Since December, a global jump in rate hiking expectations has caused bonds to sell-off. Both U.S and Canadian ten-year treasury yields are above 1.87 this morning, the highest since before the pandemic began in 2019.

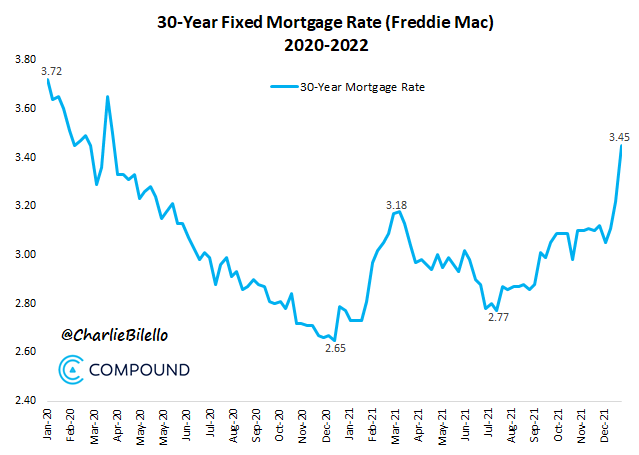

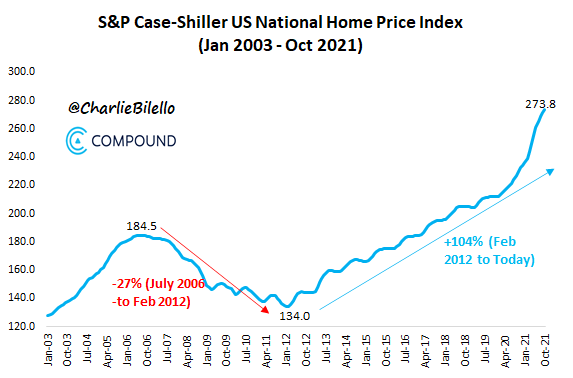

The 30-year U.S. Treasury yield on which widely referenced 30-year U.S. mortgage rates are based is above 2.26 and the highest since last October. As shown below, courtesy of Charlie Bilello, U.S. mortgage rates have already increased more than bond yields and, at 3.7% today, are the highest since early 2020. Housing affordability, meanwhile, has deteriorated significantly since 2020 because average home prices are now about 30% higher nationally. The S&P Case-Shiller U.S. National Home Price Index is below since 2003.

Housing affordability, meanwhile, has deteriorated significantly since 2020 because average home prices are now about 30% higher nationally. The S&P Case-Shiller U.S. National Home Price Index is below since 2003.

Variable mortgage rates rise when central banks hike base rates, and half of the mortgages taken on in Canada last year were variable. Already, just the expectation of coming rate hikes has caused the 5-year Treasury yield (on which 5-year fixed Canadian mortgage rates are based) to rise to 1.72% and 5-year mortgage rates have increased 43% from 1.39 on January 1 to 2% today. Five-year rates were last this high in December 2019, but again, average home prices were 30% cheaper back then.

Variable mortgage rates rise when central banks hike base rates, and half of the mortgages taken on in Canada last year were variable. Already, just the expectation of coming rate hikes has caused the 5-year Treasury yield (on which 5-year fixed Canadian mortgage rates are based) to rise to 1.72% and 5-year mortgage rates have increased 43% from 1.39 on January 1 to 2% today. Five-year rates were last this high in December 2019, but again, average home prices were 30% cheaper back then.

While the Aussie and New Zealand dollars have weakened over the past year on slowing demand for commodities and weakness emanating from China, the Canadian dollar (FXC index), below from my partner Cory Venable since 2019, has rallied over the past month on a jump in oil prices and posturing about rate hikes. Higher oil and rates slow spending.

Bonds have now priced in six Bank of Canada (BOC) hikes over the next year, with a 75% probability of the first announced at next week’s January 26 BOC meeting. See Rate hike in play after hawkish bank of Canada survey.

Lest anyone forget, housing has been the dominant driver of Canadian GDP growth for several years now, just as it has been in China. The slowing of able buyers has negative implications overall.

Stagnation or a retreat in home prices–while better for longer-term stability–will magnify the strain on highly leveraged households, developers and lenders in several countries. This is one of the main reasons that we doubt central banks will tighten as much as presently priced into bonds and the Loonie. We expect treasuries to rebound again and the Loonie, commodities and equities to weaken, as financial fragility dawns.