded. It’s not that the Fed is simply replenishing its arsenal for the next downturn. The subtext of normalization is that economic fundamentals, not market-friendly monetary policy, will finally determine asset values.

The Fed, it is to be hoped, is finally coming clean on the perils of asset-dependent growth and the long string of financial bubbles that has done great damage to the US economy over the past 20 years. Just as Paul Volcker had the courage to tackle the Great Inflation, Jerome Powell may well be remembered for taking an equally courageous stand against the insidious perils of the Asset Economy. It is great to be a fan of the Fed again.

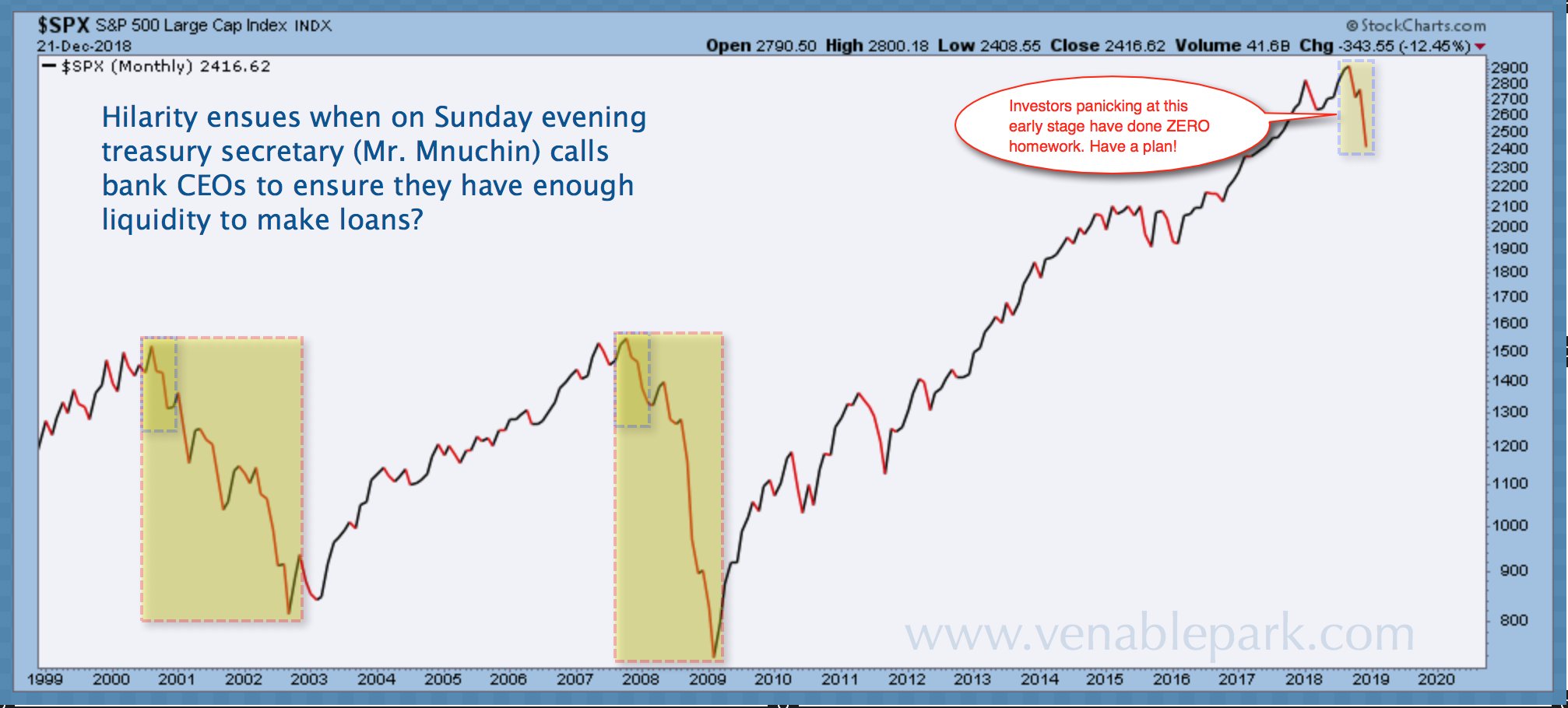

For some much-needed perspective on the S&P 500’s 20% decline since October, that evidently prompted Secretary Mnuchin to call major bank heads on ‘liquidity’ concerns, here is the chart (yellow box on far right below, compared with the past two bear markets on left). We would be wise to remember, that smooth sailing does not build the best sailors. And years of ‘easy money’ have aggrandized fools and enabled widespread idiocy.