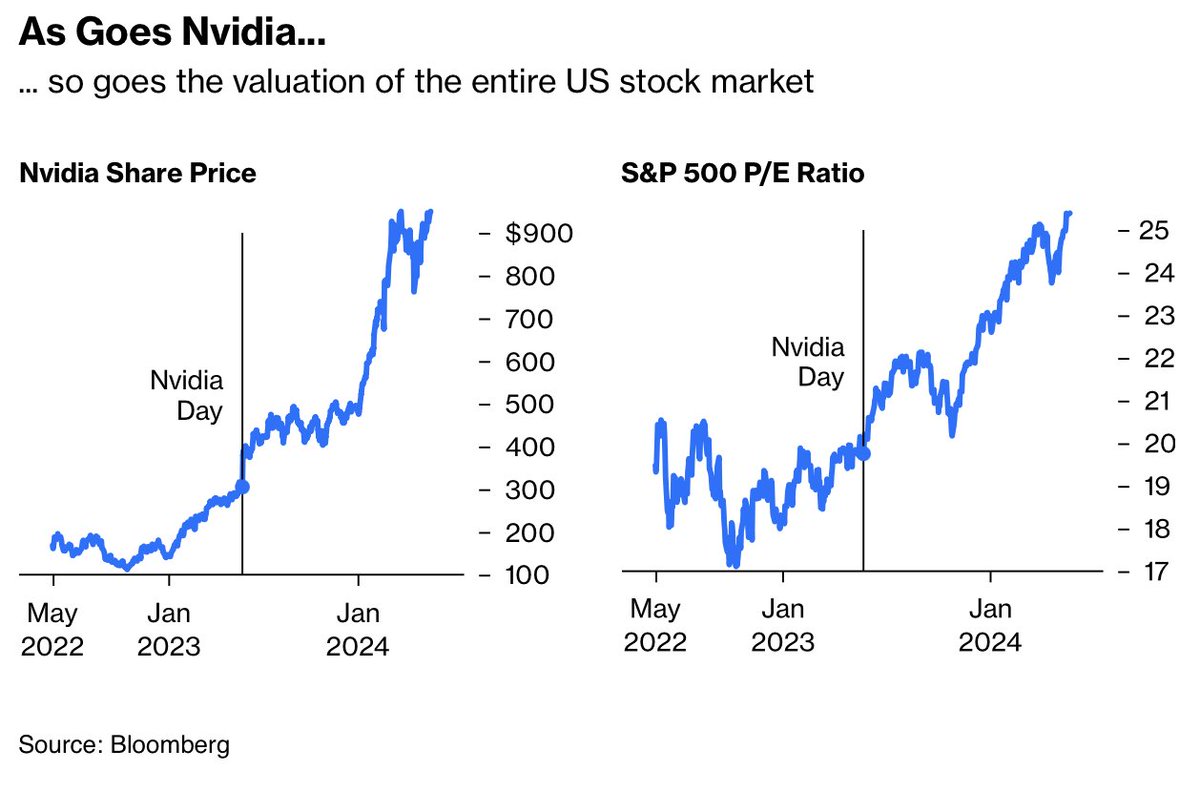

It’s a worldview thing: bulls celebrate AI euphoria led by Nvidia (chart below courtesy of Bloomberg), driving record-high stock valuations amid overstated job and GDP growth that get revised lower in retrospect. Realists see all this and everything else within the historical context.

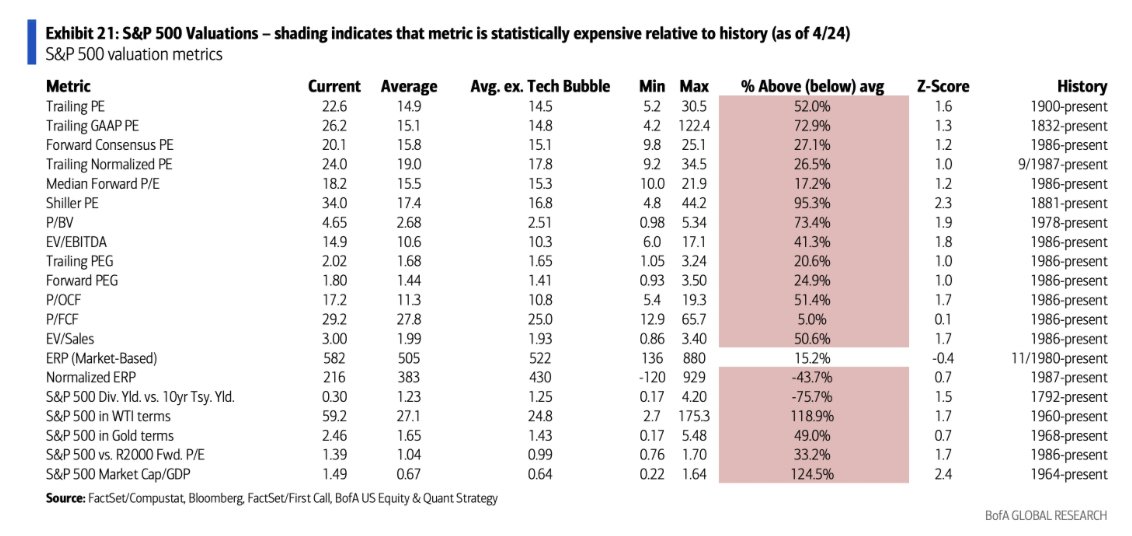

With assets priced for perfection, there’s no room for disappointment. The S&P 500 is leading global equity markets with extreme overvaluations in 19 of the 20 most historically reliable metrics (red below highlights the percent above the long-term average for each measure, courtesy of Bank of America). Such very rare conditions historically have always ended in a steep capital loss cycle. It’s a matter of when not if.

With assets priced for perfection, there’s no room for disappointment. The S&P 500 is leading global equity markets with extreme overvaluations in 19 of the 20 most historically reliable metrics (red below highlights the percent above the long-term average for each measure, courtesy of Bank of America). Such very rare conditions historically have always ended in a steep capital loss cycle. It’s a matter of when not if.

Twenty-six months after the Fed’s first rate hike, the consensus has declared all clear, just as lagged impacts are intensifying as usual.

Twenty-six months after the Fed’s first rate hike, the consensus has declared all clear, just as lagged impacts are intensifying as usual.

The first-guestimate US GDP, at 1.6%, was the slowest since the second quarter of 2022, and unemployment is on the rise. Consumers have spent their brains out by maxing out credit and slashing their savings rate—all classic risk-magnification behaviours that precede financial storms.

Who are you going to believe, investment salespeople or realists looking to avoid capital losses? The latter periodically induces periods of nausea, but the former eventually leads to catastrophe. We each pick our poison and live with the consequences.

The discussion below offers some big-picture clarity.

Stocks fall to session low: Bond Yields climb after Fed Minutes — DiMartino Booth Joins Charles Payne of Fox Business News to Discuss. Here is a direct video link.