Meanwhile, in the financial casino…stocks are leaping again on recycled headlines of debt-financed spending by governments and more loans to small businesses, even though the first business loan programs have not been taken up as hoped.

Weak demand is the global problem that policymakers cannot fix it. It has always been customers that drive sale s and jobs, not CEOs or central banks, and today, customers are retreating from discretionary spending, focused on survival and saving where possible.

s and jobs, not CEOs or central banks, and today, customers are retreating from discretionary spending, focused on survival and saving where possible.

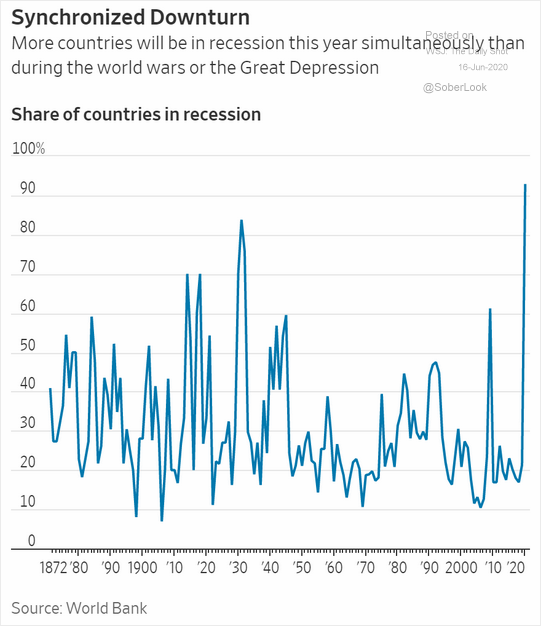

Ninety percent of the world’s economies are now in recession–more than during the Great Depression or any other time in the last 150 years–as shown in the chart on left from Soberlook.

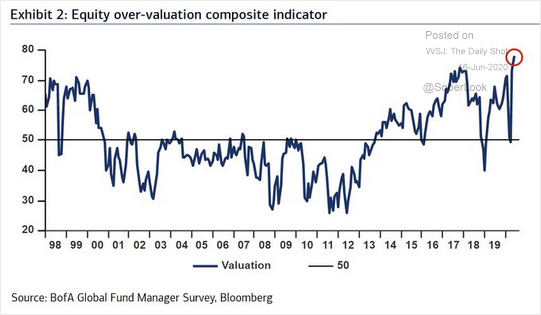

While 78% of asset managers surveyed by Bank of America admit that stocks are ‘overvalued’ on reliable metrics

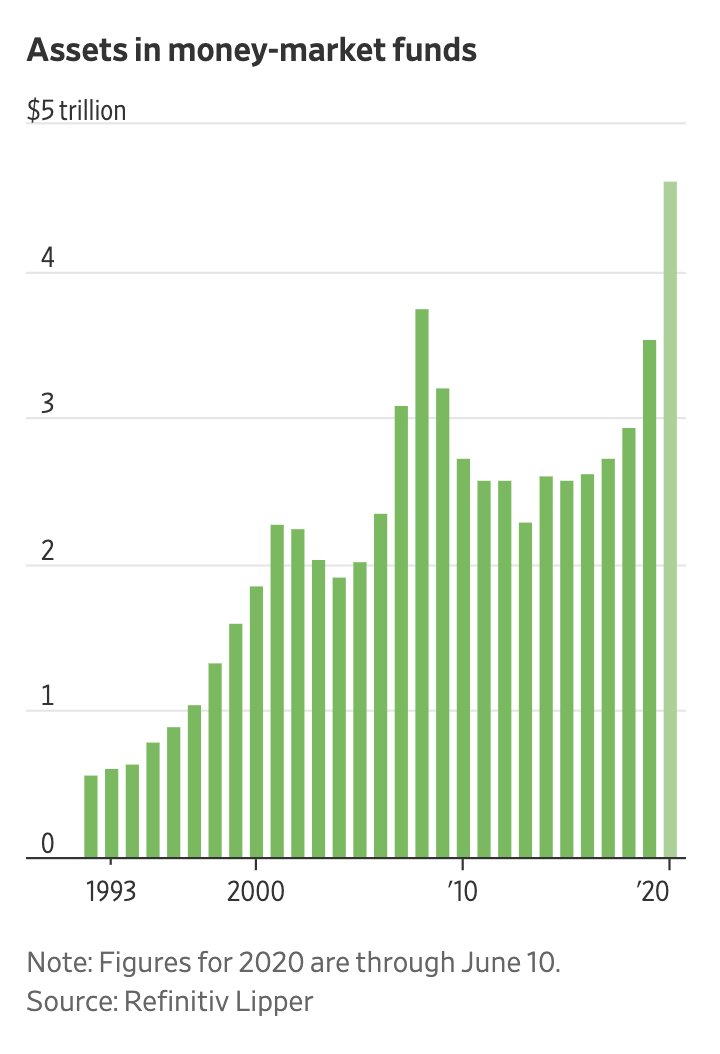

Not everyone is taking the clickbait though, despite yields suppressed near zero, cash held in money market funds hit a record high last week as shown below.  Past tops in money market funds coincided with the equity market tops in 2000-01 and 2007-08.

Past tops in money market funds coincided with the equity market tops in 2000-01 and 2007-08.

Not everyone is a sucker for FOMO. When everyone without meaningful loss-avoidance rules has bought, when all the long-always money to be wagered is in, the market reaches a stand-off between bulls and bears.

Holders can lever themselves some more to buy even more assets at nonsensical prices, but value-conscience buyers, who understand the math of loss and are free to exercise independent decisions, patiently wait for rational prices to present. We do this because we know that it is necessary in order to make lasting progress, with positive compound returns over full market cycles.