Despite spring market optimism, US Home sales in March posted their most significant decline in more than a year (-4.3% month-over-month–largest monthly decline since November 2022) as 30-year fixed mortgage rates moved back above 7% from just over 6% in early February. See Housing Market Slumps as Mortgage Rates Top 7%. Also, see, This could be the year the home improvement boom fizzles out.

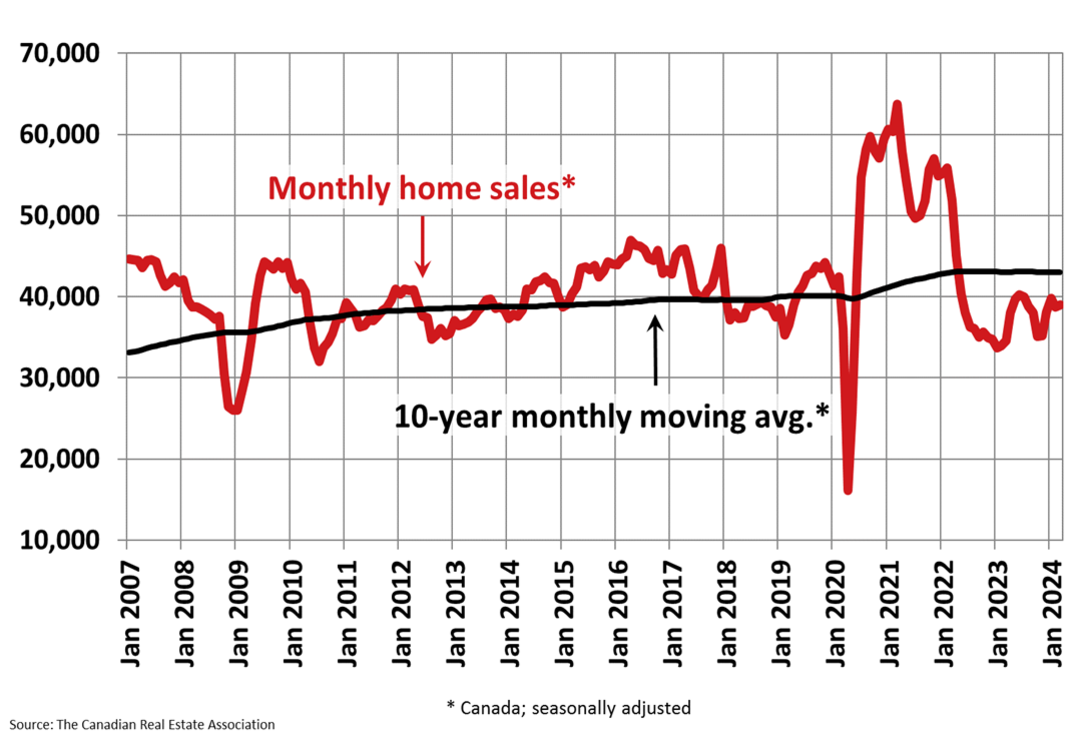

In Canada, where fixed mortgage rates are back above 5%, March home sales and prices were mostly unchanged month-over-month (Canadian Real Estate Association data (CREA). Home sales activity recorded over Canadian MLS® Systems rose just 0.5% between February and March 2024, some 10% below the average of the last ten years (chart below since 2007). While the Bank of Canada is expected to lower its base rate in the second half of this year, Pandemic-era mortgages that were taken out at rock-bottom interest rates are still likely to face higher interest rates at renewal over the next three years.

While the Bank of Canada is expected to lower its base rate in the second half of this year, Pandemic-era mortgages that were taken out at rock-bottom interest rates are still likely to face higher interest rates at renewal over the next three years.

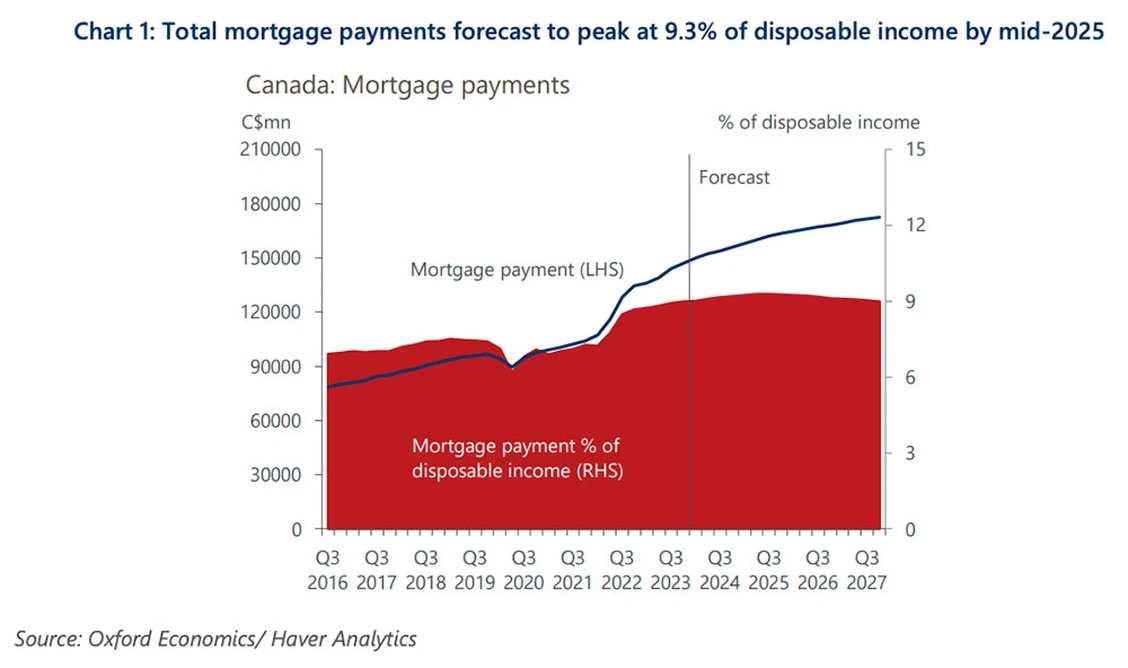

Oxford Economics forecasts that mortgage payments will increase by another 6% to $156 billion by the end of 2024 and 18% to $173 billion by the end of 2027. This would take mortgage payment’s share of disposable income to a peak of 9.3% by mid-2025–the highest on records going back to 1990 (chart below).

The implications are less money for everything else and a rash of forced asset sales. See, the Pain of Canadians’ Mortgage Rate Shock is not over–not by a long shot:

The implications are less money for everything else and a rash of forced asset sales. See, the Pain of Canadians’ Mortgage Rate Shock is not over–not by a long shot:

The hardest hit will be low to medium-income households, which have little spare income, excess pandemic savings or ability to take on more debt.

According to Oxford, these households hold about 45 per cent of the mortgage debt in this country, with higher-income households accounting for 55 per cent.Higher income households, with more disposable income, are obviously better equipped to deal with rising mortgage payments. For less wealthy Canadians, however, these payments are expected to gobble up 10 per cent of disposable income by mid-2025, compared to 8.8 per cent for higher incomes.

With little to no buffer, lower-income households could be forced to cut discretionary spending, become delinquent on their mortgages or sell their homes, said the economists.

And since these households accounted for 50 per cent of consumption in Canada last year, the pullback will hit the economy, they said.

Oxford’s outlier forecast is that aggregate real consumer spending will slow to 0.5 per cent this year, down from 1.7 per cent growth in 2023, bringing on a mild recession.

“Weaker consumption, which accounts for more than half of GDP, is a key driver of our recession forecast, but we could also see a period of deleveraging in coming years,” said Oxford.