On Friday, markets were spooked when the yield on the US 3-month treasury bill rose to 2.44% while the 10-year treasury yield moved below it to 2.38%. Since investors normally require higher yields for loaning money over longer terms than shorter, this ‘inverted’ yield spread signals a belief that the economy is heading south, and central banks will soon move to cut their short-term bank lending rates to prod more borrowing.

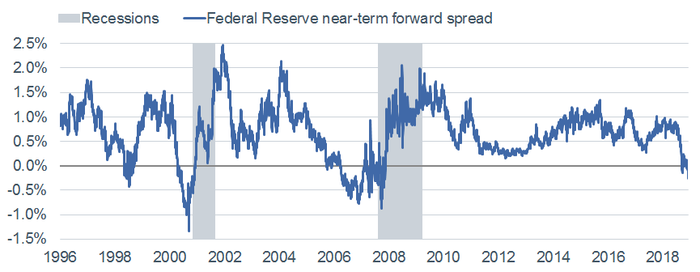

Risk-sellers and long-always financial managers don’t like to talk much about yield curve inversions because as shown in my partner Cory Venable’s chart below since 1995, when this spread goes negative, bear markets for corporate bonds and equities have followed.

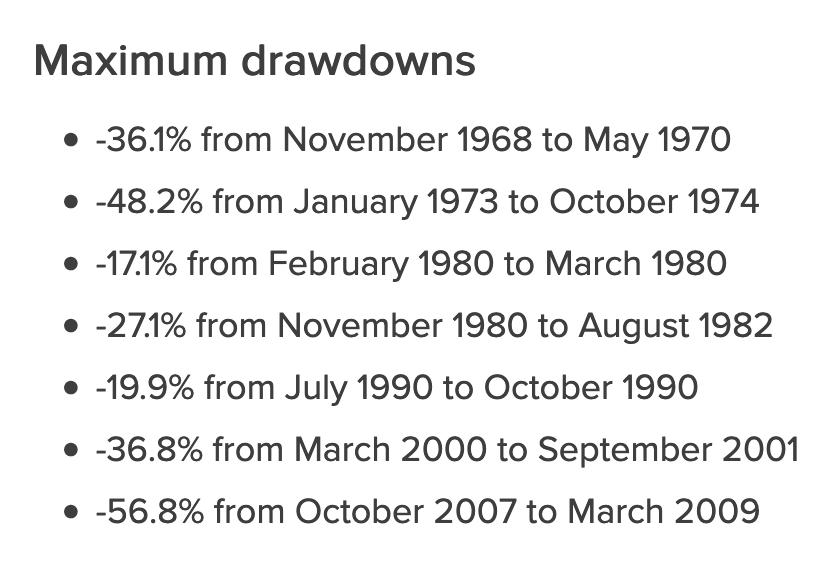

As shown in this table from Charles Schwab, other episodes since 1968 have also marked large in coming loss cycles for stocks (below shown for the S&P 500).

In June 2018, US Fed economists presented a paper highlighting that inversions between the current 3-month yield and the implied forward 3-month yield 18 months from now, is an even stronger indicator of incoming recession than the more commonly followed 3/10 spread.

In June 2018, US Fed economists presented a paper highlighting that inversions between the current 3-month yield and the implied forward 3-month yield 18 months from now, is an even stronger indicator of incoming recession than the more commonly followed 3/10 spread.

As noted by authors Engstrom and Sharpe, when negative, the market expects monetary policy to ease in response to the likelihood or onset of a recession. As shown here from Charles Schwab this spread is today also at a level of inversion last seen in 2008 and 2000.

Perhaps this time is different, but those with savings to lose should be very defensive here.

In general, government bonds or treasuries are little used or explained by mainstream financial types because capital in them usually pays advisors/managers lower fees than allocations to corporate securities, and few have developed any expertise in how to buy and sell them. But treasuries are where institutional money hides when other markets and economies are faltering, so they tend to not only preserve principal and pay their interest coupon, but also rise in value as other assets tank. This makes them one of the few valuable holdings in present conditions.

This clip courtesy of the Wall Street Journal offers more education on the subject.

Amid a shaky marketplace, investors are eyeing the yield curve for signs of economic stability. History shows that when the yield curve inverts, a recession may soon follow. Here is a direct video link.