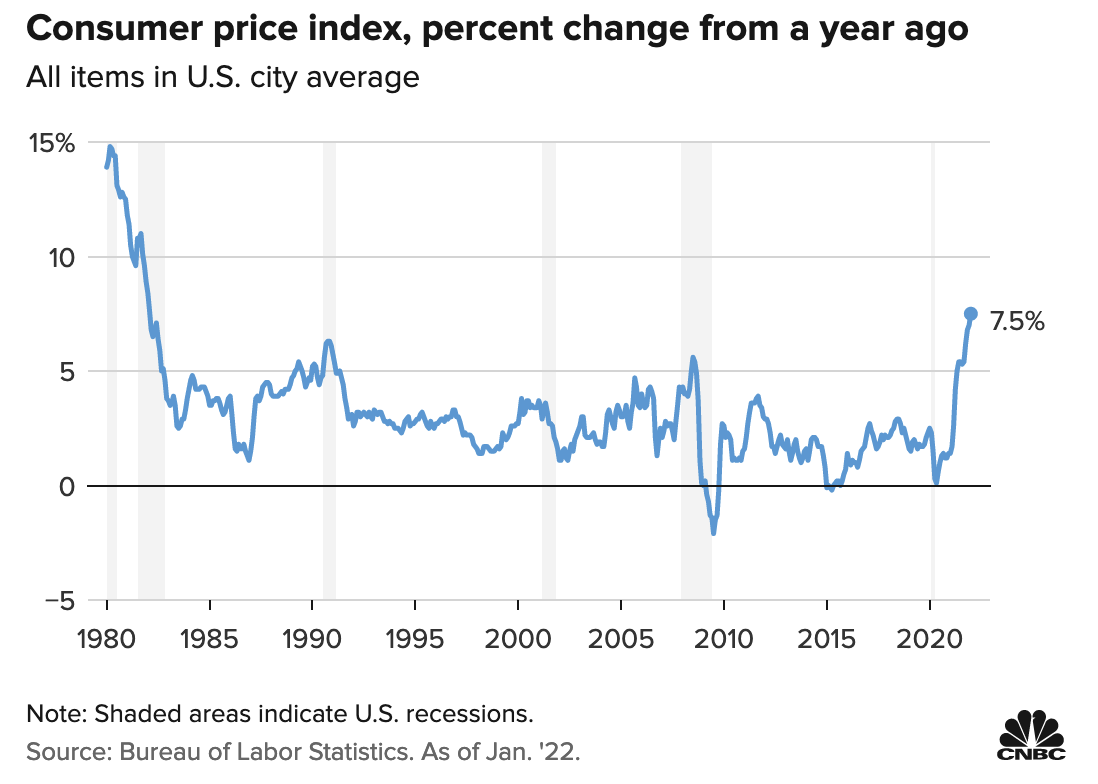

The consumer price index for January rose 7.5% compared with a year ago and was slightly higher than the consensus estimate of 7.2%. As shown on the left courtesy of CNBC, this was the highest on this reading since February 1982.

the consensus estimate of 7.2%. As shown on the left courtesy of CNBC, this was the highest on this reading since February 1982.

Meanwhile, real earnings for workers increased just 0.1% on the month, and University of Michigan consumer sentiment fell to 61.7 in January vs. 67.2 in December. Consumer expectations tumbled to 57.4–both the lowest readings since 2011. See: What to expect when consumers don’t expect inflation to last.

The bond market accelerated its bearish flattening on the news, with short bond yields leaping more than long yields. This afternoon, the spread between the US 10 and 2-year Treasury yield is just .44%. As shown in my partner Cory Venable’s chart below of the spread at the end of January, this economically-insightful metric was .63 just 11 days ago and has been tightening steadily over the past year on dimming economic prospects into 2022.  The 7, 10, 20 and 30-year Treasury yields all touched above 2% today (although just a .30% difference from the shortest to the longest). The last time the US 10-year was at 2% was in July 2019, when the policy rate was sitting at 2.375% compared with the financial incentive-distorting .08% today.

The 7, 10, 20 and 30-year Treasury yields all touched above 2% today (although just a .30% difference from the shortest to the longest). The last time the US 10-year was at 2% was in July 2019, when the policy rate was sitting at 2.375% compared with the financial incentive-distorting .08% today.

Nearly two years of zero rates have been another epic central bank policy mistake. And, coupled with unprecedented fiscal stimulus early in the pandemic, has inspired ominous debt, housing, cryptocurrency, commodity, and stock market bubbles, all simultaneously.

Adding insult to cash-stressed households, oil prices are roaring in classic late-cycle style. West Texas Crude and Brent are both above $93 this afternoon.

Cue the end of QE and a whopping seven policy rate hikes priced into market expectations for 2022. No wonder most of the stock market has been falling for months now.

A perfect financial shit storm is now unfolding—all demons of our dumb design.