The shares of world-leading companies with incredible products still commonly end up devastating as investments when bought at euphoric prices.

Investors’ faith in the Federal Reserve has become so unshakable that not even the highest inflation in three decades is enough to cause a sell-off in assets, according to Jeremy Grantham, the value-investing giant and co-founder of Boston-based asset manager GMO. He spoke with David Westin on Bloomberg Television’s “Wall Street Week.” Here is a direct video link.

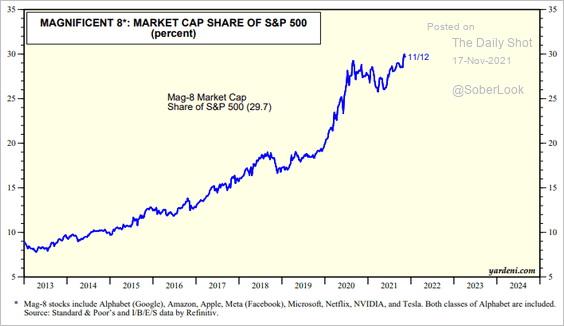

As shown below, since 2012, the eight most expensive tech companies now make up 30 percent of the S&P 500 market capitalization. This means that a world of funds, managers, and portfolios that track the S&P 500, are less diversified and more risk-concentrated than commonly understood.