Persistently high inflation can reduce buying power for households when comparable increases in wages do not offset it, and wage growth has been flat for years.

However, the greater fear for central banks is that persistently low inflation, disinflation, and outright price deflation leave much less room for monetary policy (at near-zero interest rates) to prod spending, economic growth, and capital flows into corporate securities.

While pandemics of the magnitude of COVID-19 have been historically rare, they’ve tended to be deflationary, reducing consumers and consumption in their aftermath.

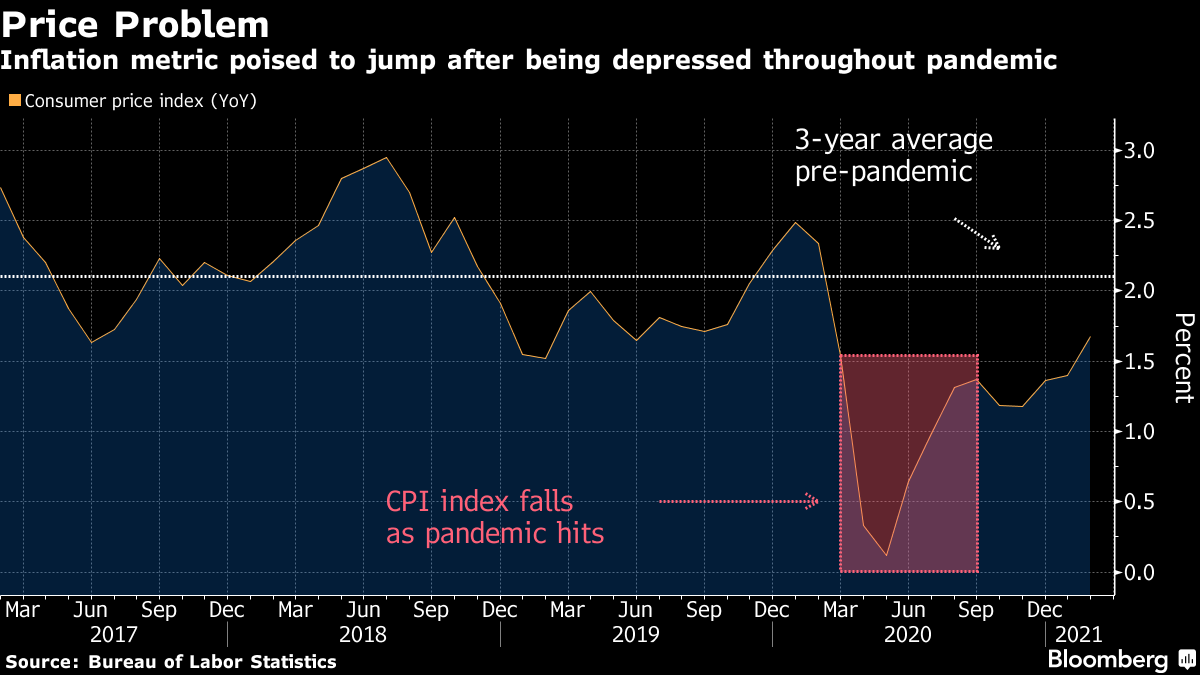

That said, in the near term, there is no question that year-over-year comparables look inflated from depression readings in the first half of 2020 (base effects), on top of recent supply chain disruptions and some pent-up demand, mostly for services.

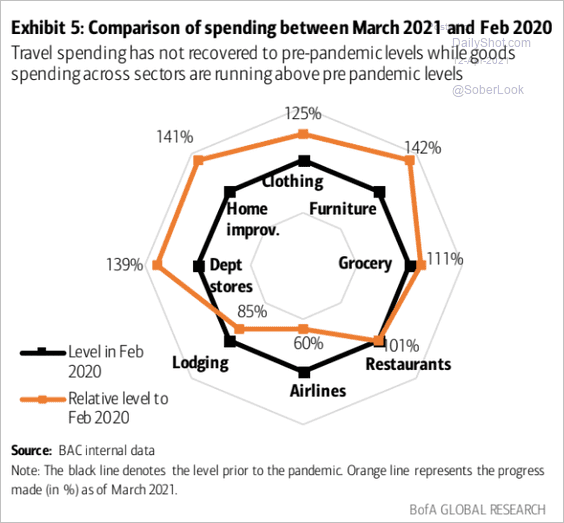

On the demand point, it is important to realize that consumer spending through the 2020 pandemic/recession h as already been extraordinary, thanks to record government assistance. Bank of America credit/debit card data (charted beside) shows that March 2021 household spending (in orange) was significantly higher on key goods than February of 2020 (in black) and only lower on lodging and airlines. The elevated consumption of goods is unlikely to continue indefinitely.

as already been extraordinary, thanks to record government assistance. Bank of America credit/debit card data (charted beside) shows that March 2021 household spending (in orange) was significantly higher on key goods than February of 2020 (in black) and only lower on lodging and airlines. The elevated consumption of goods is unlikely to continue indefinitely.

Much of the jump in prices we see in the first half of 2021 is not so much inflation as reflation from depression levels in early 2020. This chart captures the relative change well.

While central banks and the finance sector continue to tout an inflation narrative, the case for non-transitory effects (and much higher interest rates) remains sketchy thus far.

While central banks and the finance sector continue to tout an inflation narrative, the case for non-transitory effects (and much higher interest rates) remains sketchy thus far.