The Bank of Canada has slashed overnight interest rates by 200 basis points over the past seven months to 3% from 5%, while variable and fixed mortgage rates have fallen to around 4% from more than 5% a year ago.

Mortgage rates of around 4% are not high; they are about average historically. The trouble is that they are about double those accessed during the pandemic.

Over one million fixed-rate mortgages are up for renewal in 2025; 85% were taken out during 2020-21 (CMHC data) when the Bank of Canada rate was less than 1% and fixed mortgage rates less than 2%.

Debt payments are particularly taxing in Ontario, where home prices and mortgage balances went parabolic. The typical home jumped more than 70 percent to a peak of $1,070,400 in early 2022, while the average new mortgage balance in Ontario was $434,744 at the end of 2024, 26% higher than the national average of $344,928.

Although home prices have been declining since 2022, the typical Ontario home is still 40% more expensive than in early 2020. Unsurprisingly, new for-sale listings are dramatically outpacing home sales, and more homeowners are falling behind on their payments. See Mortgage defaults climb in Ontario as homeowners face renewal at higher rates:

Equifax found that homeowners with more than 11,000 mortgages in Ontario recorded a missed payment in the fourth quarter, foreshadowing an increase in the 90-day delinquency rate this year. The credit reporting agency said mortgage holders who are falling behind in their payments also carry large mortgage balances.

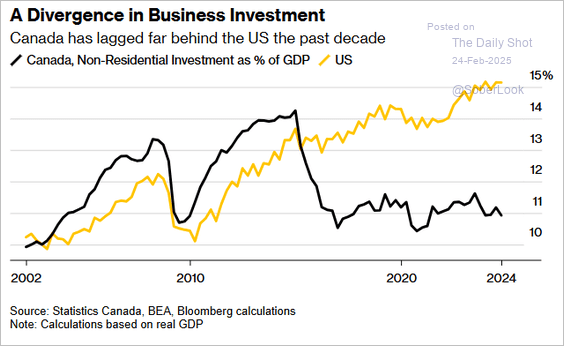

Many poor financial choices were made during the ultra-low interest rate era. The legacy is particularly costly in Canada because housing mania diverted critical investment away from productive assets and innovation into increasingly expensive shelters (non-residential investment as a percentage of GDP for Canada is shown below in black since 2002 versus America in yellow).

Canada’s economy is now particularly vulnerable as the housing bust mean-reverts the ‘wealth effect’ (they always do), and we have fewer income-generating businesses and technologies to help lower costs and pay back what we borrowed. Canada has a lot of work to do to rebuild strength and resilience. Admitting mistakes is a first step to recovery.

Canada’s economy is now particularly vulnerable as the housing bust mean-reverts the ‘wealth effect’ (they always do), and we have fewer income-generating businesses and technologies to help lower costs and pay back what we borrowed. Canada has a lot of work to do to rebuild strength and resilience. Admitting mistakes is a first step to recovery.