The true source of widespread financial instability today is rarely acknowledged by mainstream commentators and their sponsors. Former Senator Heitkamp’s comments on CNBC this week were an exception, see: A tax alone won’t fix the wealth-income gap.

The fact is that we are in the midst of a debt crisis globally.

This has been compounded by corporations, politicians and debt-sellers who never want to see near-term consumption decline and debt fall so that savings can rise. Because people are carrying so much debt, it makes it very hard to save for retirement and other goals. To fix what ails households and the economy, we need to forego some present consumption and near-term corporate profits. Monetary and government policies have encouraged debt creation and financial speculation over the last 30 years at great expense to savings and capital preservation. These policies must be reversed.

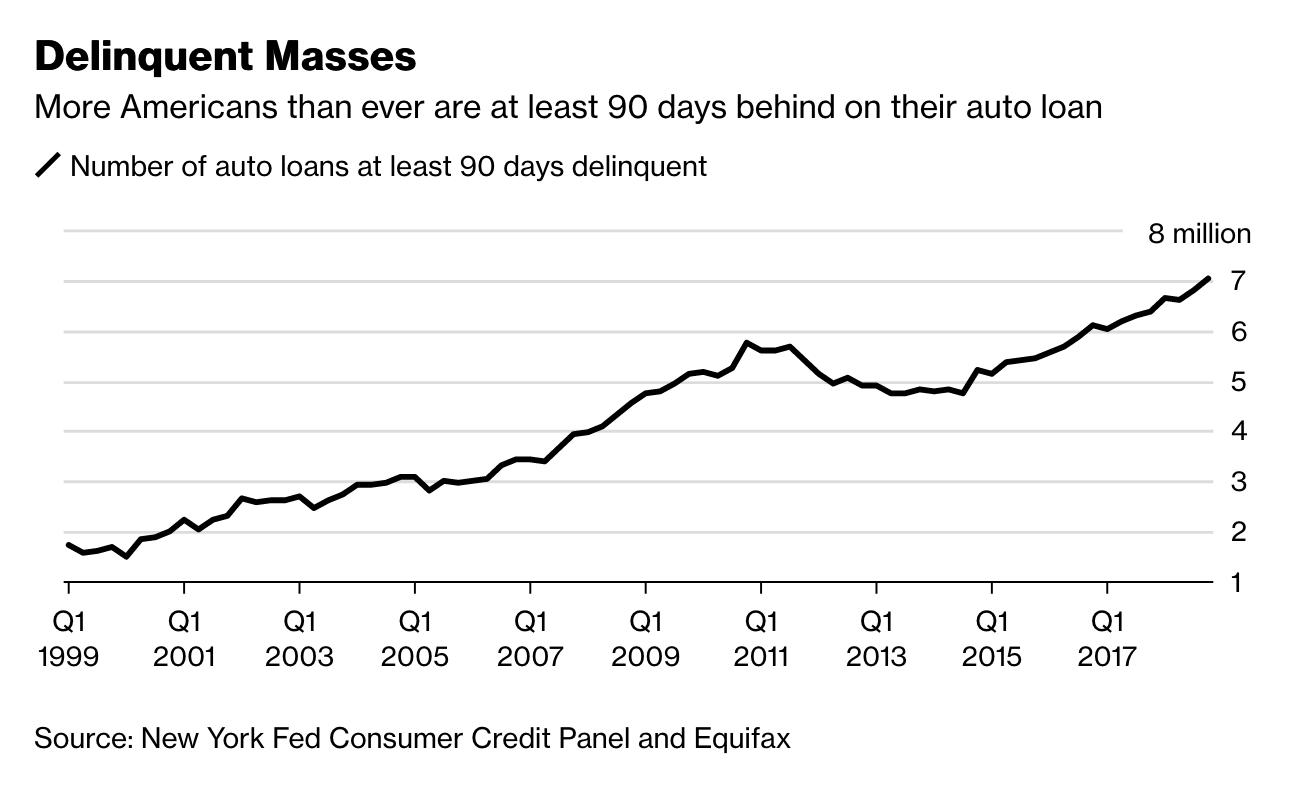

Further to this point, the Federal Reserve Bank of New York reported this week that more than 7 million Americans were at least 90 days behind on their car loan payments in the fourth quarter of 2018 (chart below). This is more than in the 2008 recession when unemployment was a cycle highs. Today, we have record loan delinquencies while the unemployment rate is near a record low. This gives a sense of the economic vulnerability that years of debt abuse have now wrought, see Why the Fed is treading so lightly even in a ‘booming’ economy.