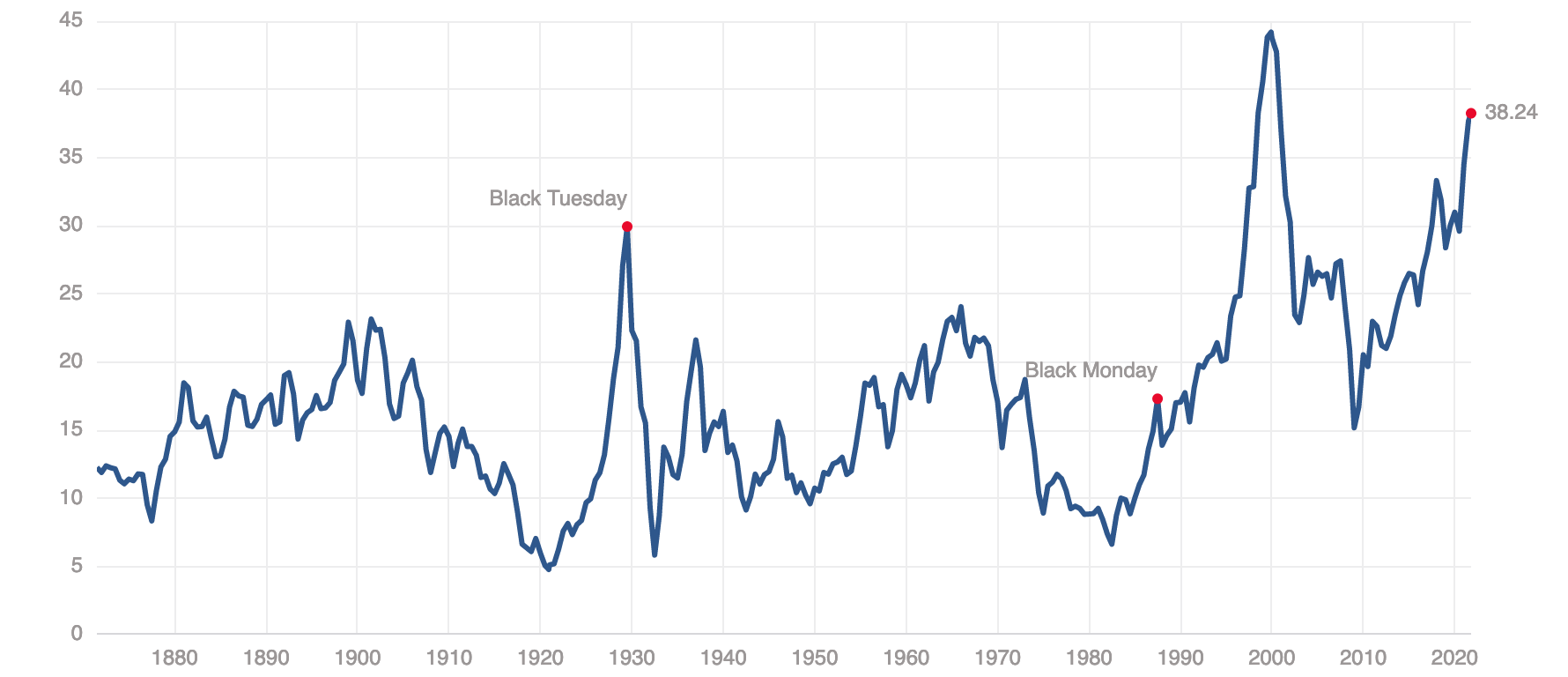

One of the most historically informative capital risk readings, the S&P 500 Shiller price to earnings ratio (shown below since 1870), topped 38 this month, far beyond the 1929 market top, and second only to the fleeting 44 clocked at the top of the 2000 dot-bomb hysteria.

Prevailing incentives and policies are an incredible mess to behold, but there is nothing new in financial markets. Speculative episodes are as old as time, and no asset bubbles have ever been corrected by going sideways. While we can’t predict when bubbles will burst, thinking people can benefit from the question that matters most: is this market cycle nearer to an end or a beginning?

Jesse Felder revisited this yesterday with a look at the timeless chart of investor sentiment:

Where are we in the market cycle? pic.twitter.com/sxfWNvTHvc

— Jesse Felder (@jessefelder) October 13, 2021

After reviewing recent sentiment indicators here, he comes to this:

“Perhaps more importantly, it also suggests we now find ourselves in the October 2000 stage of the market cycle and there are some important similarities between then and now to support this thesis. Back then, it was becoming increasingly clear that March of that year represented the blow-off in sentiment. Stocks managed to hold up for another five or six months before officially rolling over into the bear market that saw dozens and dozens of the most popular stocks in the market fall 90% or more”.

An 80%+ loss cycle followed both the 1929 and 2000 stock valuation peaks. It’s important to consider how a loss cycle of that magnitude or even a run-of-the-mill -25 to -50% decline would impact our life savings and retirement plans. Proactive defence is the rational course. Financial manias end with a bang, not a whimper.