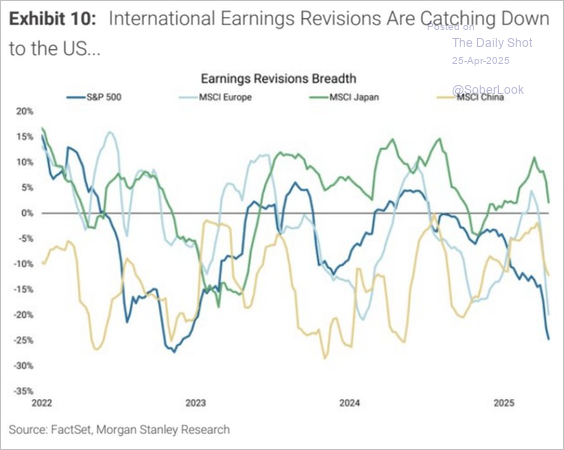

The extremely over-valued, tech-concentrated US stock market has been a bug in search of a window for a long time. Trump’s chaos is accelerating an inevitable mean reversion that started with the bursting of the AI bubble on China’s DeepSeek news on January 10th. Year to date, the US market has been underperforming international stock markets. Still, the downturn in corporate earnings is global (S&P 500 earnings revisions since 2022 below in navy, versus Europe (light blue), Japan (green) and China (in yellow).

Year to date, the US market has been underperforming international stock markets. Still, the downturn in corporate earnings is global (S&P 500 earnings revisions since 2022 below in navy, versus Europe (light blue), Japan (green) and China (in yellow). Disappointment is contagious. As the most widely held assets falter, highly leveraged funds and speculators are increasingly forced into selling what they can. Illiquid things can be hard, even impossible, to exit. Just ask those sitting with real estate or private credit funds that they’ve been trying to sell for many months now.

Disappointment is contagious. As the most widely held assets falter, highly leveraged funds and speculators are increasingly forced into selling what they can. Illiquid things can be hard, even impossible, to exit. Just ask those sitting with real estate or private credit funds that they’ve been trying to sell for many months now.

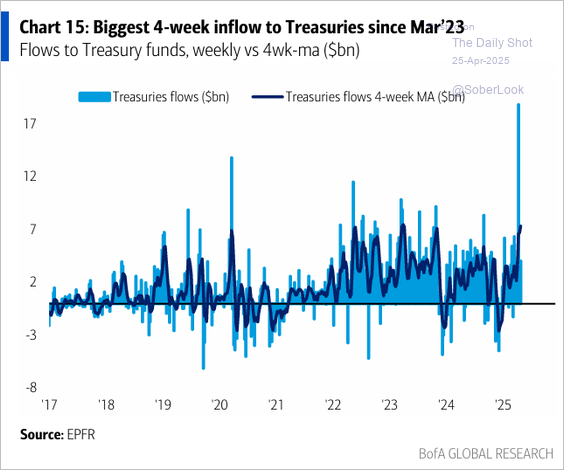

For all the talk about investors “dumping” US Treasuries, most major economies have seen outflows and higher yields in April. Canadian 10-year yields rose from 2.96% at the end of March to 3.17% as of April 25. The latest record weekly flows into US Treasuries (shown below since 2017) have a familiar risk-off look. Best to watch what fund flows do rather than what talking heads say.