Danielle was a return guest on Thoughtful Money with Adam Taggart. You can watch a video clip of the segment here.

If you haven’t seen the 2022 film Dumb Money, it’s worth a look. Here’s the trailer link. Evidently, the capital wipeout from 2021 through 2023 was not enough to kill the gambling fever, see Is the Meme Stock Craze Back?

Below are a few charts touched on in the TM discussion…

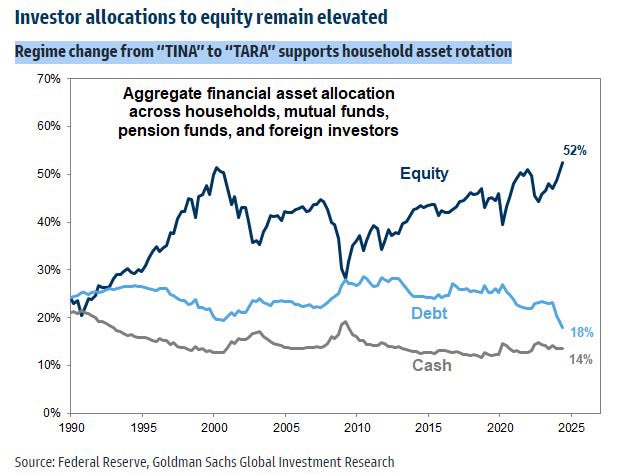

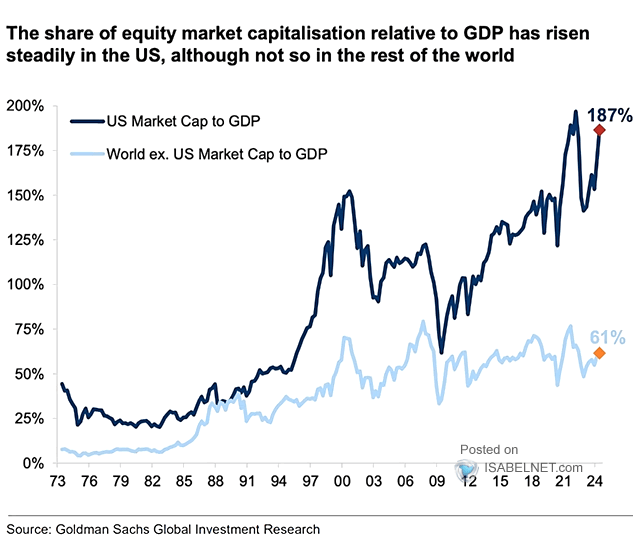

A record 52% of financial assets are allocated to equities today, surpassing prior manic peaks in 2021 and 2000, while allocations to cash and bonds (“debt”) hover near all-time lows. While there are reasonable alternatives today (“TARA”), Boomers hold most of the equities at age 61 to 78 and are 24 years older than at the 2000 tech bubble top. Unlike in 2000, boomers are net withdrawers from their savings today, needing cash to fund retirement. In other words, their time horizons have never been shorter, and their capital has never been more risk-exposed. #badcombo. Within a plethora of products, equity holdings are concentrated in US stock markets that are dominated by the top ten most expensive companies, mainly in the tech sector. In the process, the market capitalization of the US stock market has been pushed to 187% of GDP, a record extreme only seen briefly in 2021 and above the 150% peak in March of 2000 (dark blue below since 1973). In the rest of the world, equity markets at 61% of GDP are not as optimistic and have not recovered the 2021 price peak (light blue).

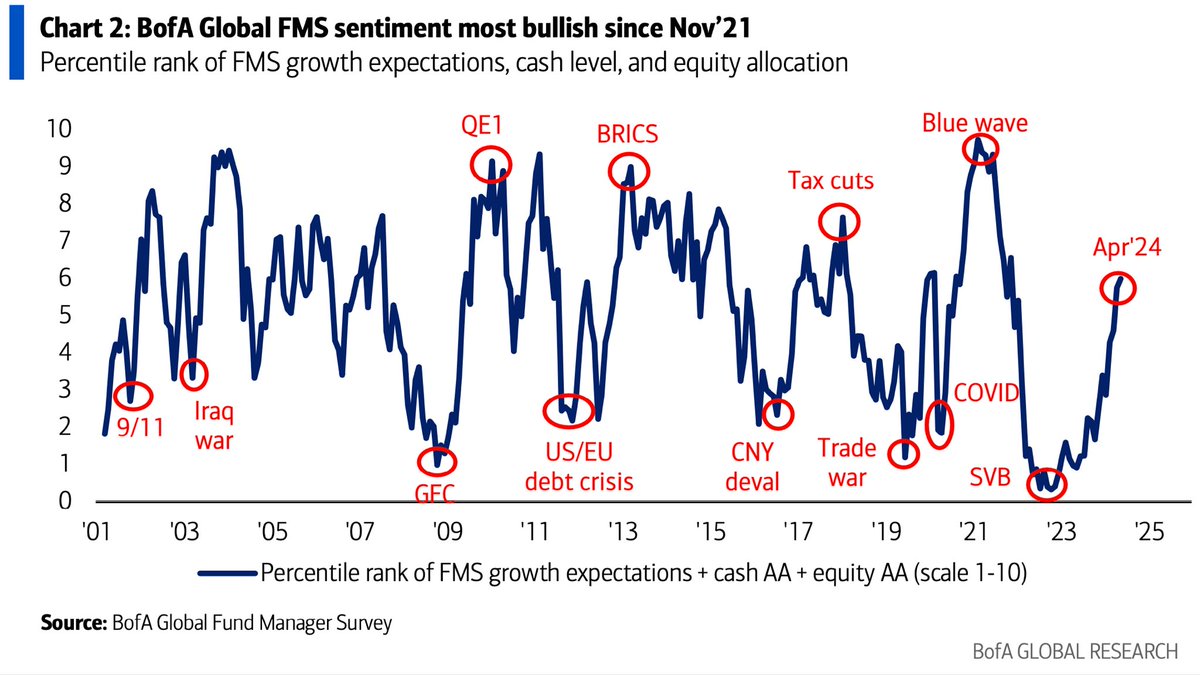

Within a plethora of products, equity holdings are concentrated in US stock markets that are dominated by the top ten most expensive companies, mainly in the tech sector. In the process, the market capitalization of the US stock market has been pushed to 187% of GDP, a record extreme only seen briefly in 2021 and above the 150% peak in March of 2000 (dark blue below since 1973). In the rest of the world, equity markets at 61% of GDP are not as optimistic and have not recovered the 2021 price peak (light blue). In typical trend-chasing groupthink, global fund managers are the most bullish since the 2021 top (shown below since 2001), just before the average portfolio lost 35% of its value.

In typical trend-chasing groupthink, global fund managers are the most bullish since the 2021 top (shown below since 2001), just before the average portfolio lost 35% of its value. The trouble with buying and holding with the masses is that corrections inevitably arrive and evaporate years of apparent “performance” in weeks and months. From cyclical highs, it is common to see a decade-plus of capital returns disappear and take years to grow back.

The trouble with buying and holding with the masses is that corrections inevitably arrive and evaporate years of apparent “performance” in weeks and months. From cyclical highs, it is common to see a decade-plus of capital returns disappear and take years to grow back.

The chart below, courtesy of my partner Cory Venable, shows the price performance of Canada’s TSX since 2006 (mentioned in the discussion with Adam). Even though Canada’s economy was much less indebted than the US at the 2008 top (and Canada today), the TSX fell 50% with US stocks to March 2009. It then took a decade to 2019 before the TSX durably broke above its 2008 cycle high. This was short-lived before the stock market plunged back to its 2006 price level in 2020–14 years of zero returns. While the TSX recently recovered its 2022 high, it is poised for another setback as the economy struggles and central banks respond to rising unemployment with another easing cycle. Savings are much harder to hold on to than the ever-bullish investment business lets on. For individuals, the best chance of durable success requires risk aversion when the masses are jubilant and risk-seeking with cash at the ready when the masses are liquidating in losses.

Savings are much harder to hold on to than the ever-bullish investment business lets on. For individuals, the best chance of durable success requires risk aversion when the masses are jubilant and risk-seeking with cash at the ready when the masses are liquidating in losses.

Everyone gets a turn in market cycles, but benefiting from that turn requires pre-work, personal discipline, and keeping our wits about us when others are losing theirs.