Participating in a recent VRIC panel with my two favourite economists was fun, and I have included the video clip below.

As the only money manager on the panel, I must add a caveat to David’s comments about the Canadian stock market being relatively cheaper than the U.S. That’s true, as I have noted many times, including most recently in Starting Points Matter most of all.

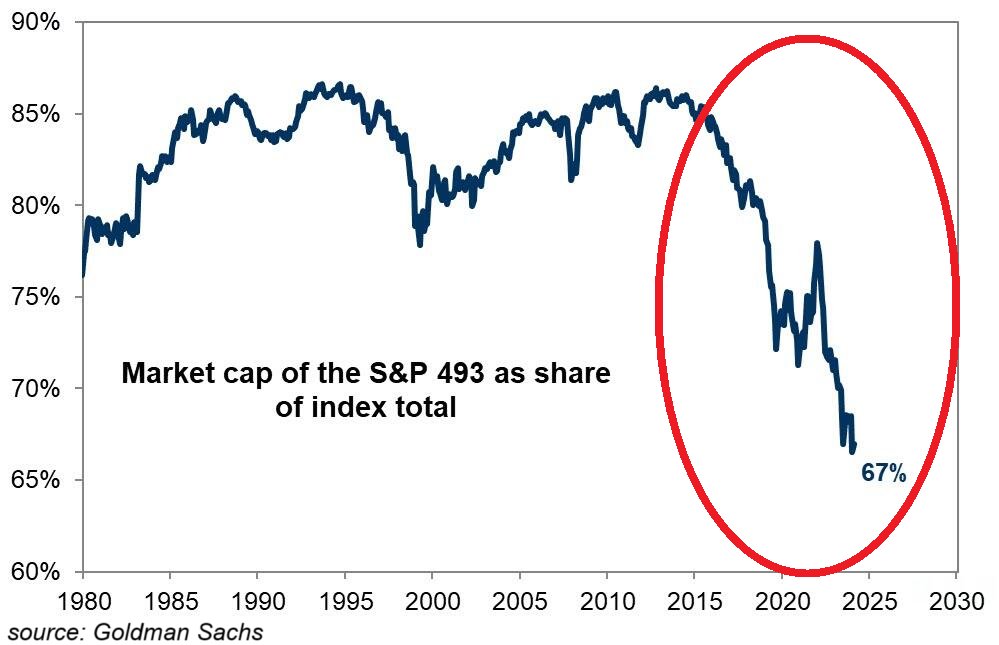

U.S. stock markets are trading at the highest valuations in the world and higher than 92% of all historical incidents on the insightful, cyclically adjusted price-to-earnings ratio “CAPE.” Canadian stocks have appreciated less, to be sure, but at 25x earnings, they rank second only to the U.S. globally and more than 69% of historical incidents.

Unfortunately, being less overvalued does not mean the Canadian stock market will be saved from a bear market. If that were true, life as a capital protector would be much easier. In reality, global stock markets are highly correlated.

Canadian stocks were less overvalued in the 2000 tech bubble, and Canada did not follow America into an official recession in 2001. Still, the TSX lost 50% (2000-2003) while the Nasdaq fell 80%. In 1980-1982, the TSX dropped 45%, 1990-1993 (24%), and 2008-2009 (50%). In the 2020 COVID meltdown, the more ‘fairly valued’ TSX fell 37% in 3 weeks as global markets crashed.

Apart from the highly irregular COVID plunge and 11-month bounce back, the shortest recovery time was four years to 1984 to recoup the 1980-82 losses. It took eight years to 1995 to recover from the 1987 market drop, even though no recession unfolded.

In the 2008 bear market, the TSX dropped back to the price level it had first reached eleven years earlier in 1998.

It took six years for the market to recoup its 2008 high by 2014, and it remained range-bound until December 2018, for a decade of flat pricing. Even that proved fleeting; the TSX gave back twenty years of gains as it tumbled back to the 2000 cycle high in March 2020.

Amid unprecedented monetary and fiscal stimulus following 2008, including years of near-zero interest rates, it took twelve years for the price index of Canada’s most valued companies to hold above the 2008 cycle peak by May 2020.

Then, the 14% sell-off from March 2022 to last October returned the TSX to the same level as April 2021. At that point, the index had managed a 24% gain over more than 15 years and underperformed T-bills with much greater capital risk and psychological trauma.

Dividends help reduce total losses to the extent they continue to be paid. If a market drops 40% while paying a 3.2% dividend (like the TSX today), the total capital loss will be reduced to 36.8%, assuming no withdrawals or fees and all dividends are reinvested.

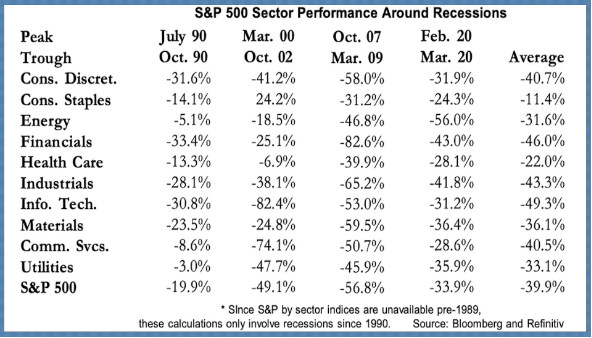

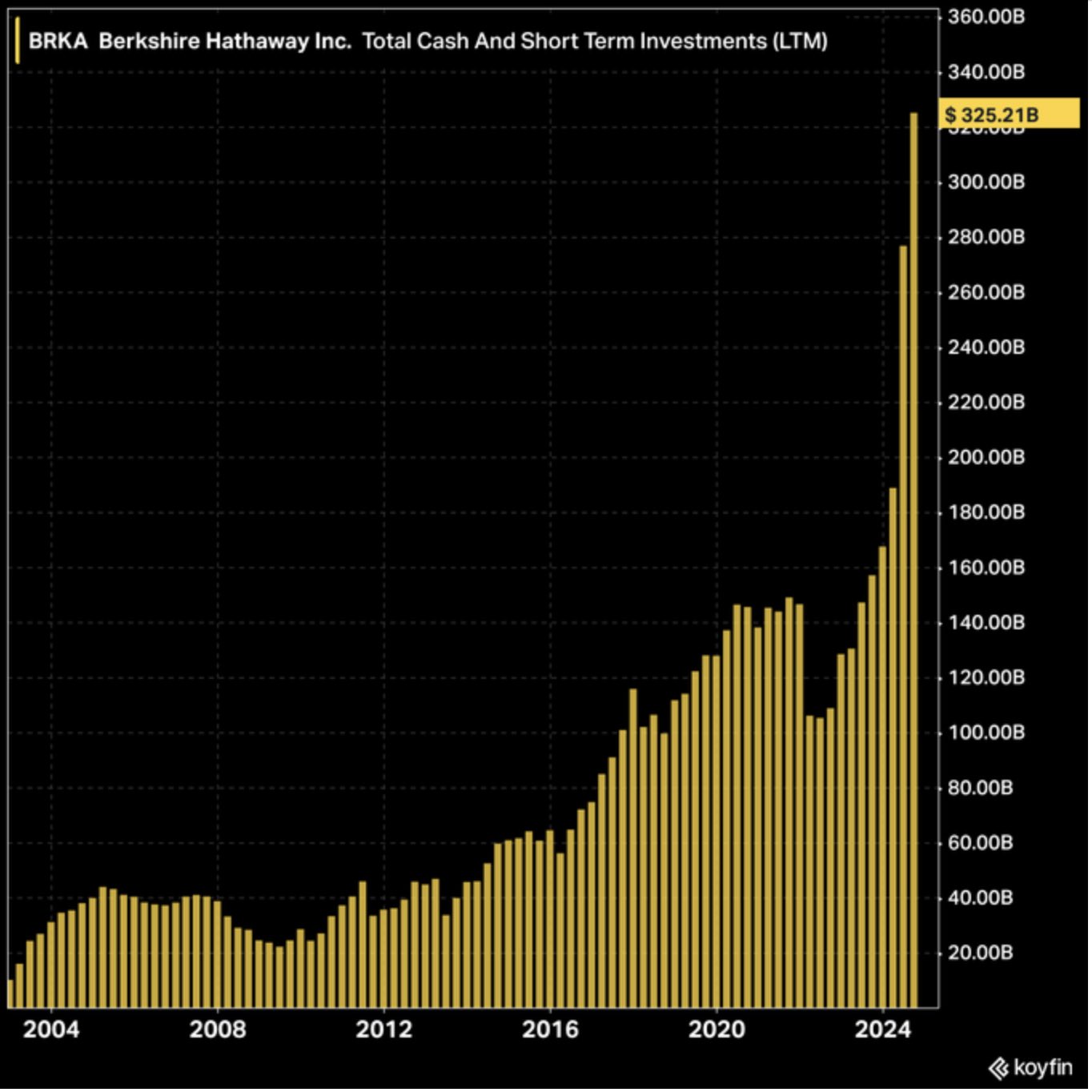

The table below (ala A. Gary Shilling) shows the cyclical decline in different sectors, including dividend-payers like staples, financials, health care and utilities, versus the S&P 500 over the past four recessions. #fuugly for holders, but this is how valuable investment opportunities present to those with cash and discipline.

Today on the channel, Jay is joined by Danielle Dimartino Booth, Danielle Park and David Rosenberg on stage at the VRIC 2025. The conversation covers key economic and market themes, including the impact of Donald Trump’s second-term policies, potential tariffs on Canada, inflationary risks, the Federal Reserve’s monetary response, and the current state of the stock market. The panelists provide expert insights on market overvaluation, interest rates, and global economic trends, offering a mix of cautious skepticism and strategic investment considerations. Here is a direct video link.