The good news is that shelter prices are finally retreating; the bad news is that this has significant knock-on effects for existing owners, debtors, lenders, and many other feeder sectors.

Thousands of Canadians are missing mortgage payments — especially in Ontario and B.C. — as the affordability crisis stretches household budgets to the limit despite multiple interest-rate cuts. Here is a direct video link.

Reducing foreign students is needed to correct prior excesses, but another negative for housing demand, revenue, and employment. See, ‘New home buyers are nowhere to be found.’ Toronto-area January new home sales near ‘record low’ despite excessive inventory, falling prices.

The decline in foreign students at Georgian College will have far-reaching local impacts. Here is a direct video link.

Delinquencies and motivated property sellers are rising sharply in America, too. While U.S. new home completions rose 10% year over year in January, for-sale listings rose 4.8% year over year, and buyer demand fell back to 1995 levels. See, Home buyers are finally getting the upper hand again:

A dearth of buyers has slowed down the housing market. U.S. existing-home sales fell 4.9% in January from the prior month to a seasonally adjusted annual rate of 4.08 million, the National Association of Realtors said Friday. Last year, home sales fell to the lowest level since 1995 for the second straight year.

And prices continue to trend higher. The national median existing-home price in January was $396,900, up 4.8% from a year ago.

Mortgage rates are just below 7%, adding hundreds or thousands of dollars to the monthly cost of homeownership from just a few years ago. The costs of insurance, property tax and homeowners association fees have all been rising briskly in many parts of the country.

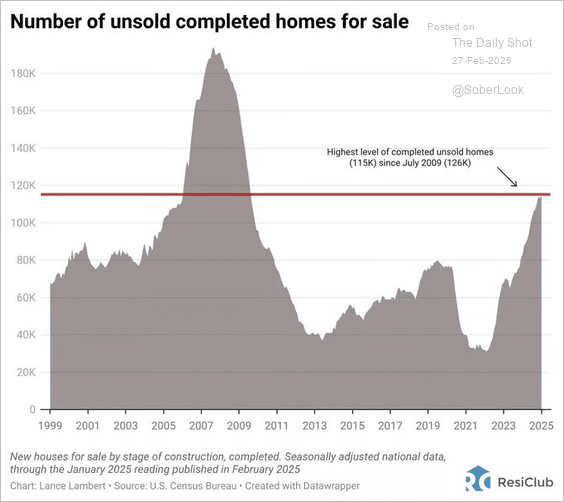

The inventory of unsold completed homes for sale rose to the highest since the last US housing bust began in 2006.

Government spending cuts further erode demand and increase motivated selling in the property space. Private businesses that feed on government employees and contracts are also taking a hit. See DOGE move to slash federal leases threatens office-market recovery:

The Trump administration’s move to terminate millions of square feet of federal leases and sell government buildings threatens to weaken a fledgling recovery in the U.S. office market, from California to Washington, D.C.

Elon Musk’s Department of Government Efficiency has targeted nearly 100 leases at government agency offices for termination or consolidation. The Trump administration is also considering selling two-thirds of the federally owned office buildings that are empty or underused.