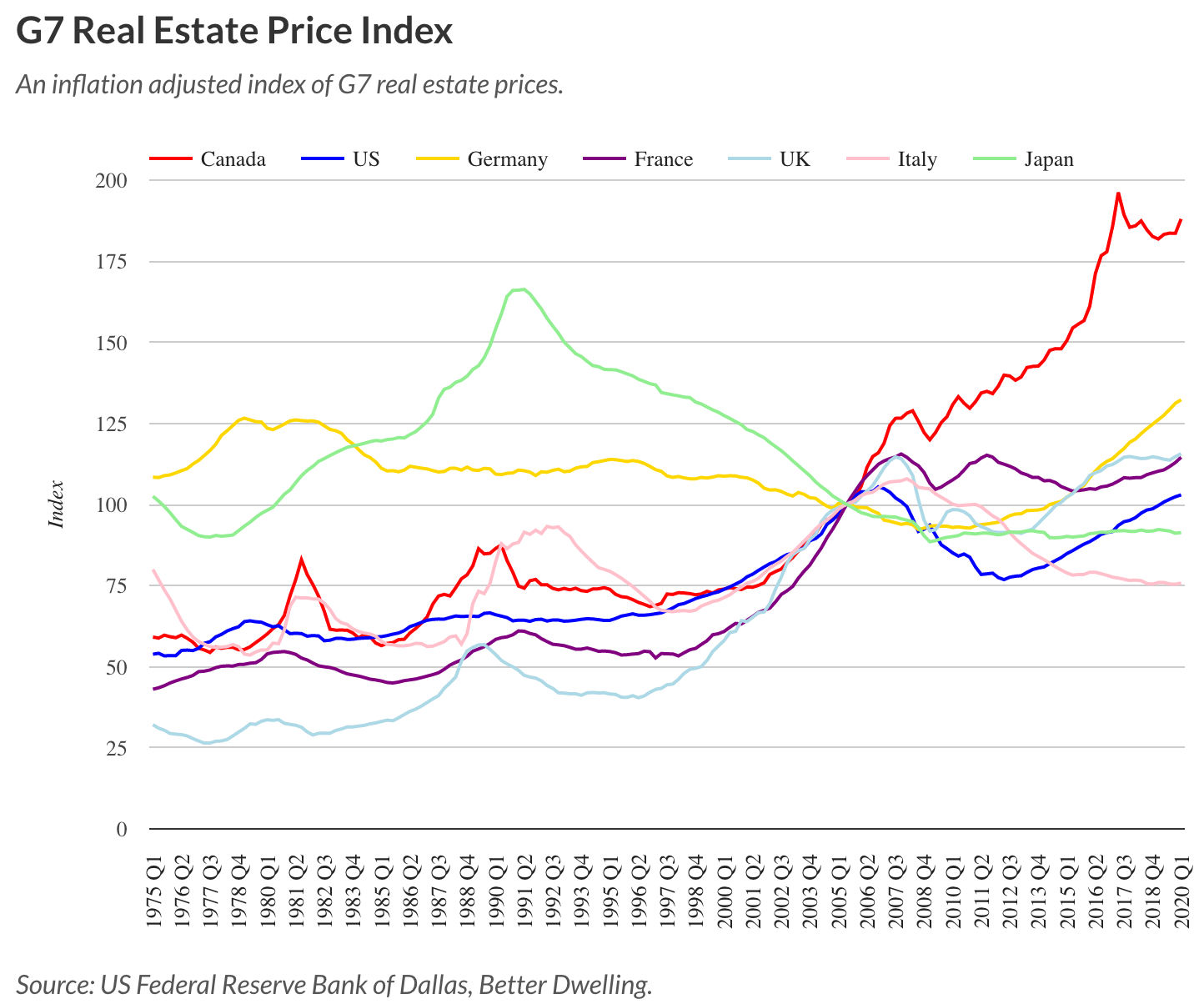

Canadian real estate prices have increased by 88% since 2005–nearly triple the pace of any G7 country (red line below since 1975). The next closest is Germany (in yellow), with an increase of 32.3% over the same period. Historical precedents are daunting for Canada.

After bubbling into a 2005 peak, US real estate prices (in blue) collapsed over 30% and were still -15% a decade later in 2015. Rising since then, in 2020, US prices are now just 3.0% above their peak 15 years ago. Japanese real estate prices (above in green) also collapsed from a bubble peak in 1990 to be -44% by 2008 and have flatlined since.

After bubbling into a 2005 peak, US real estate prices (in blue) collapsed over 30% and were still -15% a decade later in 2015. Rising since then, in 2020, US prices are now just 3.0% above their peak 15 years ago. Japanese real estate prices (above in green) also collapsed from a bubble peak in 1990 to be -44% by 2008 and have flatlined since.

Canada has paid for unaffordable housing with unsustainable debt levels, diminished household savings and a loss of economic productivity. All are likely to exact a negative financial toll for years to come. See more from Better Dwelling here: Canada doubles down on real estate since 2005. Now it’s the biggest bubble the G7 has ever seen, and its getting bigger:

“Since the Global Financial Crisis, Canada has leaned on non-productive investment, and it shows. The rate of residential investment to GDP more than doubled from 2000 to 2020. Last year, real estate transactions were generating almost half of all GDP growth. This isn’t just a Toronto and Vancouver thing either. The national index outpaces growth for every other G7 country, and is more than double the next one. With the government currently dedicating an unusual amount of resources to driving home prices during this recession, they’re shooting to go all-in or for failure.”