After broad selling last week, the risk trade is bouncing. Most stocks are now trading below recent highs and not just the most sketchy ‘meme’ names. As shown below, courtesy of Mac10, beneath the hood, just 43% of even the widely considered ‘conservative’ Dow 30 components (red line) are above their 200-day moving averages. In comparison, the Dow index (in black) remains less than 2% beneath its November high.

At the same time, S&P futures net speculative long positions (lower panel) are back at highs not seen since December 2018 before the Fed announced its fourth rate hike of that year to 2.50%–and the last hike since. As stocks dumped and the economy slowed into 2019, the Fed was back to cutting rates by August that year.

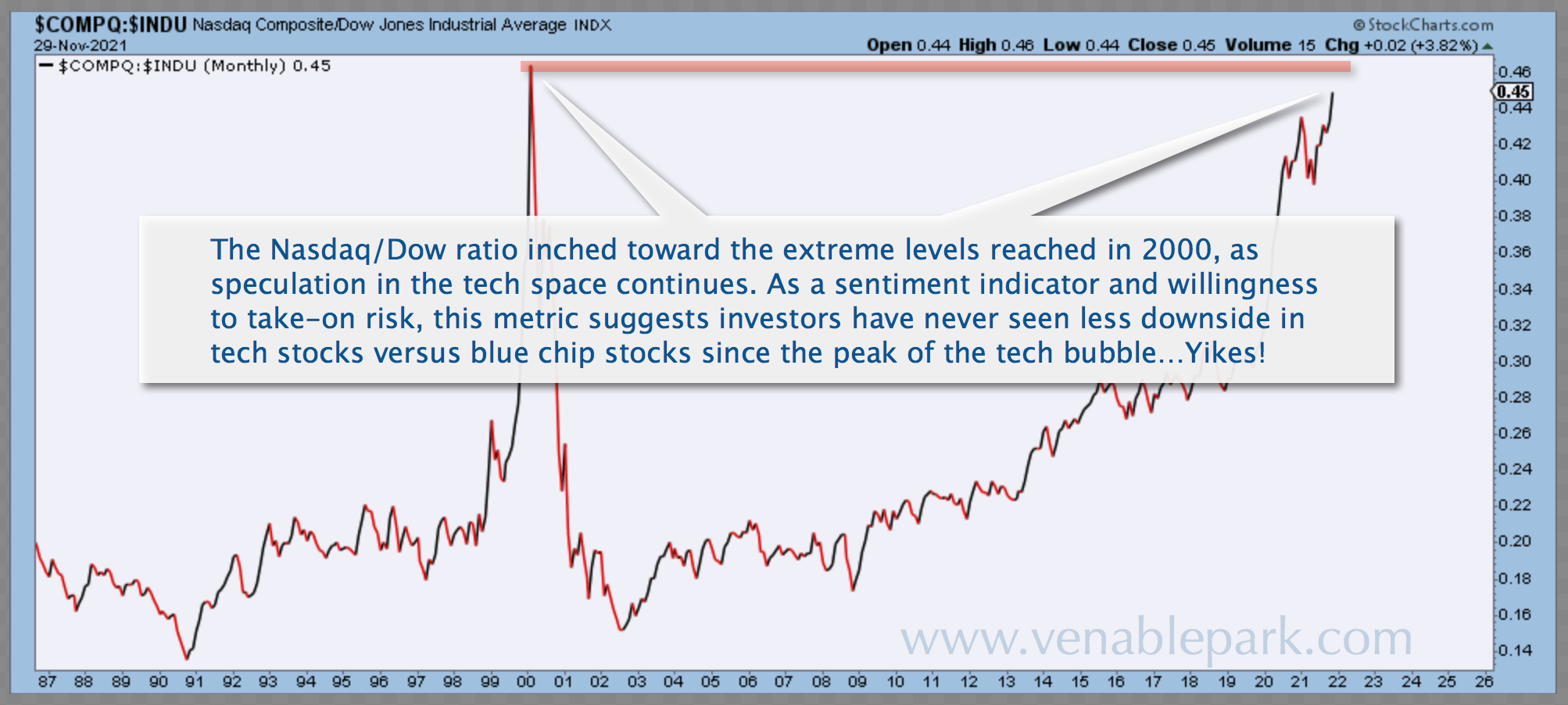

The five most expensive FAANG stocks continue to levitate the NASDAQ to concentration risk levels beyond the Dow (which only has Apple). As shown below from my partner Cory Venable, the market capitalization (price x shares) of the NASDAQ 100 remains near a record ratio of the Dow Jones Index–a distortion only seen once before at the fleeting tech top March 2000.

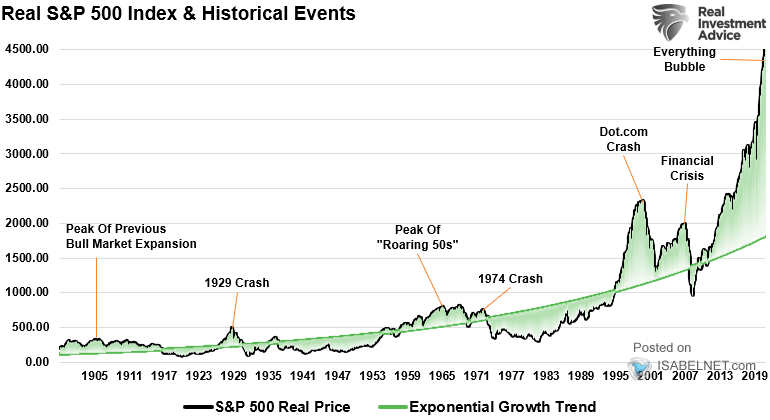

The euphoria of this cycle is much broader and more extreme than the 2000 dot.com-led bubble–by far. As shown below, courtesy of Real Investment Advice and ISABELNET.com, the S&P 500 Index price is an ominous 61% above its exponential growth trend since 1900, a line under which stock prices have dipped below and laboured for years after previous (and lesser) bubble’s burst. This time won’t be different.

All’s well that ends well–and for the masses who have bought in, this cycle won’t end well. As Jeremy Grantham has wisely observed from his decades of building billions: “sooner or later, you will have made money to have sidestepped the bubble phase.” Believe it or not.