The Canadian economy shrank 5.4% in 2020 (the sharpest annual decline since World War II) despite government transfers that totalled an incredible $20 for every dollar of other income that Canadians lost. See: Canada’s GDP Collapse reveals how Trudeau’s debt-binge went awry.

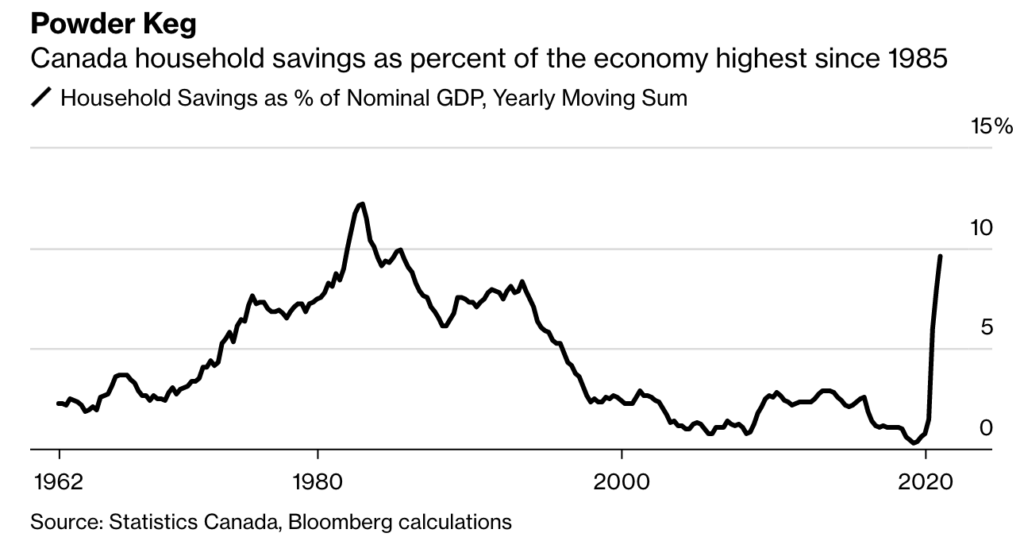

While many have borrowed and spent irrational amounts on housing and home improvements during the pandemic, overall, government transfers have elevated household savings as a percentage of nominal GDP to the highest level si nce 1985, as shown here.

nce 1985, as shown here.

After 25 years under 5%, an increase in the savings ratio was overdue and much needed to boost individuals’ financial stability. A similar phenomenon is evident in other countries, too. Americans have added $1.7 trillion in extra savings (source: Bloomberg Economics). Businesses, too, have continued to hoard cash and reduce spending as many struggle to survive.

While some commentators see higher savings as fuel for a spending boom later in the year, this is not sure. Milton Friedman’s Nobel Prize-winning work in the 1970s pointed out that only increases in income and wealth believed to be permanent tend to increase spending behaviour. See more in Three basic economic laws the pundits are overlooking as we enter the recovery phase.

Emergency government transfers aren’t permanent, and the masses feel this in their highly-indebted bones. Meanwhile, after recessions, jobs take years to recover and often lead to lower-paying work once people are rehired.

The impulse to pay down debt, file for insolvency, reduce costs and build savings is likely to be a lasting preoccupation for many. This will be better for financial footing in the longer-run but detract from economic momentum nearer-term.

As Nouriel Roubini explains in The COVID Bubble, record stock prices are of little import to most people. They won’t pay the bills.

The bottom 50% of the wealth distribution holds just 0.7% of total equity-market assets, whereas the top 10% commands 87.2%, and the top 1% holds 51.8%. The 50 richest people have as much wealth as the 165 million people at the bottom…

With equity markets reaching new heights at a time of rising income and wealth inequality, it should be obvious that today’s market mania will end in tears, reproducing the economic injustices of the 2008 crash. For all of the talk of supporting households, it is Main Street that will suffer most when the music stops.

The wealth effect of asset bubbles has always been transitory. Despite what many like to hope, there’s no ‘permanently high plateau’ in market cycles. As explained in Robert Frank’s excellent book The High Beta Rich (2011), as bubbles burst, spending and wealth among asset owners contracts too.

The ‘free’ money of the last year is not free. Economies, taxpayers, workers and investors will be paying it back for years to come.