Erratic announcements from the Trump administration continue to spook an exodus of capital from asset markets. This morning, the trend intensified following Trump’s latest threats to fire the Federal Reserve Chairman for failing to lower the US overnight rate fast enough.

In a speech last week, Fed Chair Powell reiterated concerns that the US core inflation rate remains above target. At the same time, newly announced tariffs are “significantly larger than anticipated” and “highly likely” to generate at least a temporary rise in inflation, which could become more persistent depending on various factors.

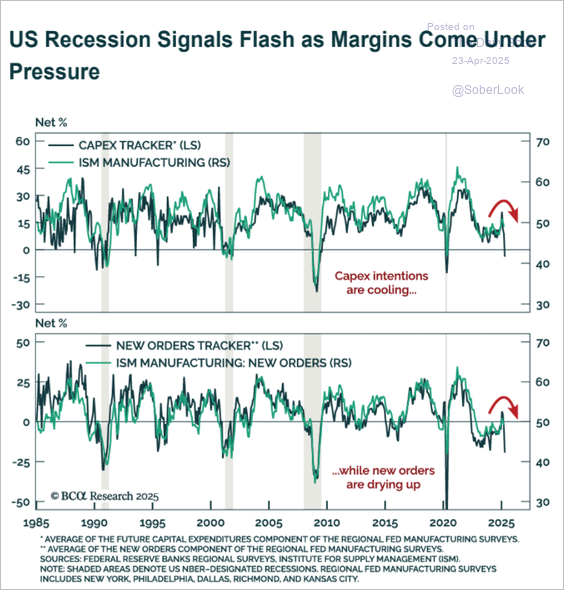

The Fed faces a “challenging scenario” in which inflation and unemployment rise, forcing the central bank to choose between keeping interest rates high to fight inflation and cutting them to spur growth and hiring.

Powell highlighted that the Fed’s tools can only address one of these issues at a time. In other words, in such conditions, monetary policy can be less responsive and accommodating than financial markets have come to expect.

The outlook for higher prices also led the Bank of Canada to leave its main interest rate unchanged at its April 16 decision, the first pause since it started cutting borrowing costs last June. This disappointed a highly leveraged Canadian economy and property market, which is feeling the burn from a decade of record debt accumulation and counterproductive spending.

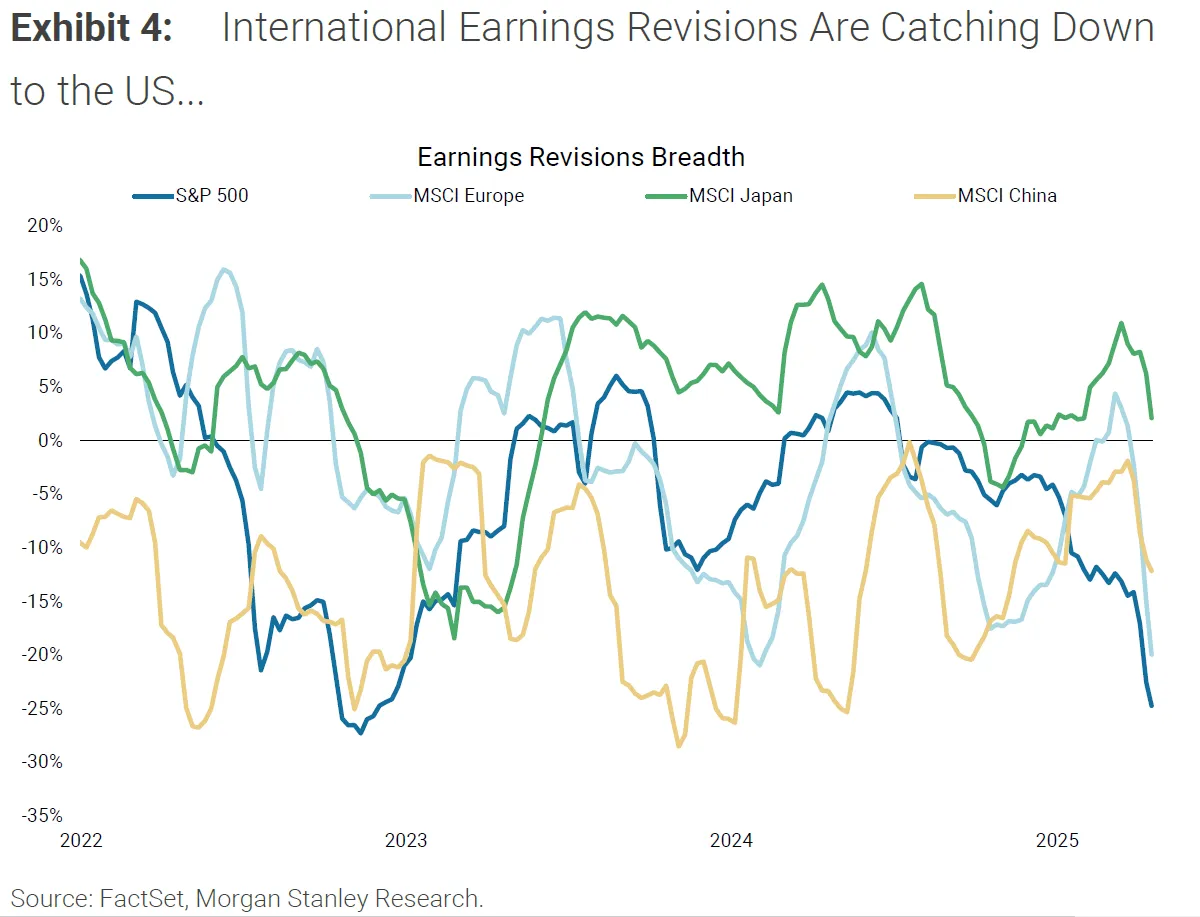

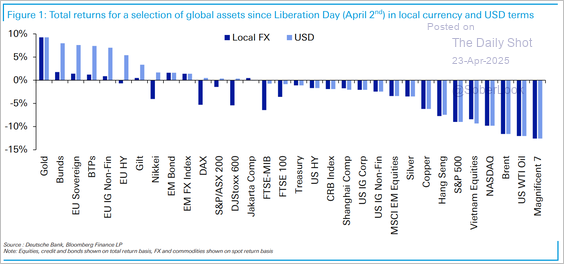

Risk markets are starting to get the memo: the S&P 500 is leading global stock markets lower with a 15% decline since February 19, the Nasdaq is -20.6% from its December 16 peak, and the S&P small cap 600 index has been -24% since November 24, 2024.

Canada’s TSX index is faring better, with a 7% decline since January 30, 2025, buoyed by a 12% weight in the metals and mining sector that has benefited from counter-US dollar flows.

Since the end of January, the Canadian dollar has risen 4.8% against the greenback, while the Euro is +11.2% and the Japanese Yen +10.5%. China has not let its currency float, and so far, the Yuan has held steady with a modest +.03% appreciation against the USD in 2025.

The many economies reliant on exports to America are suffering. In April, South Korean exports were -5.2% year over year. China’s April export numbers have not yet been released. However, analysts anticipate a significant decline due to the recent escalation in trade tensions, particularly the imposition of a 145% tariff on Chinese goods by the United States.

In March, China’s exports rose 12.4% year-on-year, primarily attributed to a shipment surge ahead of the anticipated US tariffs. This front-loading effect was seen in many economies and is expected to lead to a subsequent drop in export figures for April. UBS has projected that China’s exports to the US could decrease by up to two-thirds in the coming quarters, with an overall 10% decline in US dollar terms for 2025. (Reuters)

The latest reports from China’s largest trade fair indicate that US markets have become “frozen,” with many exporters facing suspended orders and halted payments.

The Bank of Canada (BoC) anticipates a sharp decline in Canadian exports during the second quarter of 2025, following two quarters (Q4 2024 and Q1 2025) when Canadian exports accelerated in anticipation of US tariffs. The BoC notes that foreign demand for Canadian exports, especially from the United States, has weakened considerably.

The trouble is that America is the most consumption-driven economy in the world. While Americans make up just 4.2% of the world’s population, US GDP (70% driven by US consumers) accounts for 26.5% of global GDP (IMF, October 2024 figures).

A corollary to this is that the world has come to rely on US dollars, with 89% of commodities and just over 50% of all international transactions occurring in USD. Approximately 70% of the $256 trillion in global debt is owed in USD.

The price of gold has jumped 26% in US dollar terms year to date and 22.8% in Canadian dollar terms. However, gold, too, is vulnerable as it depends on sufficient liquidity elsewhere since it produces no income and requires conversion to one’s home currency if it’s to pay bills.

As explained in the latest Hoisington Management Outlook and Review Q1 2025:

A country’s positive capital account is the inverse of a negative current account. If tariffs reduce the current account deficit, fewer foreign funds would be available for fixed investment and the U.S. budget deficit. Thus, tariffs could initiate a downturn in the international trade and capital flow sectors, significantly weakening economic growth.

The reality is that fewer US imports mean fewer dollars flowing out into the world and less capital recycling back into US asset markets, which has broad implications for everyone.

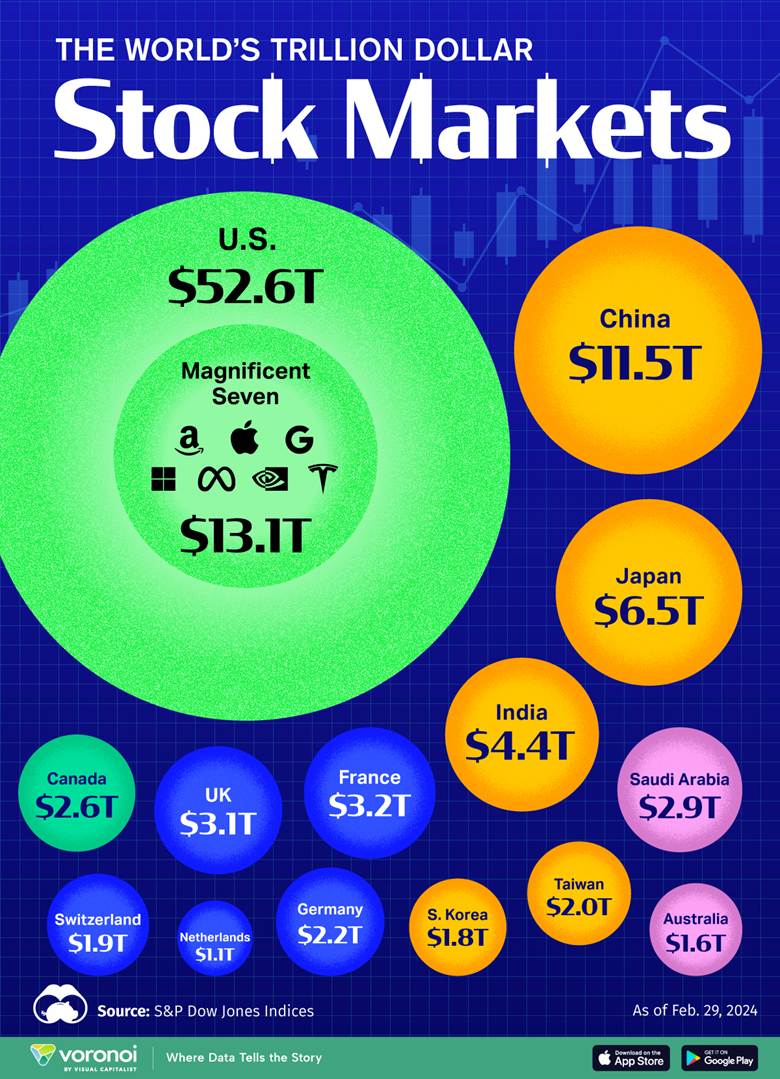

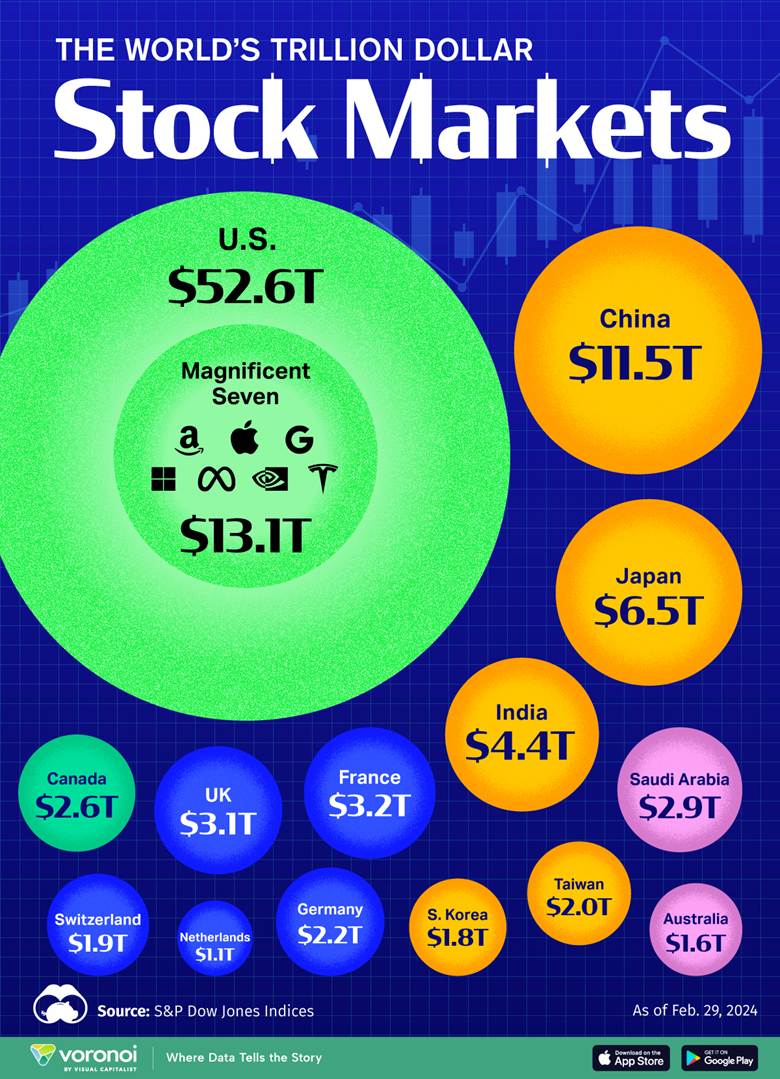

The US bond market ($51 trillion) accounts for about 40% of the global bond market. As shown below, US equities ($52.6 trillion at the end of February 2025) account for approximately 48% of the total global stock market capitalization. As capital leaves US markets, falling prices disproportionately inflict destruction on global wealth.  In the downturns of 2000, 2008, and 2020, the US dollar weakened before sharply rebounding as global risk aversion surged and demand for dollar liquidity soared. We must bet on whether this time will be different, but there’s little to suggest that it is.

In the downturns of 2000, 2008, and 2020, the US dollar weakened before sharply rebounding as global risk aversion surged and demand for dollar liquidity soared. We must bet on whether this time will be different, but there’s little to suggest that it is.

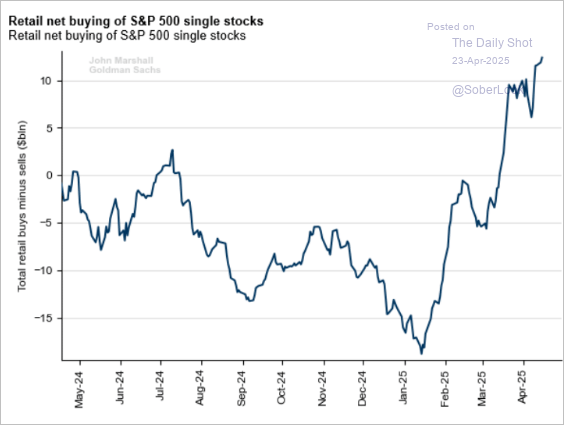

Clients can be hard to help as they often prefer the ‘good news’ touted by sell-side wizards over sober, fiduciary assessments made from the perspective of capital protection and longer-term best interests. This is especially true when sober assessments suggest people need to save more/spend less. The discussion below is painful and accurate.

Clients can be hard to help as they often prefer the ‘good news’ touted by sell-side wizards over sober, fiduciary assessments made from the perspective of capital protection and longer-term best interests. This is especially true when sober assessments suggest people need to save more/spend less. The discussion below is painful and accurate.