John Hussman’s January market comment “The Speculative “V”, patiently lays out truth for those who wish to see. No matter what hope-filled equity holders wish to believe, facts are not on their side:

“A hypervalued stock market doesn’t create wealth. At best, it only provides the holders of stocks the temporary opportunity to obtain a transfer of wealth, by selling those stocks to some other poor soul who will suffer the dismal long-term returns and steep interim losses instead.

If we want a stronger economy and a brighter future, there will come a point where we will need to abandon the delusion that overvalued securities are aggregate wealth. They are not. Aggregate wealth is not created by jacking up security prices, but by increasing the ability of the economy to generate useful, value-added economic output and deliverable long-term cash flows. There will come a point where we will have to recognize that a speculative bubble can only be extended by making its consequences worse.”

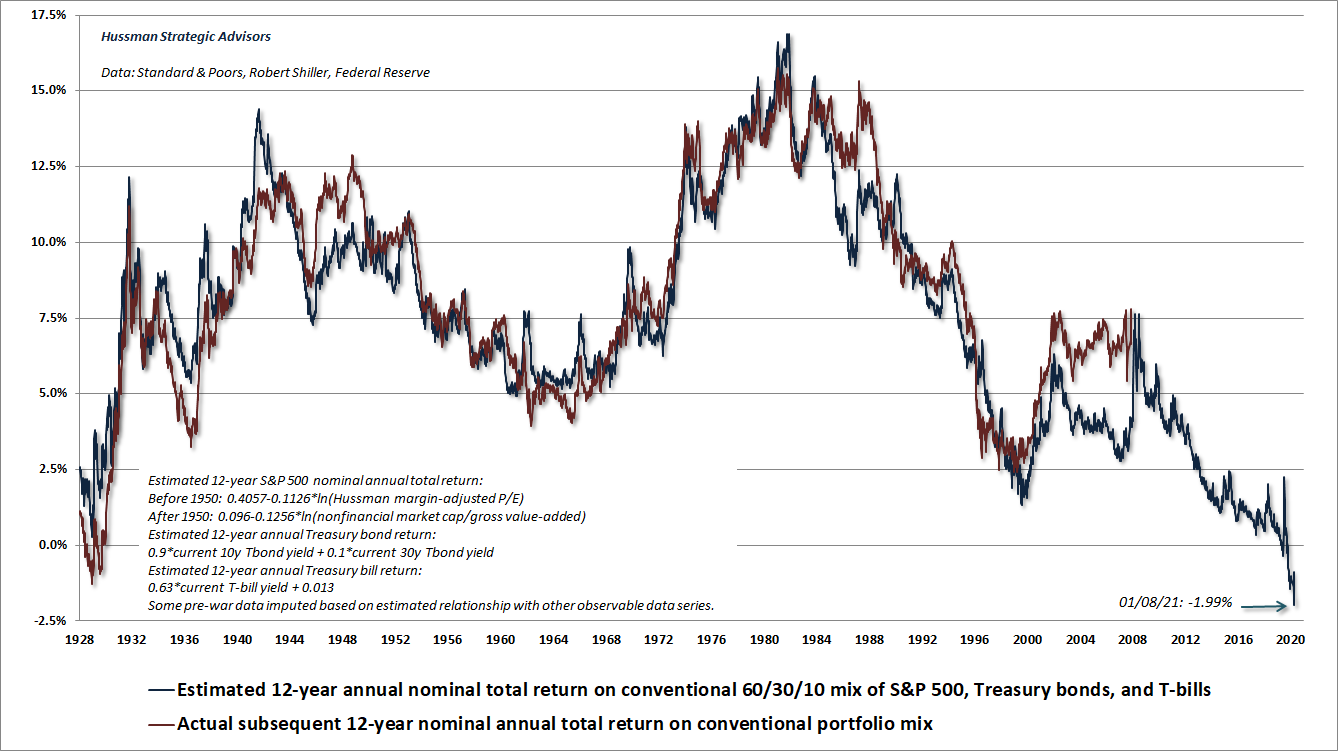

The chart below shows the present -1.99% estimate of expected 12-year nominal total returns for a conventional, passive investment mix of 60% in the S&P 500, 30% in bonds, and 10% in T-bills (cash). Behold the worst return prospects in history from present prices.

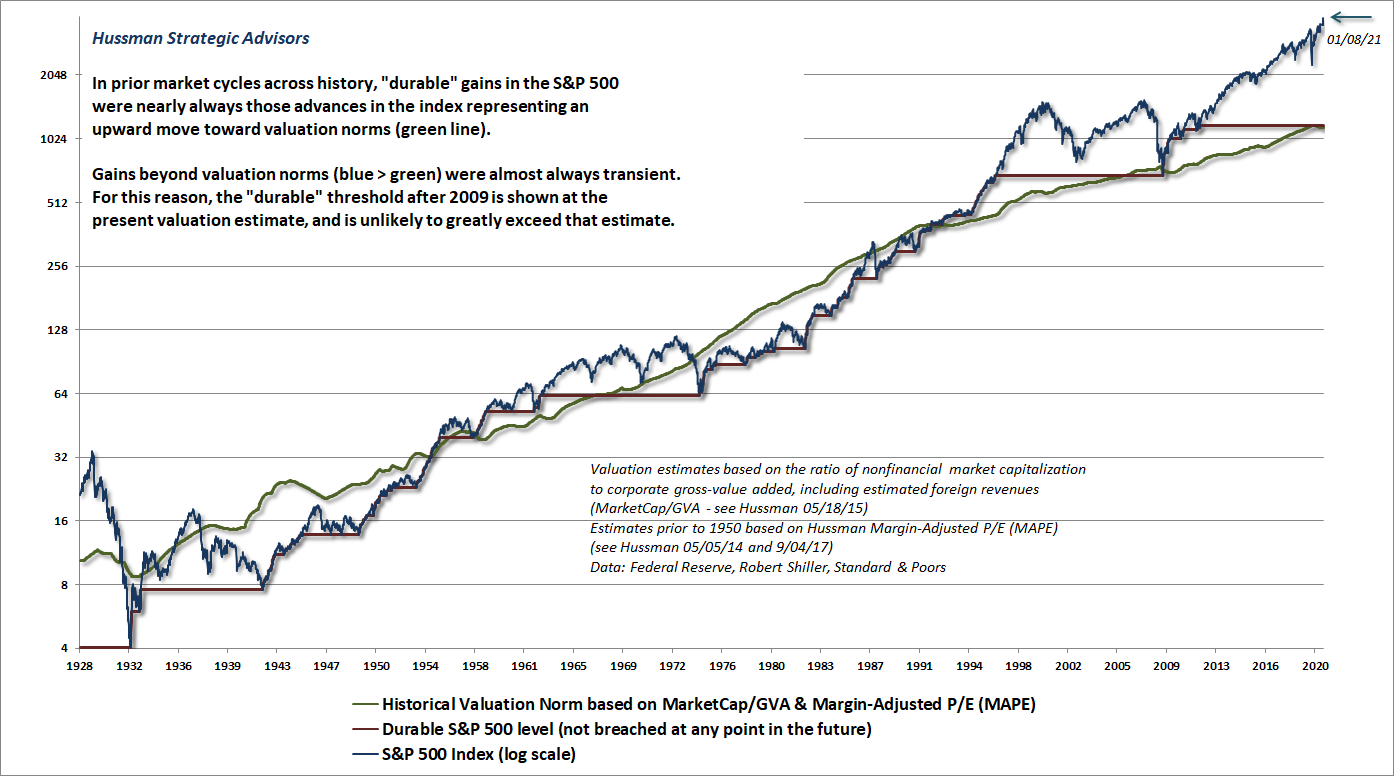

The chart below shows the current position of the stock market from the standpoint of the most reliable valuation measures (which have a correlation of 0.89 or greater with actual subsequent returns in data since 1950). Valuation entry points define return prospects. Durable gains are made for those who enter at low valuation points in the cycle. Fleeting gains are the mirage experienced by those holding at high valuation points.

Here’s Hussman’s annotation:

Note that advances in the S&P 500 (blue line) far beyond reliable valuation norms (green line) tend to be transient. In contrast, advances in the S&P 500 toward valuation norms tend to be durable. The red stairstep marks “durable” levels in the S&P 500 that were never breached in subsequent market cycles. Given that market gains well beyond reliable valuation norms have almost always been transient, the “durable” threshold after 2009 is set at the present valuation estimate, and is unlikely to substantially exceed that estimate.

Also notice that it took two cycles, not just one, to fully dissipate the valuation extremes observed at the 2000 market peak. It’s instructive to observe that the total return of the S&P 500 lagged Treasury bills for the full period from May 1995 to March 2009, despite two intervening bubbles. Such long, interesting trips to nowhere typically result from elevated starting valuations, depressed ending valuations, or some combination of both. Given current extremes, that’s exactly what I believe passive investors should expect.”