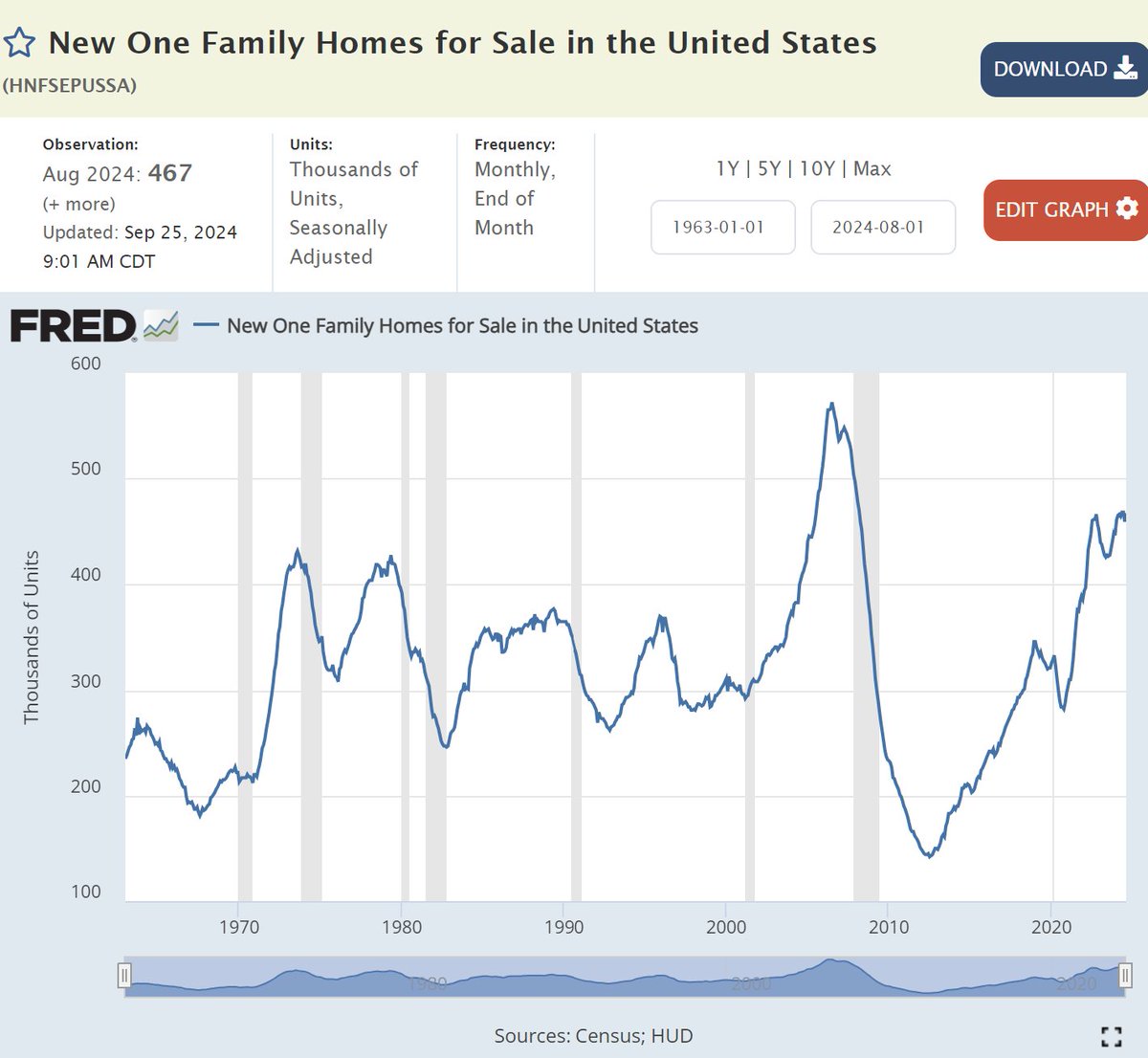

Nationally, the supply of new one-family homes in America (shown below since the 1960s) has only been higher in the 2005 housing bubble peak. As more existing homes come on the market from stretched households and investors, home supply is rising in most areas.

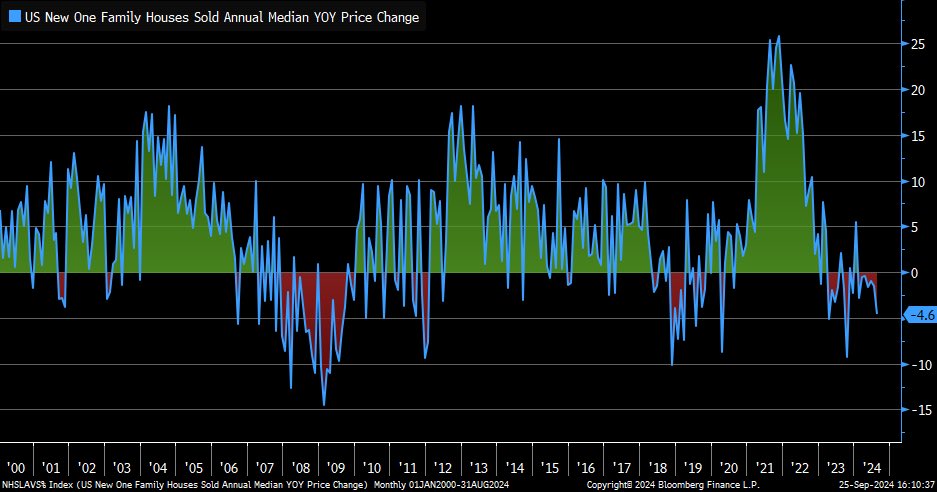

The median price of a new single-family home fell by 4.6% year over year in August—the largest drop since October 2023 and an acceleration to the downside compared to the prior month. As shown below, since 2000 (courtesy of Liz Ann Saunders), this degree of negative price action was last seen in 2019-2020 and 2005-09.

The median price of a new single-family home fell by 4.6% year over year in August—the largest drop since October 2023 and an acceleration to the downside compared to the prior month. As shown below, since 2000 (courtesy of Liz Ann Saunders), this degree of negative price action was last seen in 2019-2020 and 2005-09. While mortgage rates have moved significantly down from their peak of last October (because Treasury bonds have rallied), the rates on offer remain sharply above those of existing mortgages. As shown below, the US 30-year mortgage rate of 6.18% versus 7.62% last October remains daunting compared to the 3.89% average rate on the existing active mortgages coming up for renewal. See, Lower Interest Rates Don’t Guarantee A Soft-Landing.

While mortgage rates have moved significantly down from their peak of last October (because Treasury bonds have rallied), the rates on offer remain sharply above those of existing mortgages. As shown below, the US 30-year mortgage rate of 6.18% versus 7.62% last October remains daunting compared to the 3.89% average rate on the existing active mortgages coming up for renewal. See, Lower Interest Rates Don’t Guarantee A Soft-Landing.

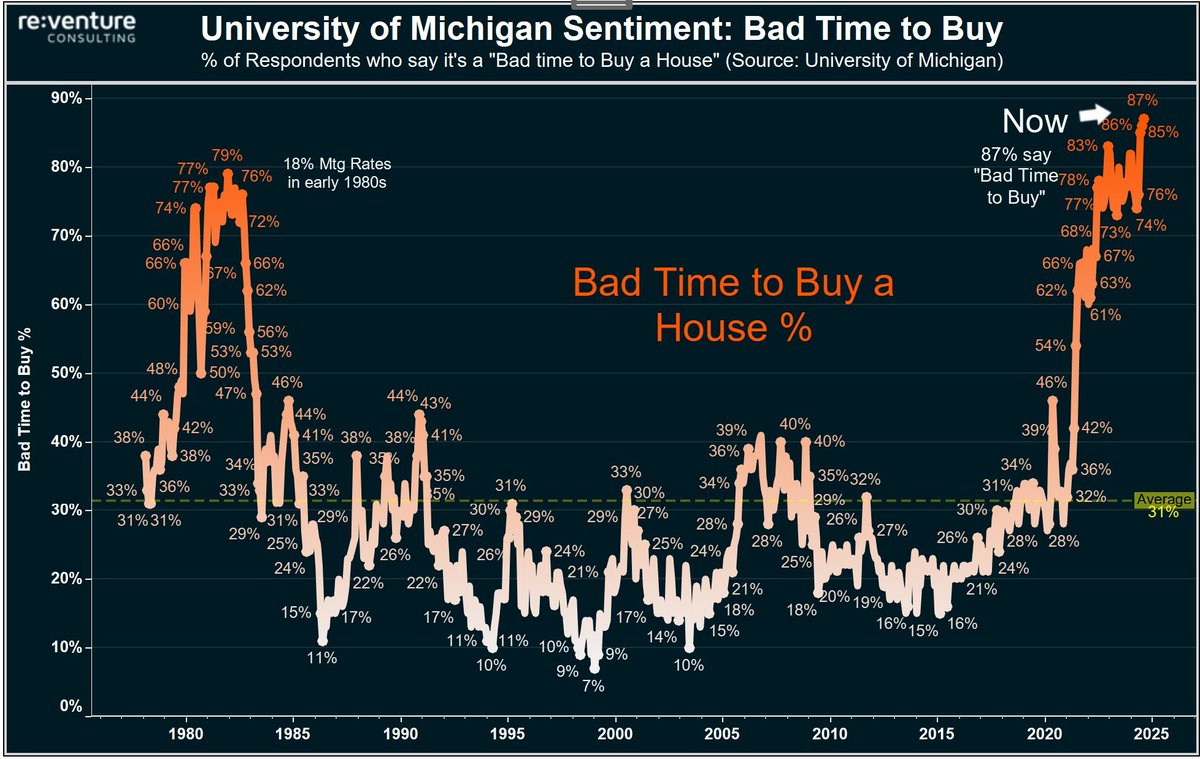

Too-high home prices remain out of reach for most. A record of eighty-seven percent of Americans surveyed by the University of Michigan say that now is a bad time to buy a home in America. This will get worse as unemployment rises.

Too-high home prices remain out of reach for most. A record of eighty-seven percent of Americans surveyed by the University of Michigan say that now is a bad time to buy a home in America. This will get worse as unemployment rises. Housing analyst Nick Gerli offers valuable insight into how selling pressure from price indiscriminate buyers in the easy money era is accelerating price writedowns now.

Housing analyst Nick Gerli offers valuable insight into how selling pressure from price indiscriminate buyers in the easy money era is accelerating price writedowns now.

Blackstone is selling yet another house in Florida, this time at a loss of $15,000. This house is located in the city of Palmetto, south of Tampa. And reflects a continued effort by corporate real estate investors to leave the Florida housing market before the downturn gets worse in 2024 and 2025. Access data on Reventure App: https://www.reventure.app The number of homes for sale in the area has spiked due to these investors selling. And values are now going down. But they are still very high compared to long-term norms. Reventure’s home price forecast suggests that values will keep declining in markets like Tampa, Sarasota, Naples, and Bradenton so long as inventory levels remain high. Here is a direct video link.