Its another Groovy Tuesday so no doubt rigged steroid injected stock prices will leap higher today. And Jamie Dimon just won the confidence vote from a majority of JP Morgan shareholders to stay on in the limitless privilege and unfair advantage of his dual role as CEO and Chairman. Same old, same old. So many elites with free reign to take freely. So few are focused on the state of the real economy.

“Traders don’t care”, “the market doesn’t care”, yes, yes, I know. The conventional wisdom will only care when stock prices collapse once more like the homes in a tornado ravaged suburb. Given that S&P earnings growth has been flat now for more than 20 months since September 2011 and forward earnings estimates have been plunging since January the only thing that is actually rising today is the appetite for market participants to pay more and more for less and less value. Goldman Sachs, that bastion of fiduciary financial advice, just upped its year end target for the S&P to 1750 and 2100 by 2015 at which point the S&P would be trading at valuations approaching the 2000 tech wreck peak as opposed to “just” the 2007 credit bubble peak that US stocks have reclaimed over the past 6 months. Next stop: to infinity and beyond. Central banks have finally managed to abolish the business cycle and banish bear markets forever more. It only took them 100 years of repeated financial booms and blowups to get in charge of the free-market system. Awesome. Long live unlimited leverage!

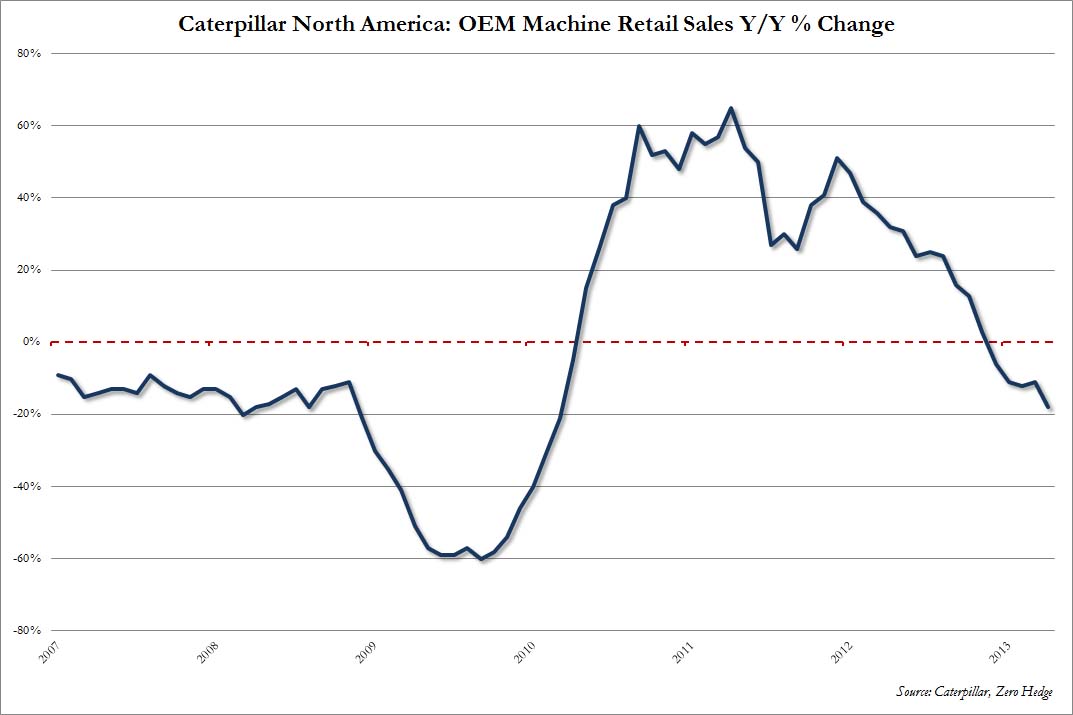

This chart of economic bell weather, heavy equipment maker Caterpillar’s machine sales reflects the business cycle trend of the global economy and corporate revenues which have been declining now since 2010. Paying more and more, for less and less is the most well worn path to financial loss ever charted. It may be hard to stand aside and wait for the inevitable collapse to run its course once more, but playing along in such treacherous conditions is positively reckless.