The Consumer Financial Protection Bureau (CFPB) is a US government agency that was founded in 2011 with the laudable mandate of making sure banks, lenders, and other financial companies treat consumers fairly. In practice, however, it has been infiltrated and directed by lobbyists from the very financial sector it is meant to oversee.

A case in point, the CFPB has acknowledged that two-thirds of payday lender customers could not afford to repay the loan when they received it and if the “ability to repay” test is required, then nine out of every ten payday loan storefronts would shut down.

Recent journalist investigations revealed that the CFPB met with and relied on the payday lending industry before it gutted consumer protection rules in this area and then lied about the meetings. Moreover, according to the reports, the CFPB has relied on at least two industry-purchased reports masquerading as independent academic studies (classic industry practice). See more in Dennis Kelleher latest article: Keep industry insiders out of the payday loan rulemaking process.

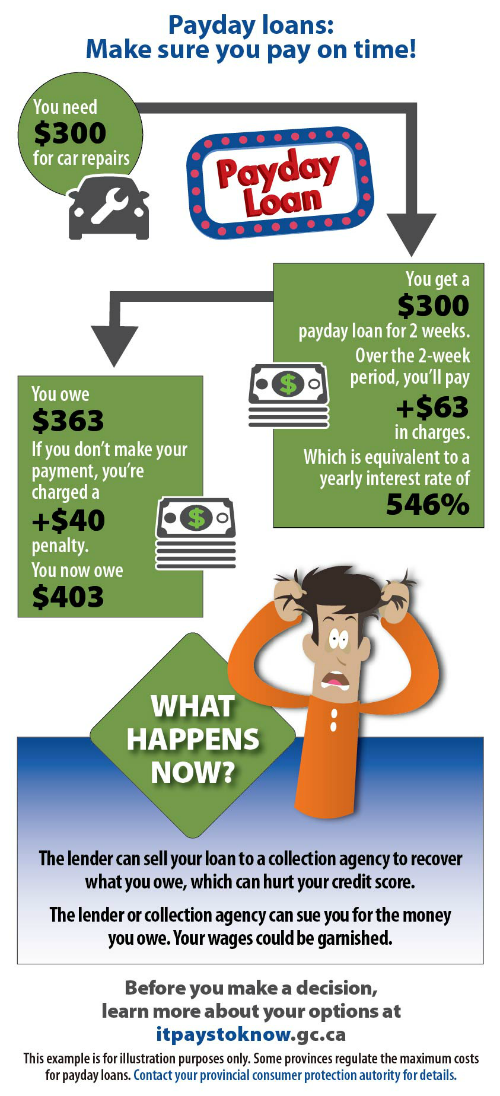

Predatory loan franchises have also been doing a booming business in Canada over the last  decade. And as shown on the left, the government of Canada’s website warns that payday loans equate to an annual interest rate of 546%.

decade. And as shown on the left, the government of Canada’s website warns that payday loans equate to an annual interest rate of 546%.

The obvious question is how such franchises are allowed to operate in a country where usury laws define (compound) annual interest rates above 60% as criminal?

The answer is that in 2007 the Federal Government amended the Canadian Criminal Code (s. 347.1) to exempt payday loans from criminal interest rate limits where provinces enact legislation to govern them. For their part, the provinces have universally failed their duty of consumer protection in favour of profits for predatory lenders.

There is little wonder then that consumer trustees are reporting 4 in 10 bankruptcies in Canada today involve payday loans. See: Can I file bankruptcy for payday loans in Canada?

We will not be able to rebuild the financial strength and stability in society and the crucial middle class until we stop letting financial predators strip-mine vulnerable people and leave social wreckage for taxpayers to underwrite. We must stop enabling criminal interest collectors as legitimate business operations; we cannot afford to continue.