Worthwhile discussion in this segment.

For decades now, nations have been taking on debt far faster than their GDP has grown. They’ve kept the borrowing binge alive by having their central banks conspire to push interest rates ever lower. But that process is unsustainable. It’s a limited-time swindle that ends when the debt service costs become too onerous. And the massive amounts of new debt issued in the wake of the pandemic have rocketed us down much of the remaining limited amount of road the system had left until it reaches its day of reckoning, portfolio manager Michael Lebowitz cautions. Here is a direct video link.

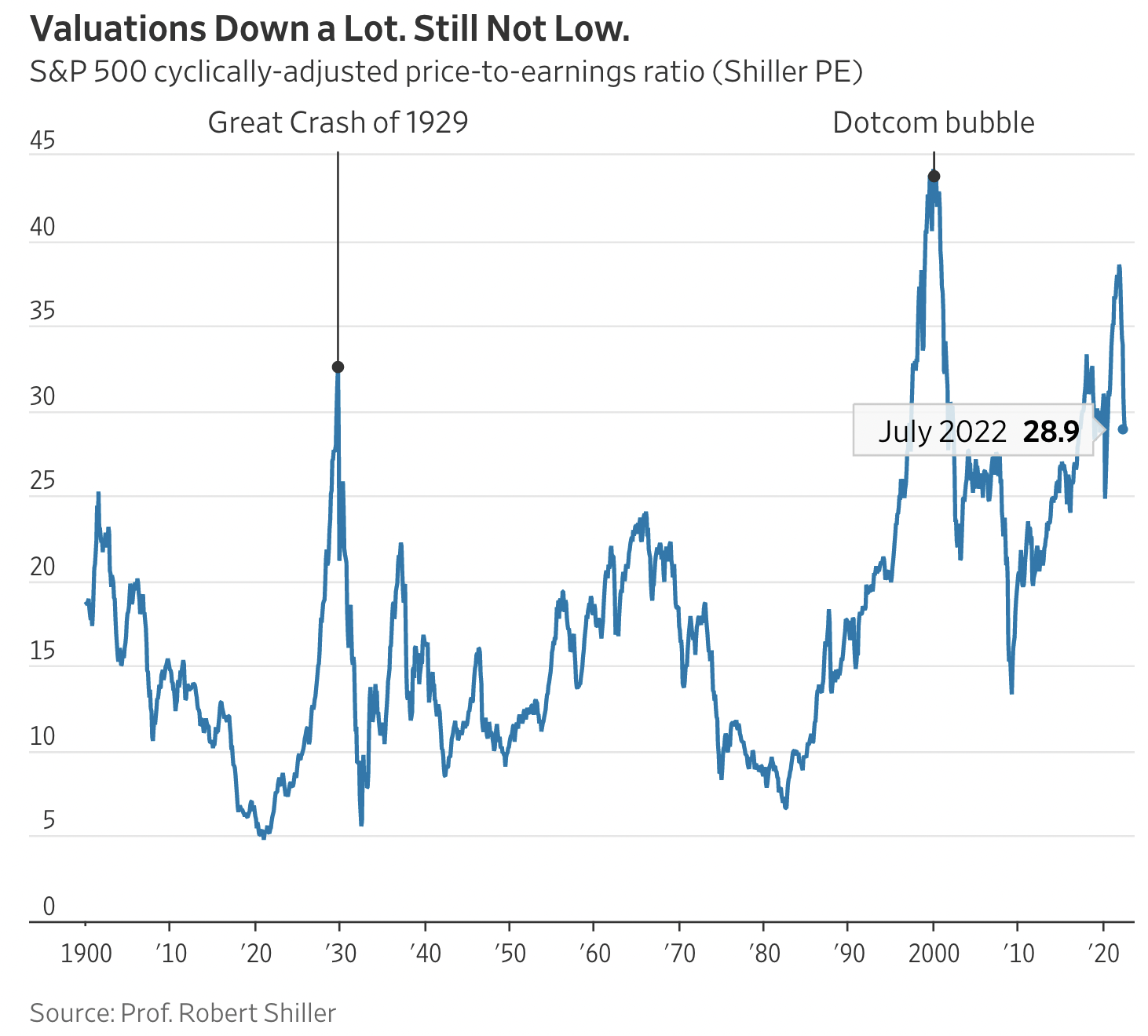

Here’s the CAPE chart since 1900 which Michael references.

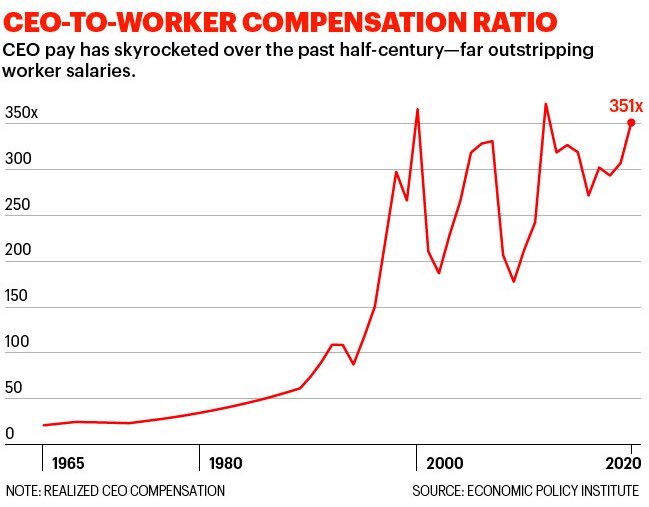

There’s also the CEO pay to average worker chart to mull in this discussion, enjoy!