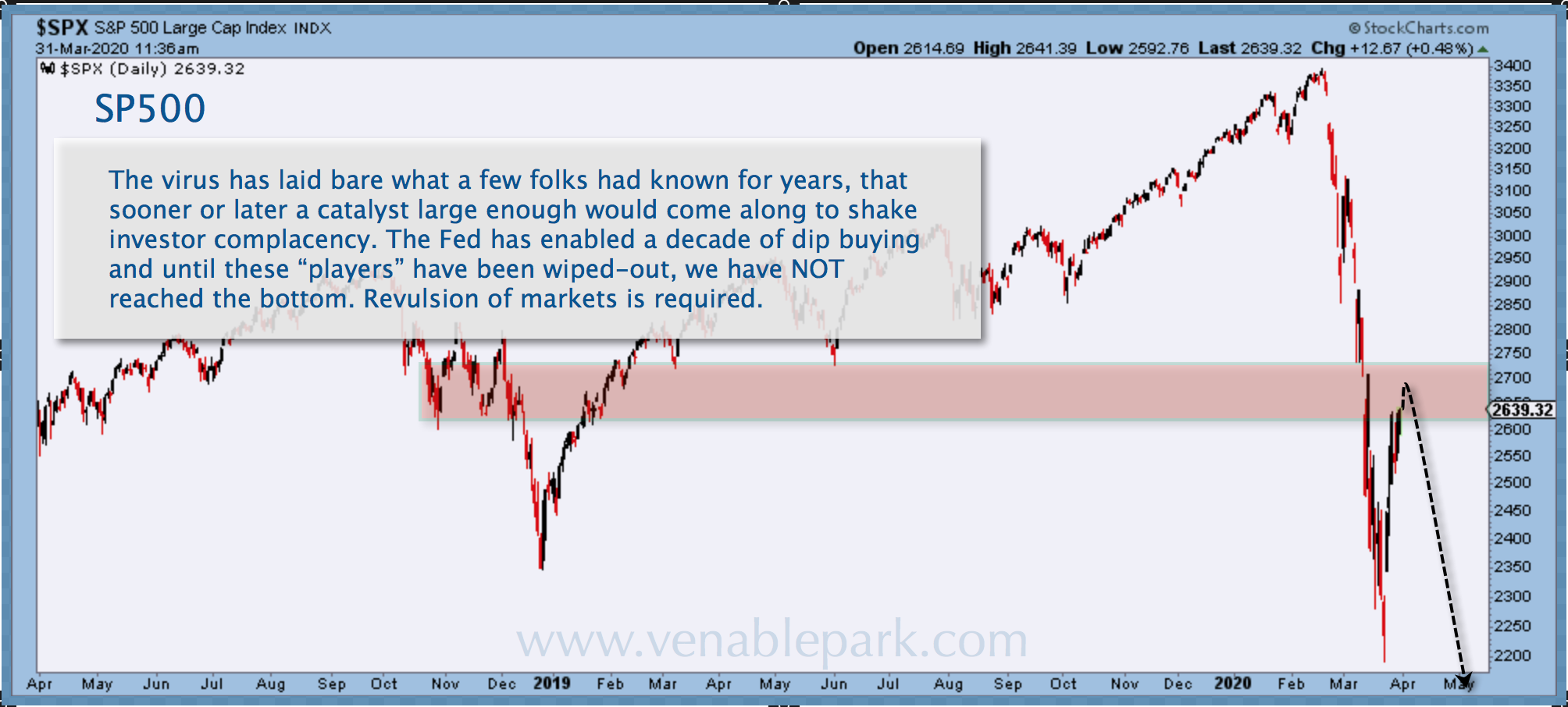

A lot of shorts getting covered today across most risk assets and yields and this has driven yet another dramatic rebound day. These are expected given the rapid price declines between Feb 19 and March 23.

On March 31st, my partner Cory Venable highlighted 2625 to 2725 as a rebound test for the S&P 500 (pink band below). At 2661 this afternoon, we are nicely into the zone.

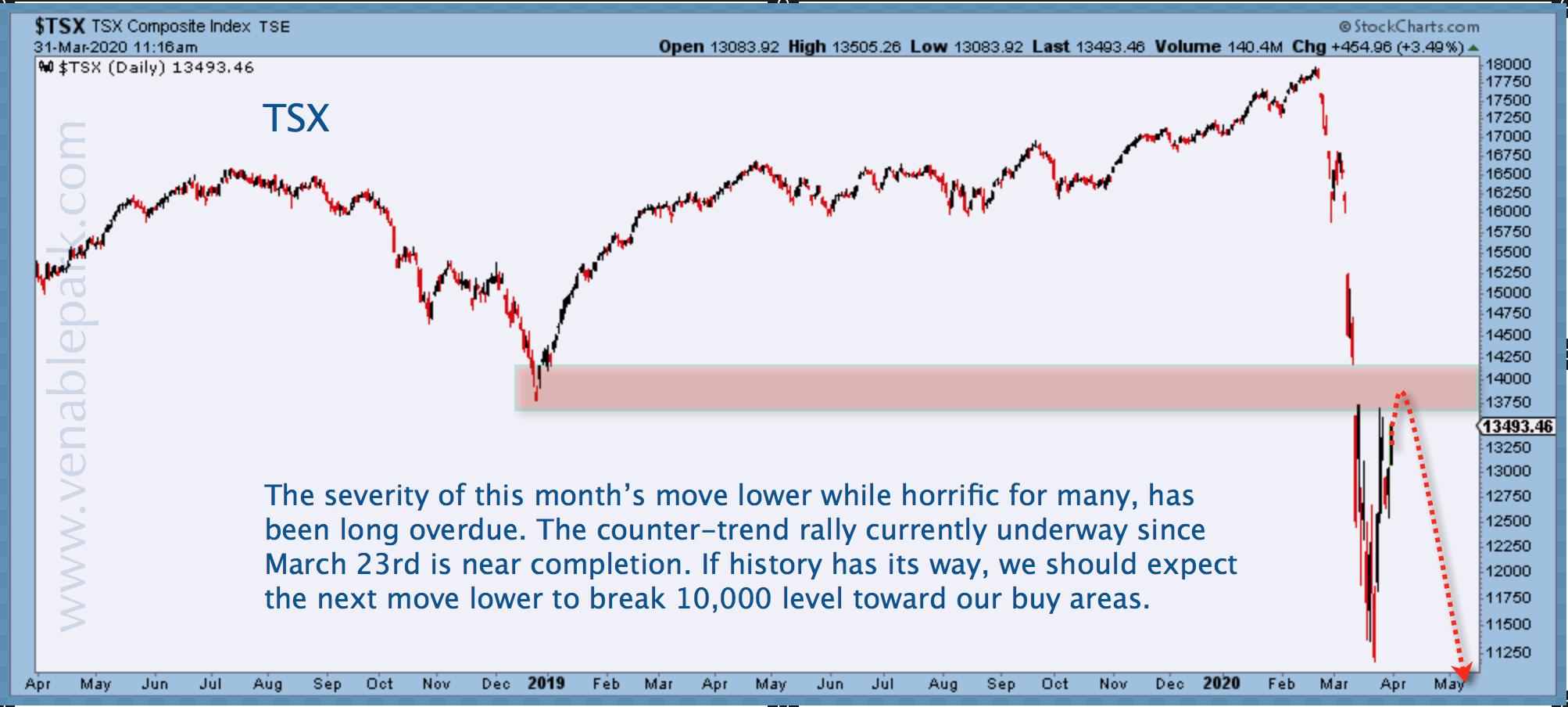

For Canada’s TSX, resistance is the 13750 to 14250 area (pink band below in Cory’s chart). At 13505 this afternoon, further headroom remains. It should be noted that these are daily charts. The weekly and monthly downtrends remain unaltered by these bounces.