Despite snow banks and cold temps in much of Canada, property owners are getting a jump on what they hope will be strong spring demand.

New property listings leapt 11% nationwide from December to January, the largest monthly increase in almost two years.

The supply influx boosted the inventory of homes for sale in Canada to its highest level since the onset of the pandemic. But so far, it’s failed to attract the desired jump in home sales—the number of transactions dipped in the past two months, including a 3.3% decline in January.

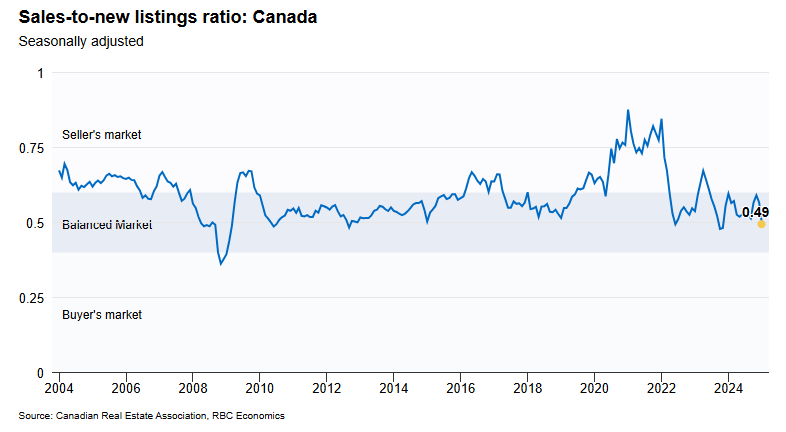

Canada’s annual sales-to-new listings ratio is shown below since 2004. When this ratio dips below .40, market conditions favour buyers over sellers. A full-on buyer’s market has not been seen nationally since this ratio fell to .36 in November 2008. See RBC, Canadian Buyers unfazed by sellers’ early jump into the housing market.

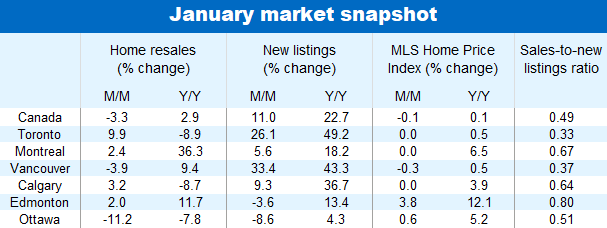

Under the hood, the sales to new listings ratio varies significantly by metropolitan area (shown below). Toronto and Vancouver, at .33 and .37, respectively, were weaker in January than during the 2008-09 recession. In Edmonton, Calgary, and Montreal, supply/demand weightings still favour sellers.

Under the hood, the sales to new listings ratio varies significantly by metropolitan area (shown below). Toronto and Vancouver, at .33 and .37, respectively, were weaker in January than during the 2008-09 recession. In Edmonton, Calgary, and Montreal, supply/demand weightings still favour sellers.

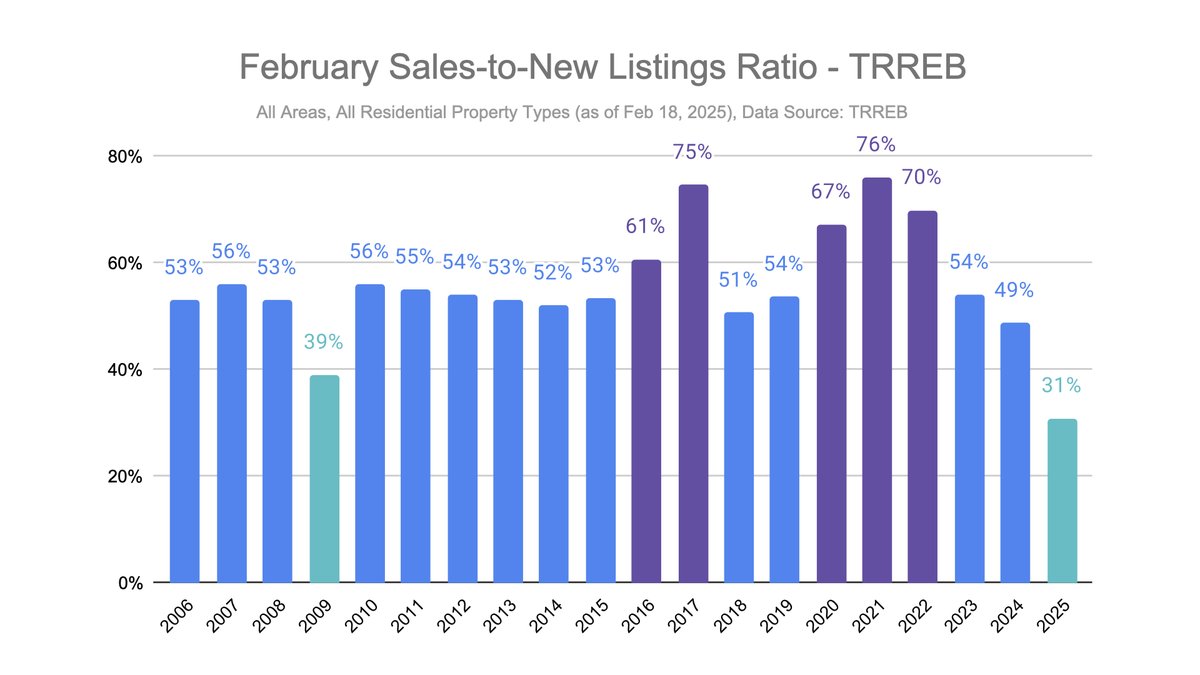

In the first 18 days of February, the sales-to-new listing ratio in Toronto was .31, lower than in 2009 (shown below since 2006). Anyone looking to buy in areas with low sales-to-new listing ratios should not be afraid to make lowball offers and be patient as sellers become more realistic, aka ‘motivated.’

In the first 18 days of February, the sales-to-new listing ratio in Toronto was .31, lower than in 2009 (shown below since 2006). Anyone looking to buy in areas with low sales-to-new listing ratios should not be afraid to make lowball offers and be patient as sellers become more realistic, aka ‘motivated.’ In the 2008 global recession, Canada fared better than most countries because it entered the downturn with relatively less inflated home prices and lower levels of household debt.

In the 2008 global recession, Canada fared better than most countries because it entered the downturn with relatively less inflated home prices and lower levels of household debt.

Unfortunately, what were tailwinds then have reversed into headwinds for Canada in 2025 (Canada’s household debt to GDP shown below since 2005).

The unnatural jump in Canada’s residential property prices from 2008-2022 is shown below (chart since 1970). Previous (lesser) overshoots have been corrected via sharp drops/years of flat prices. This time is unlikely to be different.

The unnatural jump in Canada’s residential property prices from 2008-2022 is shown below (chart since 1970). Previous (lesser) overshoots have been corrected via sharp drops/years of flat prices. This time is unlikely to be different.

Canadians need a new national obsession and investment focus outside counter-productive housing speculation. It’s time to invest in innovation and productivity enhancements that lower costs and improve life quality. MCGA (make Canada great again)?

Canadians need a new national obsession and investment focus outside counter-productive housing speculation. It’s time to invest in innovation and productivity enhancements that lower costs and improve life quality. MCGA (make Canada great again)?