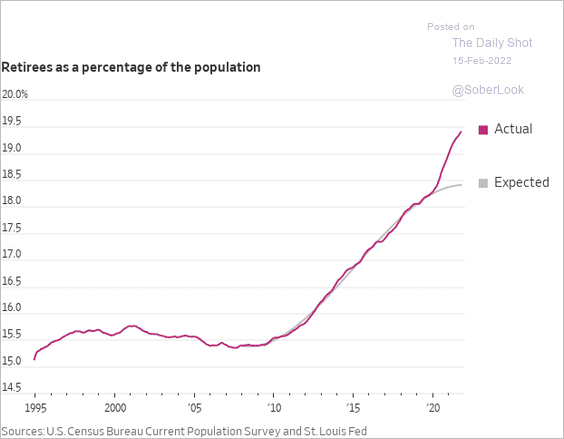

The aging population drove a steady rise in retirees over the past decade. The pandemic accelerated this with a surge in those opting to retire sooner than previously expected (shown below courtesy of Dailyshot.com).

The motivation has been partly fear and risk around contracting COVID-19 and greater workplace stress amid pandemic protocols. It was also encouraged by a surge in emergency support from governments and central banks, which boosted household income, savings and speculative fervour, goosing asset prices far beyond historical norms.

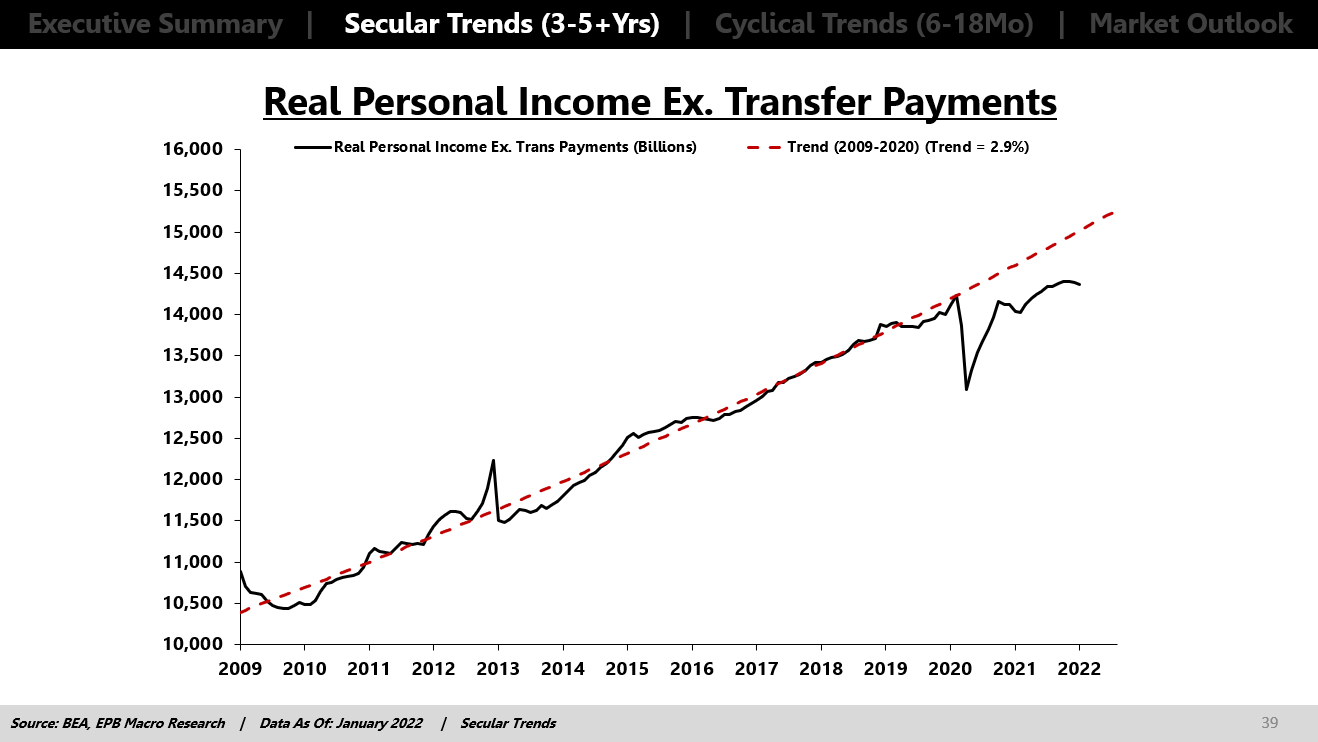

The downside is that asset gains are not permanent and, ex-government transfers, real incomes have not recovered their pre-pandemic trend (below courtesy of EPB Macro).

After two years of debt-addition and extreme price inflation in homes and corporate securities (equities and debt), households are now more risk-exposed than at any time in decades, just as the downcycle itself is poised to be larger and longer than average.

As a percentage of U.S. household assets, bonds fell to an all-time low of 2.3% in 2021. Recent Fidelity data showed that 40% of retirement accounts for 60- to 69-year-olds were 67% in equities at the end of 2021. In the process, equities, at the highest valuations in decades, became 40% of the entire financial asset mix from a long-term norm of 18%.

This level of equity concentration means that capital losses will hit twice as hard as past bear markets, just as owners are that much older and less able to wait years growing back losses.

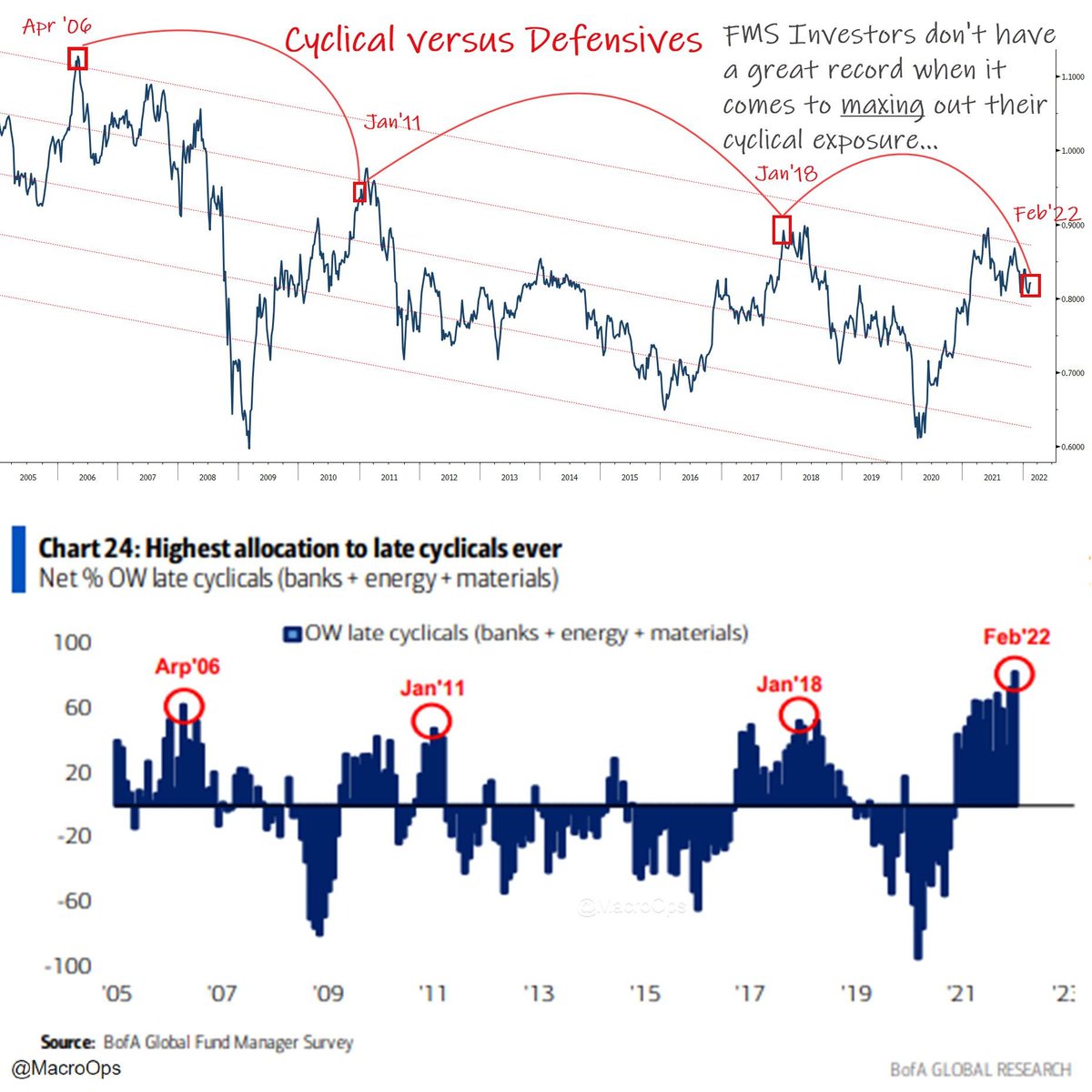

It’s not just that individuals hold a record amount of their self-directed savings in equities and equity-based products. Fund managers’ allocations (shown below since 2005), ETFs and pensions are overweight too.

The capital costs of this are just starting to bite, see U.S. Retirement funds, heavy on stocks, brace for losses:

The capital costs of this are just starting to bite, see U.S. Retirement funds, heavy on stocks, brace for losses:

Volatile stock markets are eroding the retirement savings of America’s teachers and firefighters after public pension systems ended last year with equity holdings at a 10-year high.

Public pension funds had a median 61% of their assets in stocks as of Dec. 31, up from 54% 10 years ago, according to Wilshire Trust Universe Comparison Service. Since then, the Russia-Ukraine War and expectations that the Federal Reserve will raise interest rates this month have battered equity prices, reducing those holdings by billions of dollars.

In Canada, the propensity to index-tracking magnifies exposure to dominant late cyclical sectors like financials and fossil fuel companies. While they typically hold up longer than growth sectors like tech, they follow them down in the end, especially as the yield curve flattens towards zero–as it’s doing now.

Unfortunately, value-indiscriminate buying and passive holding on the way up leads to value-indiscriminate liquidation after bubbles burst. It’s often only then that people realize the lasting ramifications of their losses. For these reasons, this PBS segment on early retirees is hard to watch.

Among the reasons for the current labor shortage in the U.S. is the exodus of older workers retiring early during the pandemic. Economics correspondent Paul Solman reports. Here is a direct video link.