Giving a lecture in Washington at the annual meeting of the International Monetary Fund last week, former Bank of England governor Mervyn King warned that the world is “sleepwalking” towards the next financial crisis with no fundamental questioning of the ideas that led to the crisis of a decade ago. No suprise here. In King’s words:

“Another economic and financial crisis would be devastating to the legitimacy of a democratic market system. By sticking to the new orthodoxy of monetary policy and pretending that we have made the banking system safe, we are sleepwalking towards that crisis.”

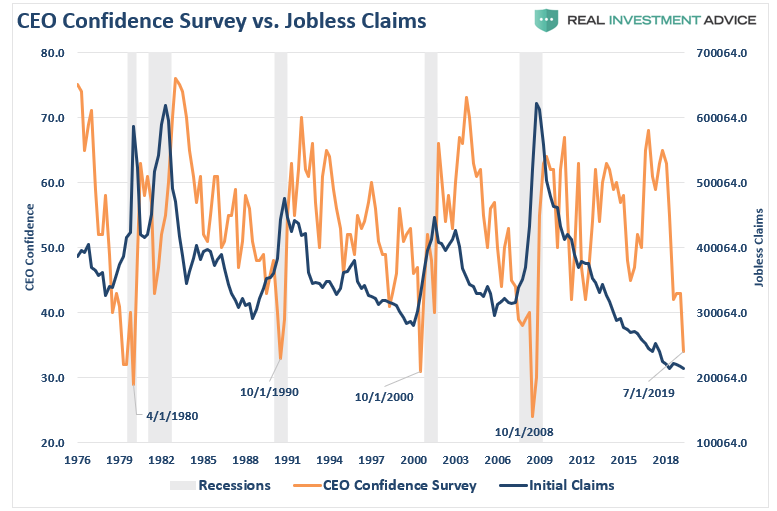

In other news, CEO pessimism is wide awake. Lance Roberts explains that CEO confidence tends to lead job losses and consumer confidence in CEO Confidence Plunges, Consumers won’t like what happens next. His chart below shows the correlation since 1976 between CEO confidence lows (orange) subsequent spikes in jobless claims (blue), and recessions (grey bars).

Goldman Sachs, meanwhile, is warning that share buybacks–the main source of equity inflows over the past five years–are “plummeting.” Second-quarter S&P 500 buybacks were 18% less than Q1, and over the last year have fallen 17% from the year before. In 2020, a further decline is predicted. See Goldman Sachs warns that buybacks are “plummeting,” ending a big source of buying power for the market.

In addition, a recent Duke University study found that the majority of CFO’s (the number crunchers) expect the U.S. will be in a recession within the next year and are looking for ways to pull in spending.

What do Goldman Sachs and other product sales franchises recommend investors do as corporate spending and earnings plummet? Why, buy and hold dividend stocks, of course. No conflicts of interest there!!

Goldman points out that the median yield for S&P companies is forecast to be 2.2% in 2021 (because prices are sky-high), while the median dividend in the Goldman Sachs Rising Dividend Growth Fund is expected to be 4% (before fees). While hoping for a 3% net yield to holders, no mention is made of the probabilities for significant capital losses in the process.

After a decade of falling interest rates, dividend-paying stocks are some of the most egregiously over-valued assets on offer in the world today. During both the 2000-03 and 2007-09 bear markets, dividend-paying stock prices halved. It is naive to expect better performance this cycle.

A 2 or 3% dividend (which can be cut at any time when companies need to) is unattractive compensation for sacrificing chunks of principle and then spending years trying to grow it back.