Today North American yields are slightly higher as stocks rebound. But one-day does-not-a-trend-reverse, and overall the Canadian 10-year Treasury yield has declined (as bond prices have risen) from 2.6% in October to 1.96% on December 31 and 1.75% today.

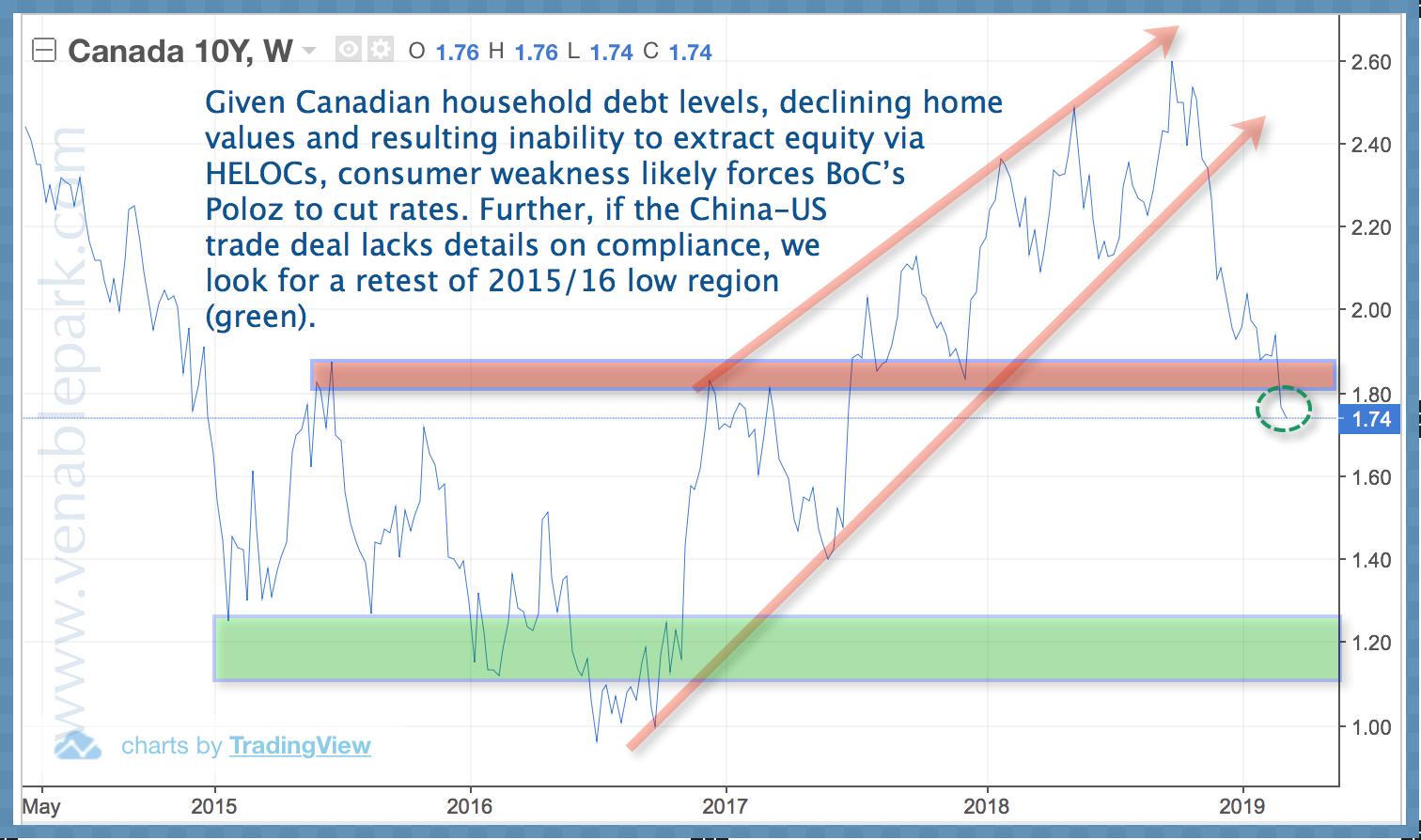

As shown below in my partner Cory Venable’s chart, the fall in yield since October 2018 has now breached the up-channel that had held during Trump’s tax cut euphoria since late 2016. That was then. Now, tax cuts are in the rearview mirror, global demand is disappointing left and right, and central banks are back to easing schemes.

Canada’s highly indebted households and businesses, amid weak housing and slowing global demand, are all reasons for the Bank of Canada to pause its hiking plans and prompt treasury bonds to rally. However, Canada is far from alone here.

As pointed out by Bloomberg’s Lisa Abram0witz today, the market value of Bloomberg Barclays Global Aggregate Negative Yielding Debt index (shown below) has risen sharply since October.

There are now $9.2 trillion in global bonds with negative yields to maturity as holders pay for the privilege of parking cash in these securities. Funds flow into treasuries during periods of risk-aversion, where the return of principle is considered more paramount than return on principle. The rise in negative yielding bonds while stocks have rebounded year-to-date runs counter to the ‘all is well’ narrative.

There are now $9.2 trillion in global bonds with negative yields to maturity as holders pay for the privilege of parking cash in these securities. Funds flow into treasuries during periods of risk-aversion, where the return of principle is considered more paramount than return on principle. The rise in negative yielding bonds while stocks have rebounded year-to-date runs counter to the ‘all is well’ narrative.

As Brexit jousting and US-China trade negotiations drag on and on and on, global credit impulses are contracting along with spending and investment, and stock holders are whistling past the avalanche signs, as usual.

In today’s world of negative-return alternatives, the positive yields and security of North American treasury bonds remain relatively attractive, with prices likely to rise further as stock markets retreat, the global economy weakens, and central banks prove powerless to arrest the fall.