Good macro overview in this segment recorded on Jan 5…

David Rosenberg believes we will transition away from the current burst of inflation to renewed disinflation. In an interview with Alfonso Peccatiello, author of the Macro Compass newsletter, Rosenberg, president at Rosenberg Research & Associates, lays out his thesis for inflation going even lower than 2.5%. Rosenberg draws on historic parallels to World War II on the current state of inflation and points to price bubbles, housing bubbles, asset bubbles, and quantitative easing as the culprits for the problems we are facing today. He believes investors should own treasuries in the 2022 economy. Holding strong to his contrarian view, Peccatiello asks him what would change his mind about his disinflation thesis. Don’t miss this interview where Rosenberg and Peccatiello discuss the inflation/disinflation story, the aging demographic and debt problem, owning treasuries, and how to position your portfolio and the emerging markets that offer growth opportunities.

You can view it here on the Real Vision site.

Word to the wise, ‘defensive’ sectors are those that typically drop less than others during bear markets; but dropping less does not mean they won’t lose money.

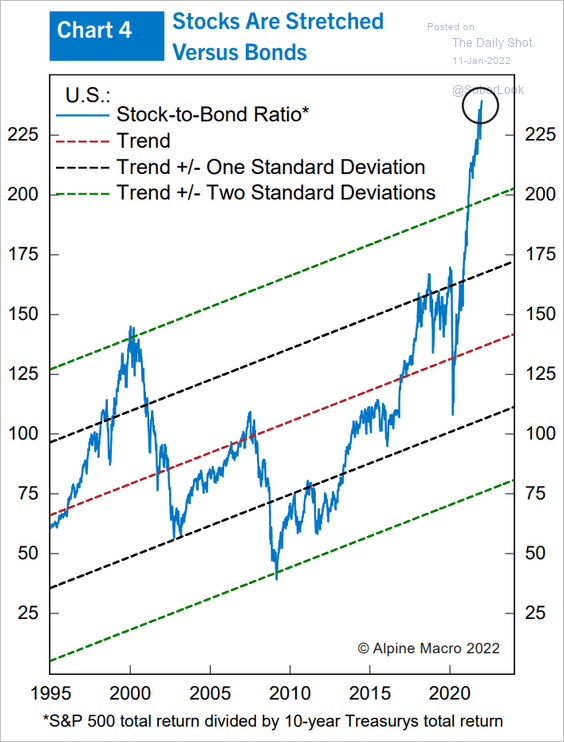

As shown below, the total return of stocks versus treasury bonds since 2020 is some three standard deviations above the long-term mean since 1995. No time for complacency!

Also, see After years of abstraction, things are getting real for markets:

Also, see After years of abstraction, things are getting real for markets:

“…the end of extreme abstraction does not augur well for those arriving last to the party.

As the market switches to other less abstract investment themes, the danger is that a vicious spiral develops. Not only would investors pivot to more “real” investments, but scrutiny intensifies on recent crowd favourites revealing that there was even less than meets the eye in many of them.

We saw both behaviours when the dotcom bubble burst and in the aftermath of the 2008 financial crisis. And therein lies a final overlooked aspect to the past year. If 2021 was the peak of yet another bubble in ungrounded possibility, it will represent the third for this generation of investors. It’s hard to imagine many will take being fooled a third time well.