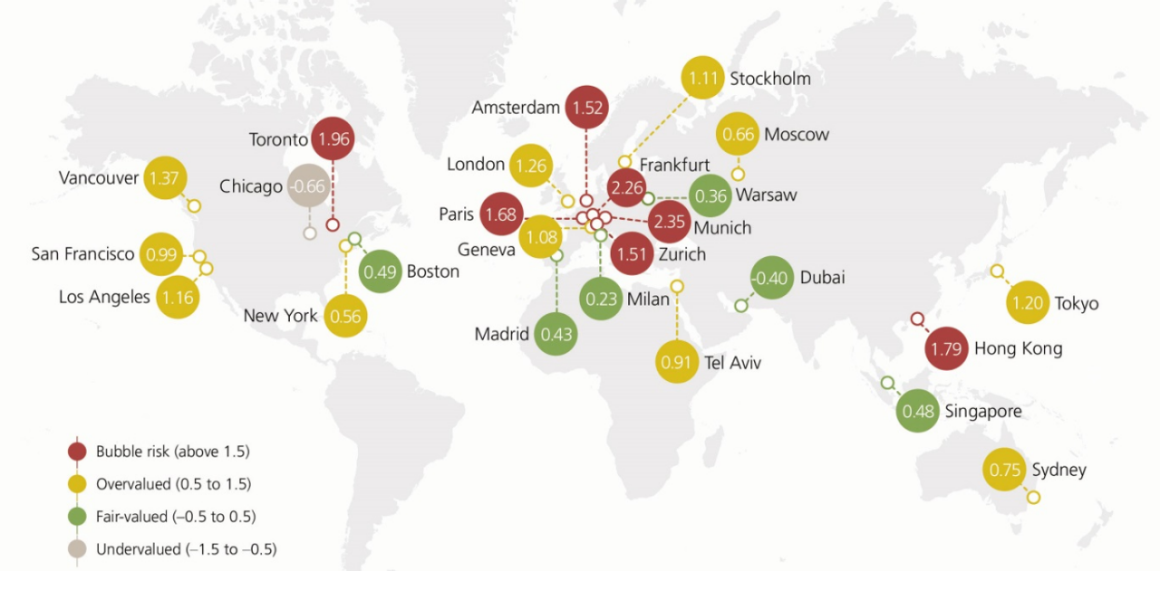

A new report from Swiss real estate investments at UBS Global Wealth Management analyzed residential property prices in 25 major cities and determined that Munich, Frankfurt and Toronto are the top three bubble risk areas in the world, with valuation readings above 1.5 in their composite (relative to rents and income).

Compared with Toronto’s 1.96 (the most extremely priced city in North America), Vancouver scored a more subdued 1.37 but was still the second most overvalued city on the continent. Here is the summary graphic.

As for why home prices have remained jubilant in the midst of a global pandemic and deepest recession since the 1930s, the study cites three main factors:

- Home prices are a backward-looking economic indicator, only able to reflect an economic downturn with a delay.

- The majority of potential home buyers did not suffer direct income losses in the first half of 2020 as credit facilities for companies and short-time work schemes mitigated [deferred] the fallout from the crisis.

- Governments supported homeowners in many cities through housing subsidies, reduced taxes, and a suspension of foreclosure procedures.

Time will tell what government support initiatives come next, but the second wave of COVID-19, ongoing job losses and business failures are driving more people out of urban areas and into shared accommodation with family and friends. Household formation levels are falling sharply. All of this makes uneconomical home prices even less feasible:

“…it’s clear that the acceleration over the past four quarters is not sustainable in the short run. Rents have been falling already in most cities, indicating that a correction phase will likely emerge when subsidies fade out and pressure on incomes increase.”