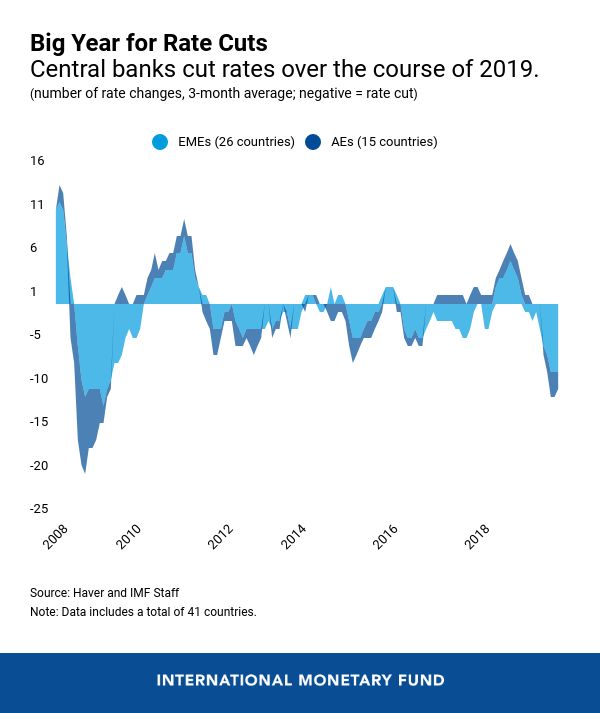

Globally, central banks undertook monetary easing efforts in 2019 by the most since the 2008 financial crisis as shown in the chart below courtesy of the IMF.

This enabled unsustainable deficits , debts, businesses and financial Ponzis to continue a while longer and made the global economy and markets more correlated and vulnerable to inevitable shocks.

, debts, businesses and financial Ponzis to continue a while longer and made the global economy and markets more correlated and vulnerable to inevitable shocks.

In reality, central bank balance sheets are tiny relative to the few hundred trillion in asset markets globally. And monetary placebos are only effective so long as they are believed. When the herd turns from manic to panic, central bank offsets are insufficient.

Today, pandemic fears join the foreseeable secular headwinds of climate change, political upheaval, falling birth rates, aging developed world populations, mean-reverting corporate profits (lower), tax rates (higher), financialization, central bank powers and globalization (all receding), and creative destruction of status quo systems and beliefs. The world in 2030 promises to look dramatically different than the world in 2020, and most are woefully underprepared for the changes afoot.

Like other financial markets, a decade of asset inflating policies has also made global home prices–the most widely held asset in the world–increasingly synchronized. While this was cited as progress on the way up, the IMF warns that it also magnifies fragility on the way down, as reported by the Wall Street Journal in New Cloud over Global Growth: Synchronized Housing Slowdown:

Mr. Martínez-García said there is a point at which lowering long-term interest rates can no longer effectively prop up residential investment. “We might be reaching that point,” he said.

And lower interest rates may be less effective given long-run restraints on housing such as the slower global growth expected over the next few years, property regulations and declining fertility rates. Supply is constrained in many cities where workers want to live. These factors are common to many countries, another reason the housing market is now globally synchronized.

Global growth was weak and slowing into 2020, and Coronavirus will doubtless magnify that trend as trade, travel and consumption are hurt by this unexpected shock. But it’s highly correlated, highly-leveraged, hyper-inflated asset markets, and rock bottom interest rates, that present the greatest contagion risks for the global economy today.

As the People’s Bank of China injected another round of monetary elixirs into the financial system last night, defaults are spreading and Chinese stocks went limit down nonetheless. See China’s rate cuts in response to coronavirus ‘too marginal’ to help economy.

Monetary placebos can have some effect so long as they’re believed. But, in truth, central banks have no vaccine to prevent global financial contagion, and that realization is certain to spread.