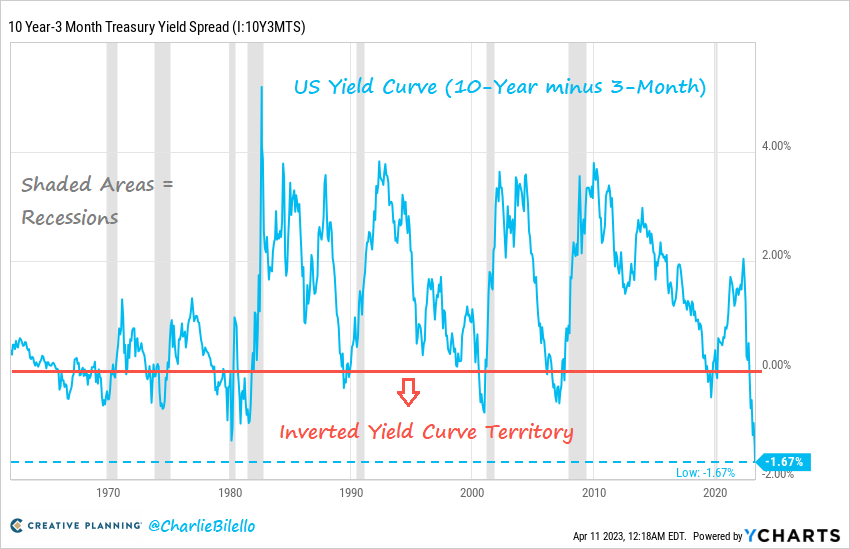

A negative US 10-year minus 3-month yield spread has signalled every incoming recession of the last 60 years (grey bars below courtesy of Charlie Bilello). The current reading, at -1.67%, is the most negative ever recorded.

Still, bullish hopes spring eternal. While most economically-sensitive sectors have floundered for two years: small cap stocks (-27% from their highs), US banks (-39%), consumer discretionary (-31%), real estate (-28%), transports (-18%), a handful of rebounding tech names pulled broad markets higher year-to-date, and the percentage of bulls in the Investor Intelligence Survey in March jumped to 48.6%–the highest since February 2023. There can be no cycle bottom for risk markets until blind optimism has been crushed into a bearish consensus once more.

In the real world, global PC shipments were –29% year over year in the first quarter, and the average work week in March’s payroll report fell to 34.4 hours–the lowest since April 2020 when the economy was in COVID-19 lockdown. Not surprisingly, the IMF just lowered its global growth forecast for 2023 (to 2.9%) and 2024 (to 3%). Unemployment (a lagging indicator) is headed higher from here.

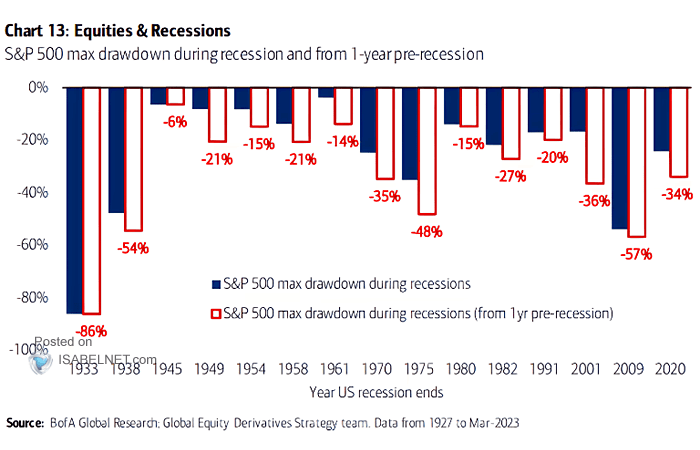

The likelihood of an incoming recession is today as sure as it gets. And for those hoping that equity losses in 2022 have already discounted for all of that, it’s essential to appreciate that the lion’s share of past cycle losses has come during recessions (blue bars below courtesy of ISABELNET.com), not in the year before.

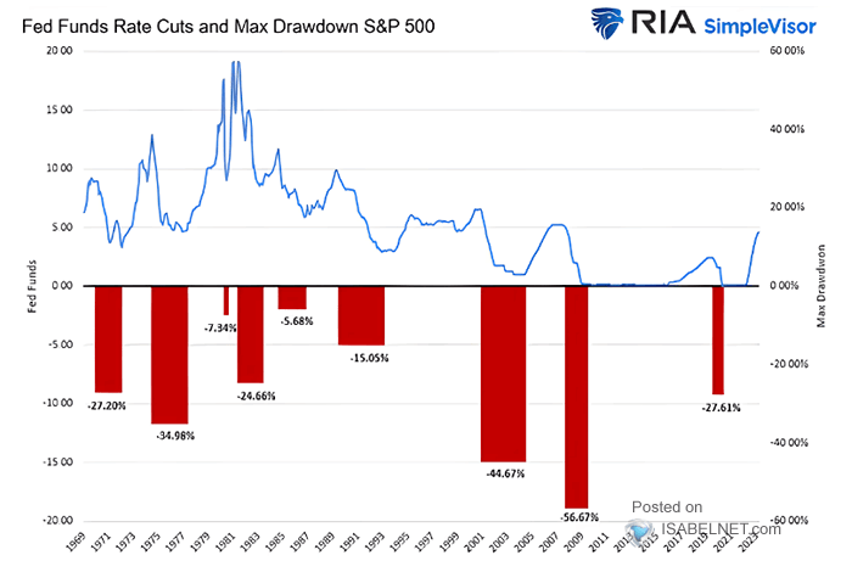

Today, most central banks, led by the US Fed, remain in monetary tightening mode. As the economy and employment contract from here, central banks will pause and resume easing efforts. For those trying to look through that valley and see coming cuts as bullish for risk markets, it bears noting that the bulk of stock market losses (red bars below) have always come while the Fed is easing, not before. Fact.