The hosts in this segment make the common misnomer of talking about bonds without specifying that they are talking about government bonds or “Treasuries,” but not corporate bonds. Corporate bonds trade with the equity cycle and do not attract safe-haven inflows during negative financial shocks and bear markets. Few acknowledge this critical distinction between Treasuries and corporate bonds. Otherwise, the discussion here is worthwhile.

This month we were joined by Dr. Lacy Hunt, an internationally known and award-winning economist. Dr. Hunt is the Executive Vice President and Chief Economist of Hoisington Investment Management Company. He also is the author of two books and numerous articles published in Barron’s, The Wall Street Journal, The New York Times, and The Financial Analysts Journal among others. Here is a direct video link.

An important point made by Hunt is that the much-anticipated spending bills expected from Congress will be less supportive of inflation and growth than widely suspected because while they mete out spending over the next decade, they start tax increases right away. Moreover, back to Hunt’s larger point, they pay for spending by increasing debt. More debt and increased taxation from here (while politically necessary) are both disinflationary–reducing room for future spending and growth.

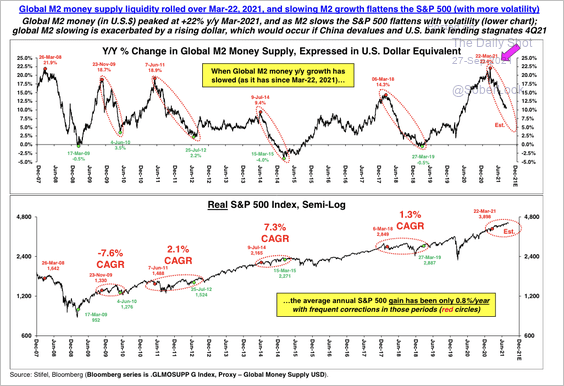

The top panel in the chart below shows the change in global M2 supply since 2007 (discussed by Hunt). When the money supply is contracting, as it has been most recently since March, stock markets (S&P in lower panel) have lost lift.