Last week, the two-year US Treasury bond yield (3.654%) closed below the ten-year yield (3.716%), making for a +.062% spread and the first upward-sloping curve for these yields since July 2022.

The re-steepening of Treasury yield spreads after months of inversion has historically proven to be a reliable warning of economic contraction, accelerating unemployment, and the most punishing part of bear markets.

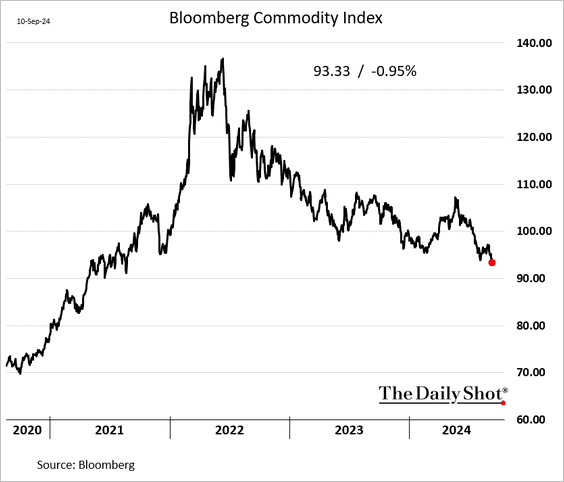

Commodity prices appear to concur with the CRB Index (39% weighted in oil and gas, 41% agriculture, 7% precious metals and 13% industrial metals), down sharply on the week and -10% since May. Oil (WTIC) is negative year to date, -13.5% in the past year and -25.6% since peaking in May 2022.

Fossil fuel company shares (XEG basket), typically the last leg propping up Canada’s TSX at cycle peaks (in black below, versus other sectors, since April 2022), had fallen 4% to the end of August (as shown below) and are down another 10% so far, in September.

The downdraft in equities and other risk markets has been minuscule relative to the due give-back period. So far, stocks and the highest-risk corporate debt have priced less than 20% odds of an incoming recession (black bars below), compared with economically sensitive Treasuries and base metals (in yellow below) that are now priced for 70 and 66% odds of recession, respectively.  See, Wall Street Traders Suddenly Converge on Economic Prospects Ahead:

See, Wall Street Traders Suddenly Converge on Economic Prospects Ahead:

“…the sentiment gap between stocks and bonds was noticeable last month. An equal-weight version of the S&P 500 — which gives Big Tech companies the same weighting as the humble consumer staple — ended August at an all-time high in an upbeat signal about the business cycle ahead. Meanwhile, the yield on two-year Treasuries kept falling, reflecting the conviction that Jerome Powell & Co. will be forced to enact a faster-than-expected pace of rate cuts.

If that conviction builds, risky assets may be forced to take fresh cues from the world’s most important bond market. It’s not a perfect science, but for three sessions in a row earlier this week, the S&P 500 stood within 2.5% of a 52-week high, while two-year rates sat within 50 basis points of a 52-week low — a cluster of divergence not seen since 2019.”

The most important question is not whether a recession and bear market will come—they are inevitable parts of financial cycles. The question is how we will fare when they do.

What’s your plan to survive and thrive through the downcycle? Most individuals and investment advisers don’t have one.