This morning we learned that US private payrolls posted another disappointing month in March as the job market continued to slow, and Deutsche bank analysts warn that order backlog growth at Caterpillar–maker of earth movers and construction equipment and global-growth bellwether– appears to be turning negative. Negative back-log growth historically precedes a negative earnings revision cycle by three months, and during these cycles, earnings estimates typically get cut by 45%, and shares fall 40% from the peak. Deutsche explained that while Caterpillar management has done a solid job, the global demand cycle has turned against them, see ‘Synchronized global growth has collapsed’:

“Synchronized global growth has collapsed, the China Land Cycle is rolling over (and will continue to weaken despite the single positive data point this week), Europe is slowing more than expected and the US is oversaturated with construction equipment,” analyst Chad Dillard said in a note to clients late Tuesday.”

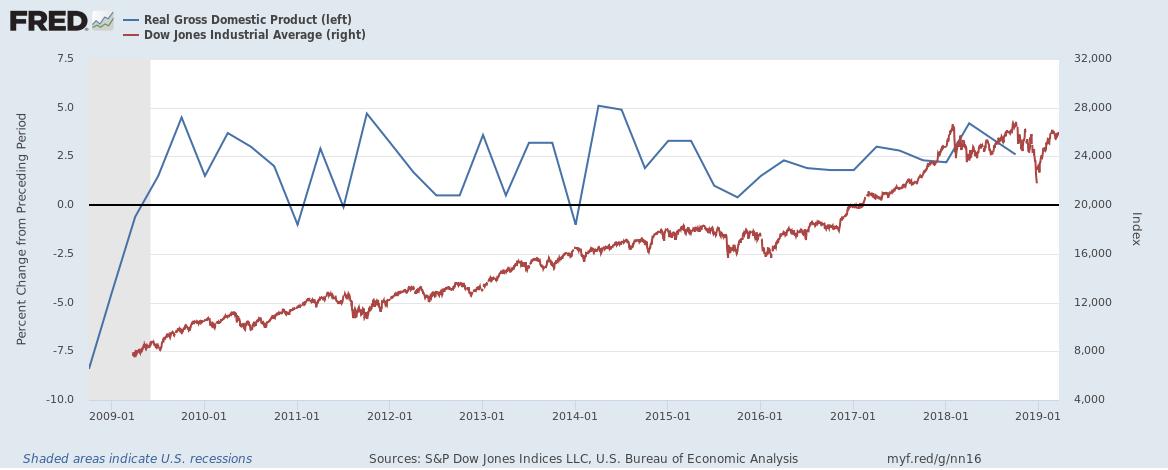

So, while every hopeful headline about an imminent US-China trade agreement or Brexit resolution sparks rallies in algo-driven stock markets, the truth is that countries are negotiating how to share a steadily shrinking pie of global revenues and demand was already tepid coming into this downturn. The below chart of US GDP growth since 2009 (in blue) confirms the lacklustre trend for the last nine years, as well as the latest rollover since 2018 and the sideways move in stocks since (Dow Jones Industrial Average in red).

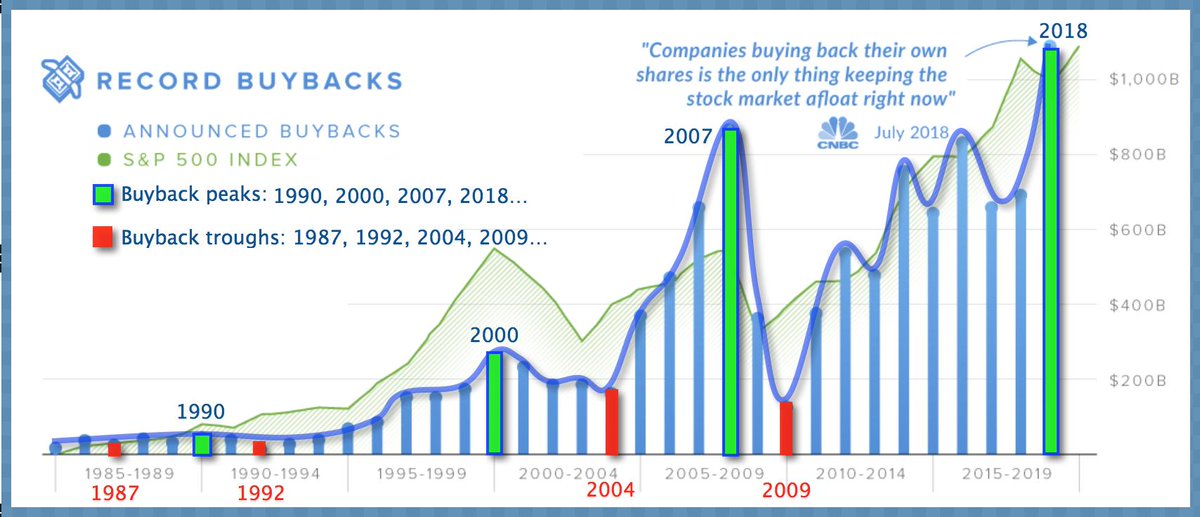

This is particularly noteworthy since the flatline in stocks has happened while US corporations have continued to plough record amounts of borrowed funds and cash flow into the black hole of share buybacks (at record valuations), below in green in 2018 compared with other market tops in 2007 and 2000, and buyback troughs near market lows in 2009, 2004, 1992 and 1987.

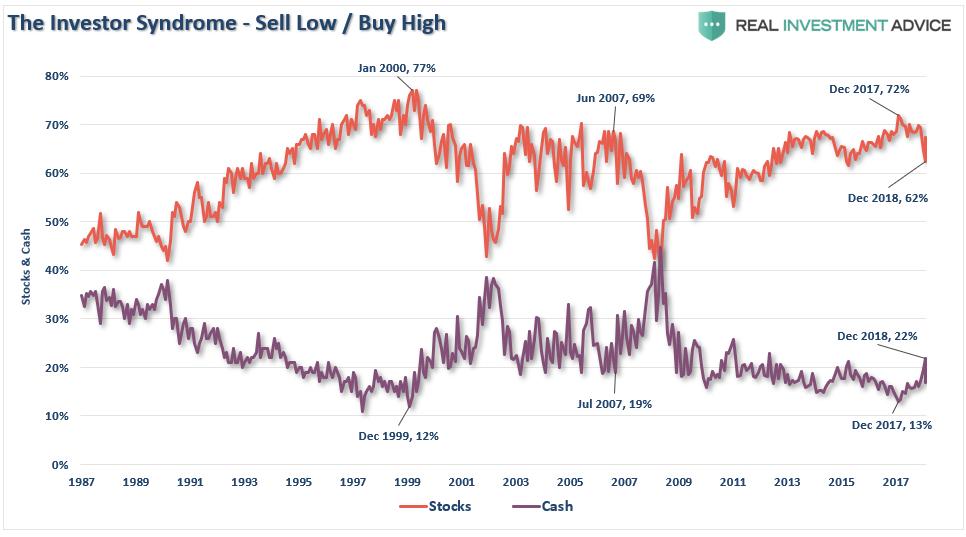

This sustained buying pressure enabled by central bank rate suppression was finally successful in enticing outside buyers back into risky assets late this cycle. As shown below, the percentage of savings allocated to stocks hit 72% (orange below) at the end of 2017, with liquid cash just 13% (in purple, similar to the 12% all-time low in December 1999).

The bottom line is that corporations, individual investors and pensions have never been more exposed to the incoming contraction in global spending and risk markets, and so financial pain will compound as this cycle moves to its natural conclusion.