The average rate on a common fixed-rate mortgage in Canada was a record-low 1.97 percent at the end of 2020. This, along with taxpayer-backing that enables minimal down payments, has helped propel Candian home prices and household debt to world-leading highs. This chart shows the top 8 year-over-year price gain areas to February 2021.

In the near-term, on paper, present property owners like myself have won a lottery. But if we don’t cash in the ticket by selling high, moving somewhere cheaper and banking the savings, there is no net benefit to exorbitant prices. Quite the opposite: many are locked out of property ownership and those who do buy are left paying off related debt for decades, with reduced savings and spending capacity throughout.

In the near-term, on paper, present property owners like myself have won a lottery. But if we don’t cash in the ticket by selling high, moving somewhere cheaper and banking the savings, there is no net benefit to exorbitant prices. Quite the opposite: many are locked out of property ownership and those who do buy are left paying off related debt for decades, with reduced savings and spending capacity throughout.

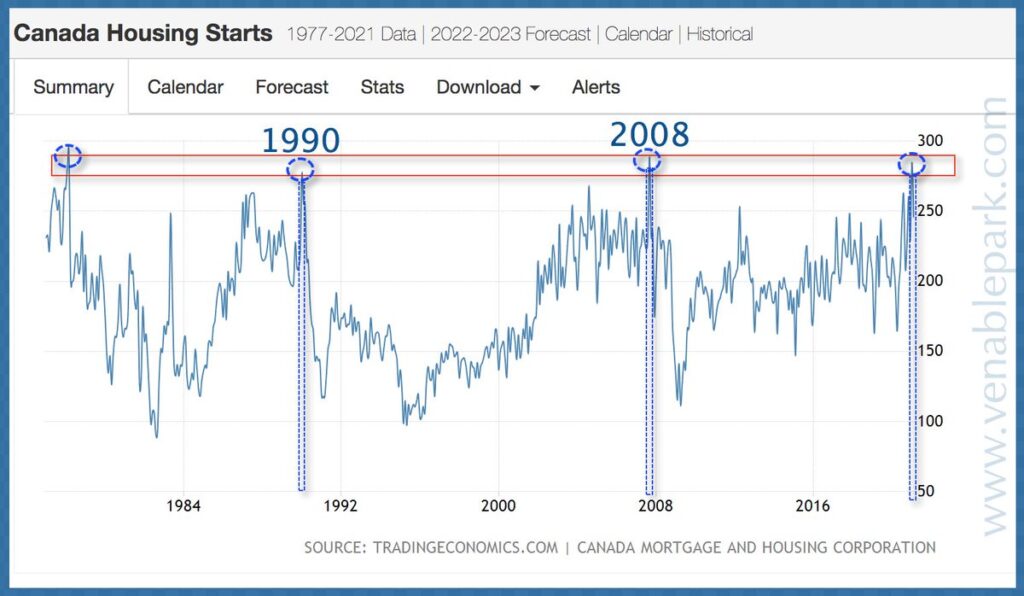

Demand has spiked new housing starts in Canada to a high not seen since previous cycle tops in 1990 and 2008, as shown below since 1977. Once more, the Canadian economy has become extremely vulnerable to any downturn in the housing sector. And yet, the cure to too high prices has always been too high prices. Painful as they are for the unprepared, downturns are naturally recurring resets endemic to credit and price cycles.

The present expansion cycle has been long and strong enough to convince many that this time is different and prices will never correct again. That would be unprecedented.

When Covid-19 hit, even Canada’s own national housing agency seemed sure this was finally the end, predicting a dive in home values ranging from bad to catastrophic. But instead the market went on to another record year. Here is a direct video link.

You can read Ari’s piece The Housing Boom that never ends here.