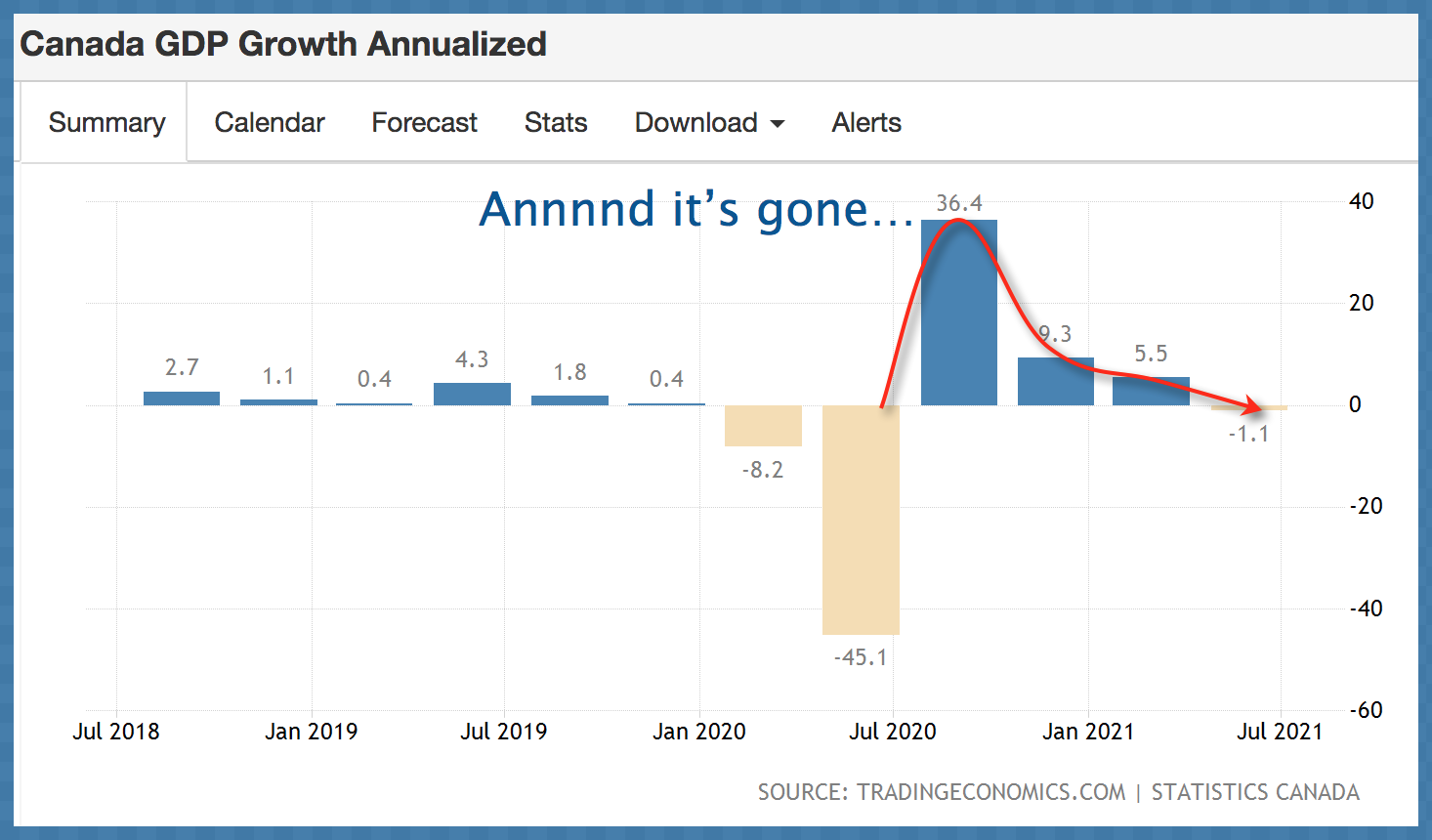

Canada’s economy unexpectedly shrank 0.3% in the second quarter for an annualized contraction of 1.1% versus the consensus forecast of a 2.5% gain. Declines in home resale activities and exports were the largest negatives. Homeownership transfer fees shrank 17.7%. Constraints in the auto sector led to a 4% decrease in exports.

Business inventories, government expenditure, capital investment in machinery and equipment, new home construction and renovation were all higher on the quarter.

As we anticipated, the loonie is lower and Canada Treasury prices are higher on the news. Slowing activity in Canada’s ridiculously priced housing sector is much overdue; it is also disinflationary. If the downturn in activity translates to falling prices–and it should–the effects will be full-out deflationary. This will be a big negative for households and an economy precariously concentrated on highly levered home prices.