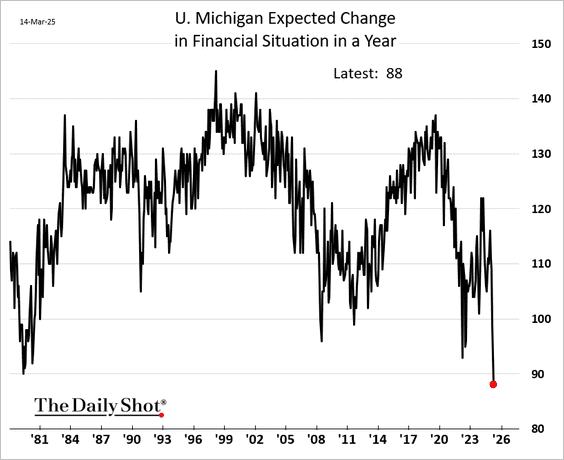

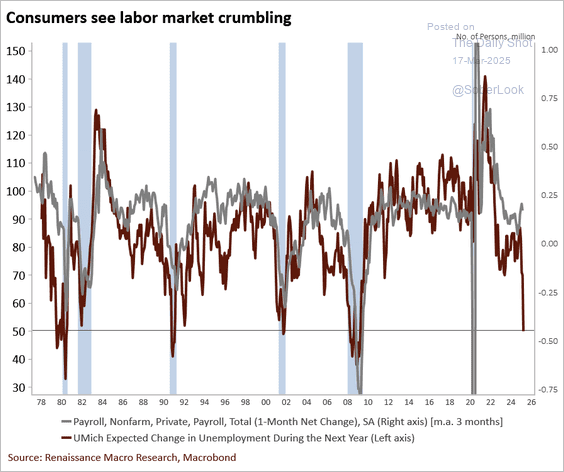

Last week’s University of Michigan consumer sentiment survey saw economic expectations plunge for Democrats, Independents and Republicans. Those expecting an improved financial situation one year from now reached the lowest since 1980 (shown below, courtesy of The Daily Shot). Those seeing improving employment conditions were the least since the 2008 recession (red line below since 1978 with recessions in blue bars).

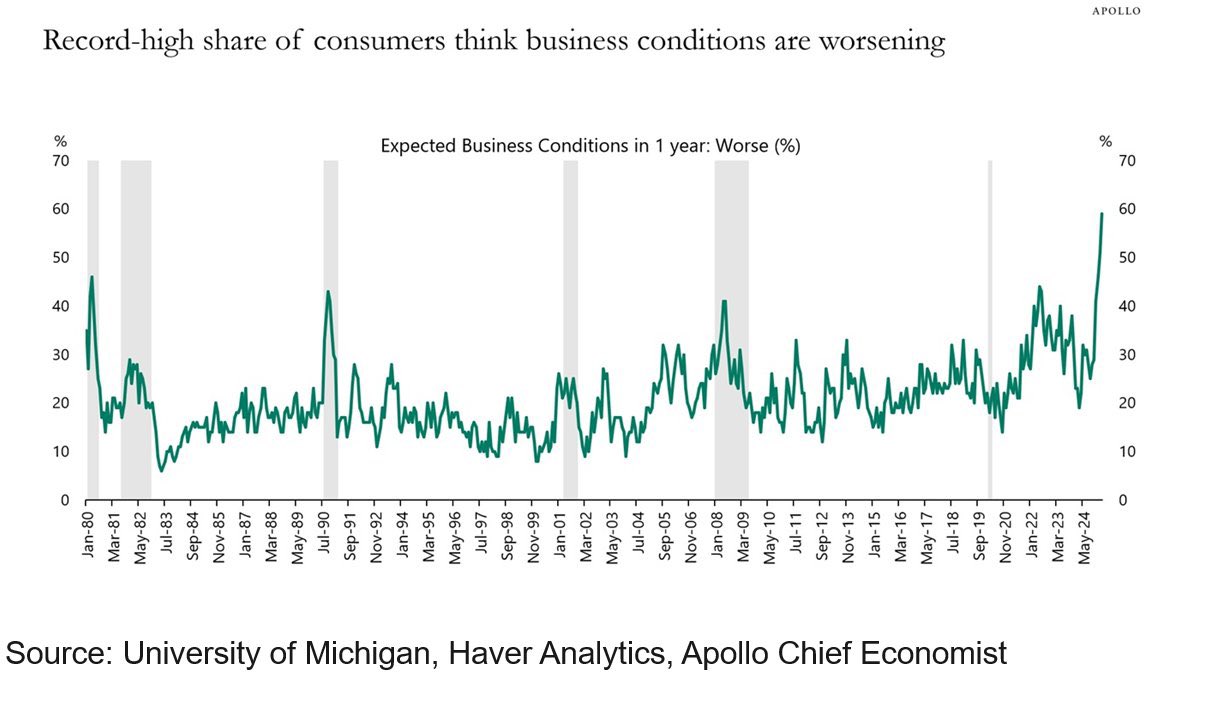

Those seeing improving employment conditions were the least since the 2008 recession (red line below since 1978 with recessions in blue bars). The share of surveyed consumers who think business conditions are worsening spiked to the highest since 1980 (below in green, with past recessions in grey bars, via Tavi Costa.)

The share of surveyed consumers who think business conditions are worsening spiked to the highest since 1980 (below in green, with past recessions in grey bars, via Tavi Costa.) A survey of 220 corporate executives conducted by Chief Executive magazine found that the outlook for business conditions over the next year was the most pessimistic since November 2012.

A survey of 220 corporate executives conducted by Chief Executive magazine found that the outlook for business conditions over the next year was the most pessimistic since November 2012.

The Business Roundtable’s CEO outlook survey fell to 84.0 in the first quarter from 91.2 in the final quarter of 2024. Capex plans dipped, and hiring intentions plunged to 54, the lowest since the third quarter of 2023. The share of businesses expecting more employment in the next six months dropped to 33%, the same level as the final quarter of 2007 when the 2008 recession was beginning.

According to Fed data, 43% of American households’ financial assets were in stocks at the end of last year, the highest share ever (shown below since 2014).

While 58% of American households own some stocks via mutual funds or individual shares, a record 93% of stock market wealth is held by the top 10% of income earners (making $250k+ a year, the chart below since 1995, courtesy of Axios).

While 58% of American households own some stocks via mutual funds or individual shares, a record 93% of stock market wealth is held by the top 10% of income earners (making $250k+ a year, the chart below since 1995, courtesy of Axios).

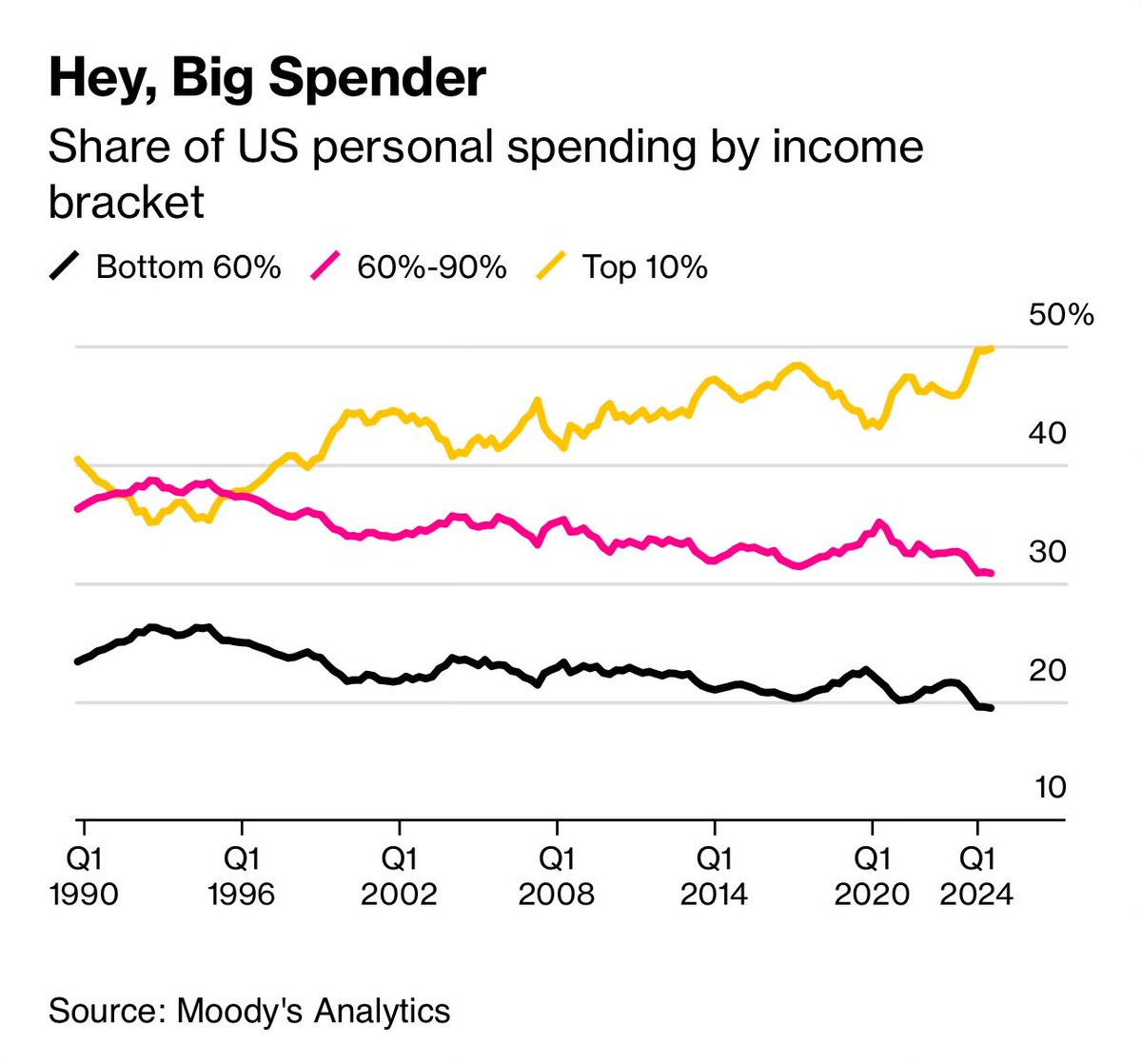

These stats are relevant since the same 10% of income earners now account for a record 50% of consumer spending (yellow line below since 1990).

These stats are relevant since the same 10% of income earners now account for a record 50% of consumer spending (yellow line below since 1990).

An over-owned, over-valued stock market increases economic risks to the downside for everyone. A Harvard study estimates that a 20% drop in stocks in 2025 could itself reduce economic growth by as much as a percentage point this year. See, Slumping Stocks Threaten a Pillar of the Economy: Spending by the Wealthy:

An over-owned, over-valued stock market increases economic risks to the downside for everyone. A Harvard study estimates that a 20% drop in stocks in 2025 could itself reduce economic growth by as much as a percentage point this year. See, Slumping Stocks Threaten a Pillar of the Economy: Spending by the Wealthy:

“In a hyperfinancialized economy like America’s, asset prices can lead the economy, not just the other way around,” said Alex Chartres of Ruffer, a British fund manager. “A decline in asset markets creates the risk of weakening conditions in the real economy.”

These knock-on effects are particularly significant since, as of early 2024, individuals aged 55 and older owned approximately 80% of all stocks, a significant increase from 60% two decades ago. See Older Americans Now Own 80% of the Stock Market—Here’s Why That’s a Problem.

Market losses later in life are harder to recover from emotionally, psychologically and financially; see Boomers Face Lasting Retirement Hit in Extended Stock Rout:

For Baby Boomers, now is a particularly bad time for a market selloff.

The S&P 500 is down more than 9% from a recent high on fears of a recession and trade-war risks. Everyone, of course, hates to see their portfolios decline. But the economic consequences could be severe if baby boomers, in particular, see their investments continue to shrink.

Much of the cohort, born between 1946 and 1964, is in the early years of retirement, or preparing to leave the workforce. And if they were to suffer persistent and deep losses while needing to withdraw money for living expenses it’s likely their portfolios would never fully recover — a scenario experts call sequence of return risk.

“Early losses while withdrawing funds can severely impact a portfolio’s longevity,” said Tomas Geoghegan, founder of Beacon Hill Private Wealth. “It’s one of the biggest but most underappreciated risks in retirement.”

Of course, standard financial advice makes its fees by getting people to keep holding equities regardless of risk-reward prospects.

While the retail crowd is all in, corporate insiders have been selling with both hands and feet (red bars below since 2005, with the S&P 500 price in blue). #retailleftholdingthebagagain

A confluence of factors is coinciding to undermine worker, business and investor sentiment in the near to medium term. Nick Gerli provides a good update with connections to the real estate market below.

A confluence of factors is coinciding to undermine worker, business and investor sentiment in the near to medium term. Nick Gerli provides a good update with connections to the real estate market below.

Economic warnings are coming from big Wall Street corporations, suggesting the US economy could be trending towards a recession in 2025. Here is a direct video link.