Financial markets experience loss cycles of more than 20% routinely, but it’s not inevitable that individuals do the same. Effective financial management has rule sets to help anticipate down cycles and positions to benefit from them. Most participants have no plan or strategy to do so, however, because mainstream theories, products and approaches are long-only. And yet, avoiding losses and buying assets cheap are the most defining imperatives of investment results over an individual’s life cycle.

As A. Gary Shilling explains in his book The Age of Deleveraging: Investment Strategies for a decade of slow growth and deflation, it is more important for savers to miss losses than it is to participate in gains. Believe it or not.

Since December 1946, the compound returns of those who were able to miss the 50 worst market months dramatically outperformed participants who stayed long through up and down months. This is the case, even if a participant missed the 50 strongest market return months completely. Here’s Shilling:

“This is extraordinary–better performance even though the 50 months of greatest market advance are excluded. The 50 strongest months witnessed less gain than the declines experienced during the 50 weakest months. Being out of the market in the weakest months is very beneficial, even if the investor also misses the strongest months. Stocks fall in bear markets much faster than they rise in bull markets. This fact is extremely comforting to anyone trying to time the market since he can hardly expect to be in cash in the biggest down months of bear markets without also being absent during some of the frequent final blow-off months of the bull markets that precede them.

…the moral of this exercise is clear: It’s profitable to be in stocks during bull markets, but it’s even more profitable to be short stocks, or at least out of the market, during bear markets–even if many of the major bull market months are missed completely.”

This math becomes even more pivotal once we factor in the reality that the bulk of our savings tends to amass later in life when individuals have less time and opportunity to replace and make back lost capital.

The last decade has seen the longest financial market expansion in history, and still, most participants have no plan other than to hold and hope it continues indefinitely. This is irrational and financially suicidal. For more perspective on the current cycle and downside opportunities due to unfold, see Crescat Capital’s recent letter Necessary, Normal, and Inevitable:

Recessions are necessary, normal, and inevitable. The longer they are postponed through government intervention, the greater the mal investment, the bigger the speculative bubbles, and the more violent the downturn.

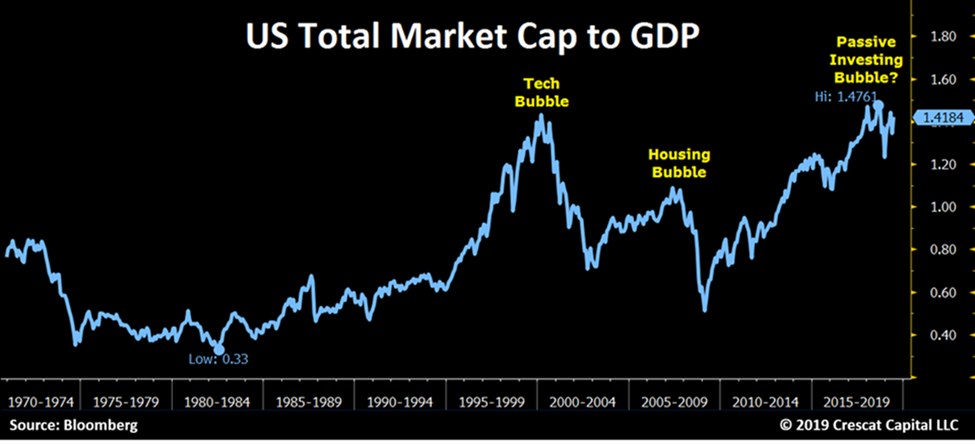

…Asset bubbles are much bigger today than they were in late 2015, particularly the US stock market. Michael Burry of Michael Lewis’ Big Short notoriety recently made a call in a Bloomberg interview that we are in a passive indexing bubble that will end like the subprime CDO debacle that led to the global financial crisis. In the history of the Wilshire 5000, the total US stock market index, stocks recently reached their most expensive ever relative to the underlying economy, higher than the peak of the tech bubble in 2000…

With the latest excesses in passive investing, the world has reached a level of gross valuation ignorance that could make the coming bear market particularly brutal.