Good discussion on the global weakness overwhelming monetary policy makers…

Council on Foreign Relations President Richard Haass discusses China, U.S. relations and the Chinese economy. Here is a direct video link.

Good discussion on the global weakness overwhelming monetary policy makers…

Council on Foreign Relations President Richard Haass discusses China, U.S. relations and the Chinese economy. Here is a direct video link.

Other than the laughable comment that equities were fairly valued in the New Year, Cooperman’s discussion here on the farce that publicly traded markets have become is worthwhile. Here is a direct video link.

And of course, Joe Saluzzi is a true expert on the function of markets, and is one of the people documenting the madness and mayhem being condoned by co-opted market regulators everyday via his Twitter feed here.

The market has a design problem, says Joe Saluzzi, Themis Trading, sharing his thoughts on the impact of high frequency trading on the market’s wild swings. Here is a direct video link.

Another weak reading from the Chinese economy with August imports falling 13.8% in U$ terms after a 8.3% drop in July. Of course exports fell as well, down 5.5% in August after -8.3% in July. Weak exports reflect the soft sales in global markets generally, but it is the weak imports into China which are foiling the best made projections of many other countries who were banking on insatiable demand there to buoy global sales.

The world’s credit driven consumption bubble of 2001-2008 is over, and the rightsizing aftermath persists with an extended period of weaker demand as consumers work down excess debt levels and companies work down excess inventories and capacity. This is not a quick rebound.

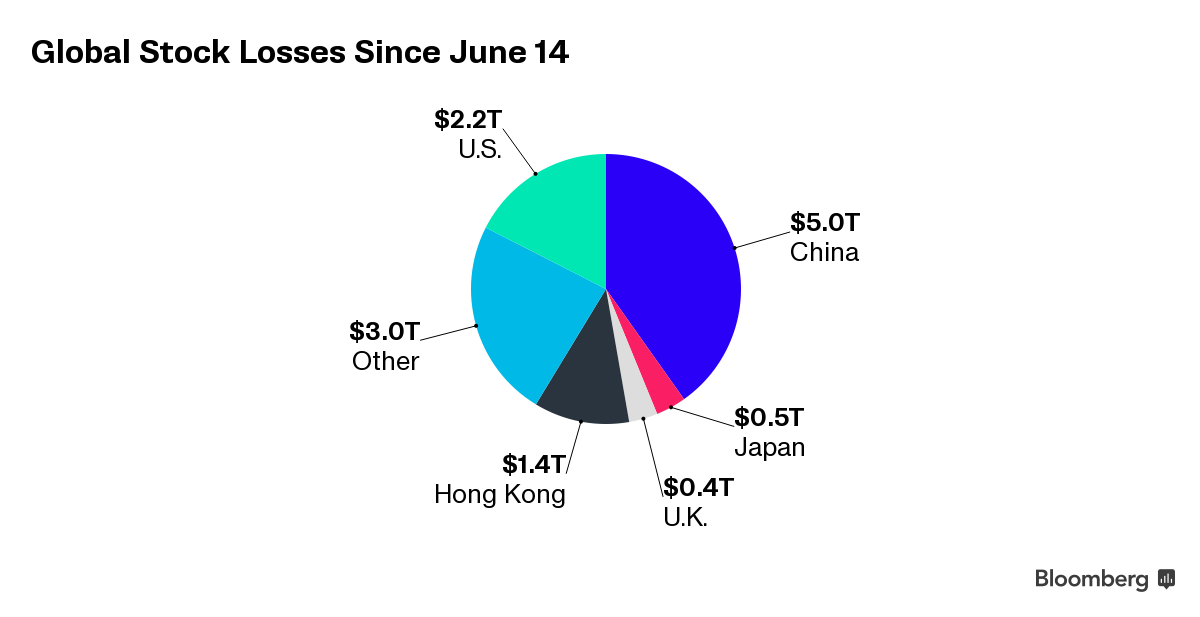

Even though Chinese authorities have been following tricks tried by western monetary magicians like issuing debt and intervening in publicly traded markets to prop up asset prices, th e net effect is still trillions in capital losses since June as graphed here from Bloomberg.

e net effect is still trillions in capital losses since June as graphed here from Bloomberg.

And for all those calling bottoms at every bounce, it is important to appreciate that debt levels and asset valuations are not low or even medium today, but remain near or above all time historic highs even as world GDP growth struggles to hit half of its 2007 pace.

As noted on the graph below of the Shanghai Composite since 2006, even China’s ‘officially’ fabricated reported GDP growth today is still 19% lower than its weakest read in the depths of the 2008 global recession. Why in the world should we assume then that financial assets have bottomed with just modest ‘corrections’ to date?