As inflationists continue to warn of run-away prices, a few big picture items are worthy of note. First, the U.S. dollar has continued to strengthen against major currencies, with the dollar index (DXY) this morning making a new 52 week high above 94.50, the highest since September 2020, and 5.6% above its $89.53 low in May.

A strengthening greenback is consistent with previous Fed tapering episodes as shrinking Q.E. injections mean fewer dollars swirling around the globe. At the same time, the U.S. Treasury is now issuing fewer bonds for sale as the 2020 emergency spending surge retreats. Fewer dollars in circulation make the world’s benchmark currency more expensive. With 40% of S&P 500 revenues coming from foreign sales, a higher greenback translates into lower U$ reported earnings.

It also means that the many foreign borrowers of U$ loans find it more expensive to make their principal and interest payments. Lest we forget, emerging market debt leapt to 236% of GDP by early 2021, from 110% in 2007, with debt owed in U.S. dollars higher for every developing country.

A stronger dollar also makes imports cheaper for America and its exports more expensive. Interestingly, as noted in yesterday’s U.S. trade data, supply bottlenecks did not prevent U.S. imports from rising 0.6% in October–the fourth increase in the past five months. Exports, on the other hand, fell 3%.

On the other end of the dollar teeter-totter, 42 of the 45 most widely traded commodities are priced in U$. A rising dollar makes these critical imports more expensive for other countries, suppressing demand while producers ramp supply. Many economically-sensitive inputs are already taking note with steel, so far, down 30%, iron ore -54%, lumber -64%, aluminum -19%, zinc -14%, copper -8%, and nickel -9%. Eggs are -34% on the food front, pork bellies -37%, corn -28%, and soybeans -27%.

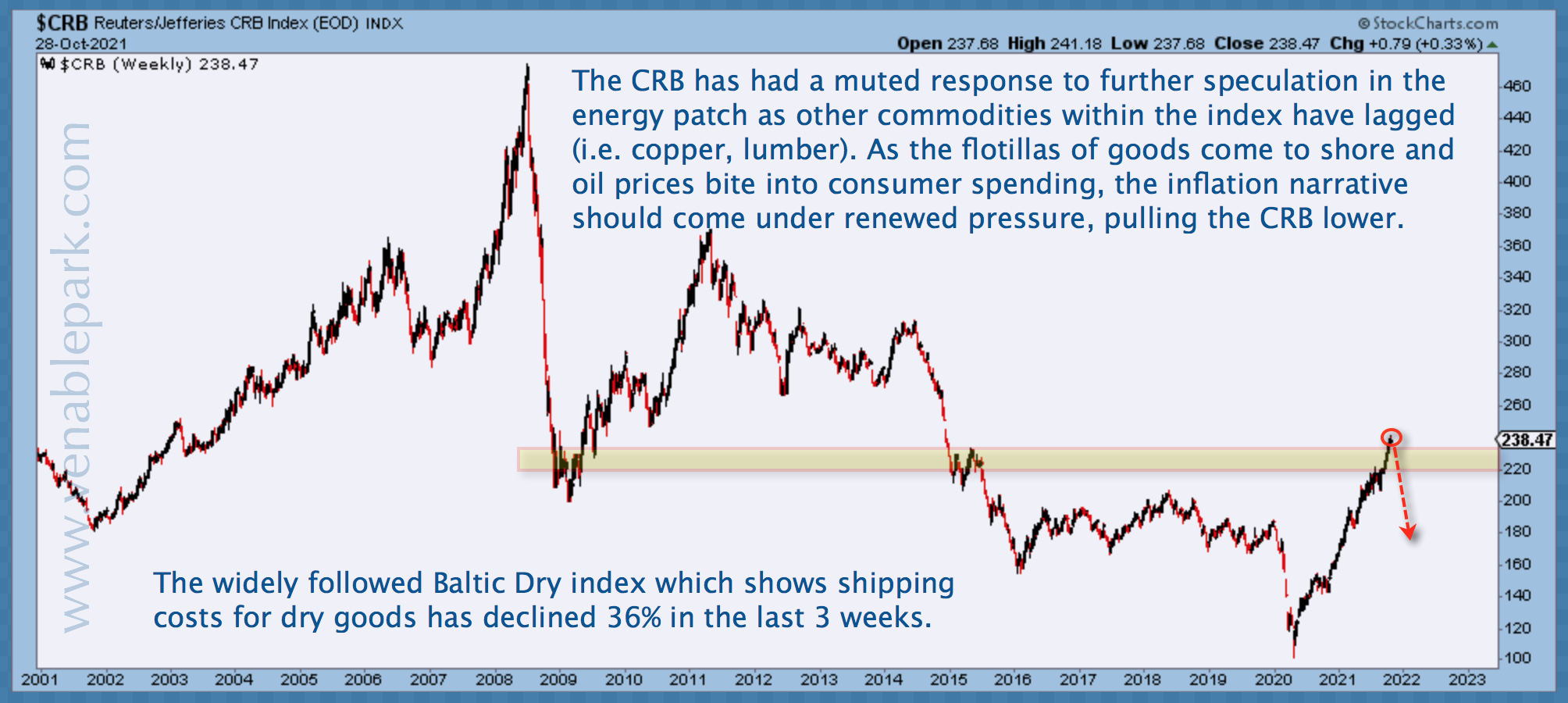

With 39% of the CRB Index weighted in oil and gas contracts, the rebound in fuel prices from their sub-zero plunge in early 2020 has been a reflating feature, to be sure. However, as shown in my partner Cory Venable’s chart of the CRB Index of global commodities, below since 2001, at the end of October, after trillions in government stimulus efforts globally, the basket had only recovered to its Great Recession low of early 2009. (Update, while the cost of shipping dry goods (the Baltic Dry Index) slumped 36% in October, further weakness this week has it now off 50%, to the lowest level in five months.

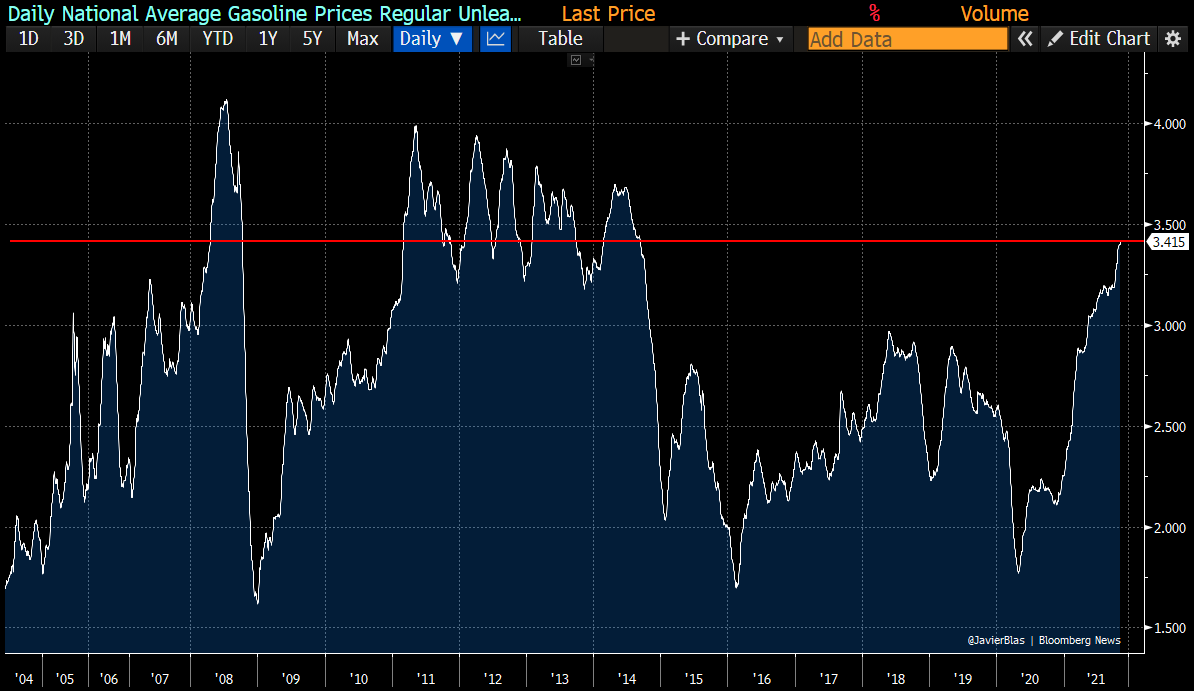

Spiking gasoline prices (U.S. national average for regular, unleaded below since 2003, source), now the highest in highest in 7 years, will, as usual, crimp funds for other spending and encourage a reduction in driving and further impetus for shared transportation and electric vehicles. High prices cure high prices in the end. As policy-enabled spending now recedes globally, inflation hype should be coming to an end once more and calling attention back to the ludicrous elevation in risk markets of all kinds.

As policy-enabled spending now recedes globally, inflation hype should be coming to an end once more and calling attention back to the ludicrous elevation in risk markets of all kinds.

From 1.70, October 22, the 10-year U.S. Treasury yield has fallen below 1.47 this morning and Canada’s from 1.76 to 1.60 in 4 days. Low yields, but it’s all relative, and North America is offering some of the highest relative treasury yields in the world today, alongside Norway and Australia.

As commodities come off the COVID-boil, yields are likely to fall further as Treasury prices rise and an appreciating U.S. dollar enhances the attraction for foreign buyers.

For all the talk about ‘bonds being for dummies,’ the total return (compound income plus capital gain) on U.S. Treasuries has outperformed the heavily-touted S&P 500 stock index by 3.8x since 1980. The next bear market for stocks is set to widen the outperformance for Treasuries even further.