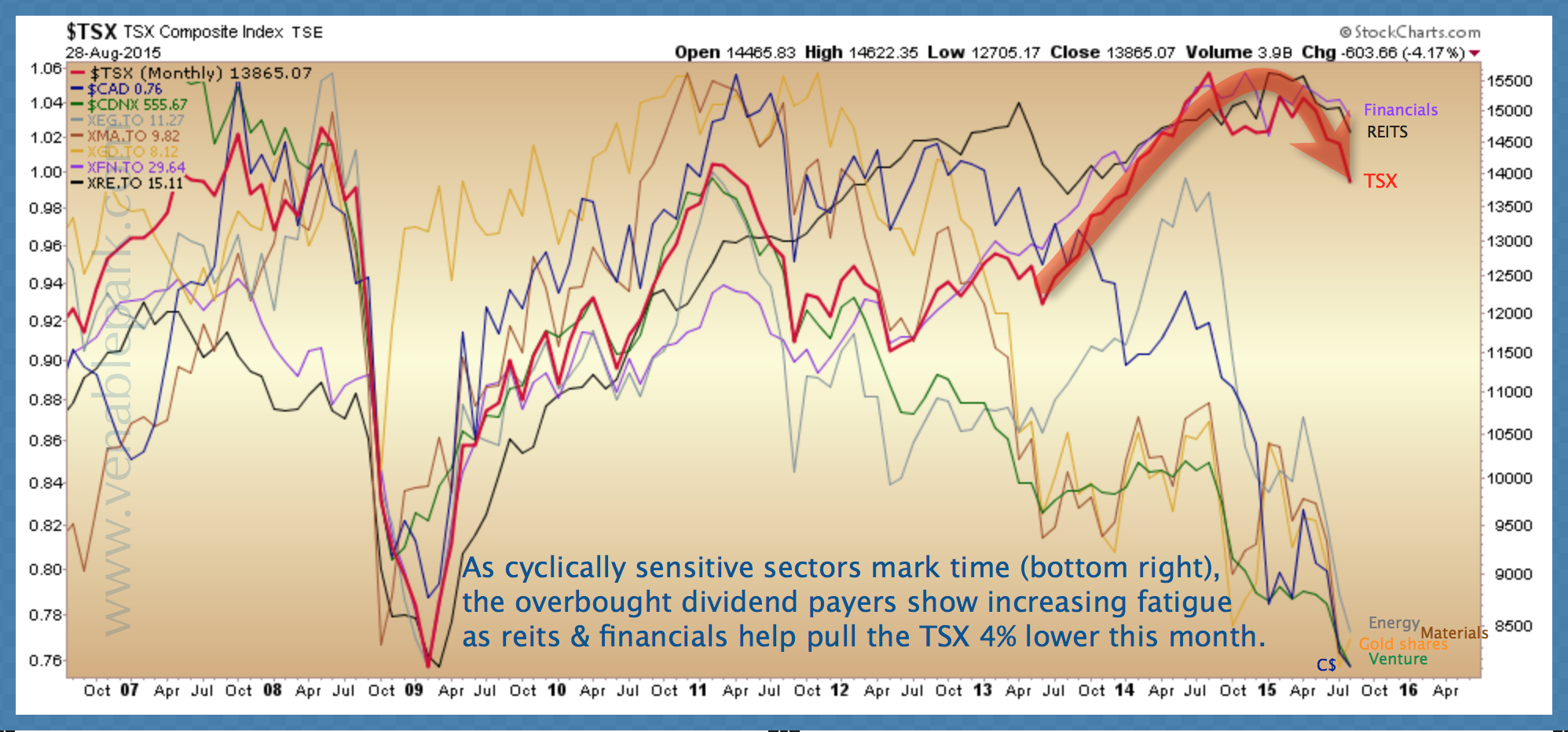

With the price of Western Canadian Crude hovering around $30 a barrel (WTI @ 46-13.30)–and likely to go lower for longer from here–one would expect that new projects that require a West Texas Intermediate (WTI) price of $80 a barrel to break even would be cancelled or postponed. And that is happening. But one would be wrong to assume that means Canadian oil sands production (some of the most expensive on the planet even before full accounting of its environmental costs) will be falling from here.

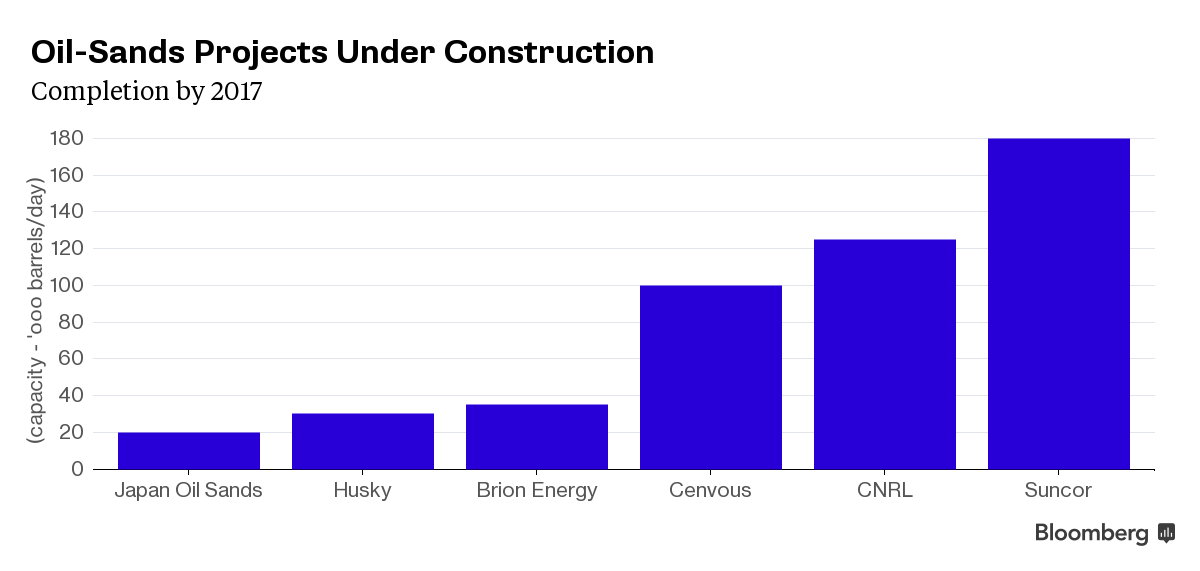

Thanks to sunk costs in projects considered too far along to turn back now, Alberta alone will add at least another 500,000 barrels a day –about a 25% increase — to an already oversupplied North American market by 2017.

All those governments and companies banking on a quick rebound in oil revenues, might want to invest some serious work in developing a viable Plan B…. See: The Oil-Sands Glut is about to get a lot bigger