The Nanos Pocketbook Index, a component of the broader Bloomberg Nanos Canadian Confidence Index and a measure of how Canadians perceive their personal finances and job security, fell to 50 last week, the same level as the pandemic low in April 2020.

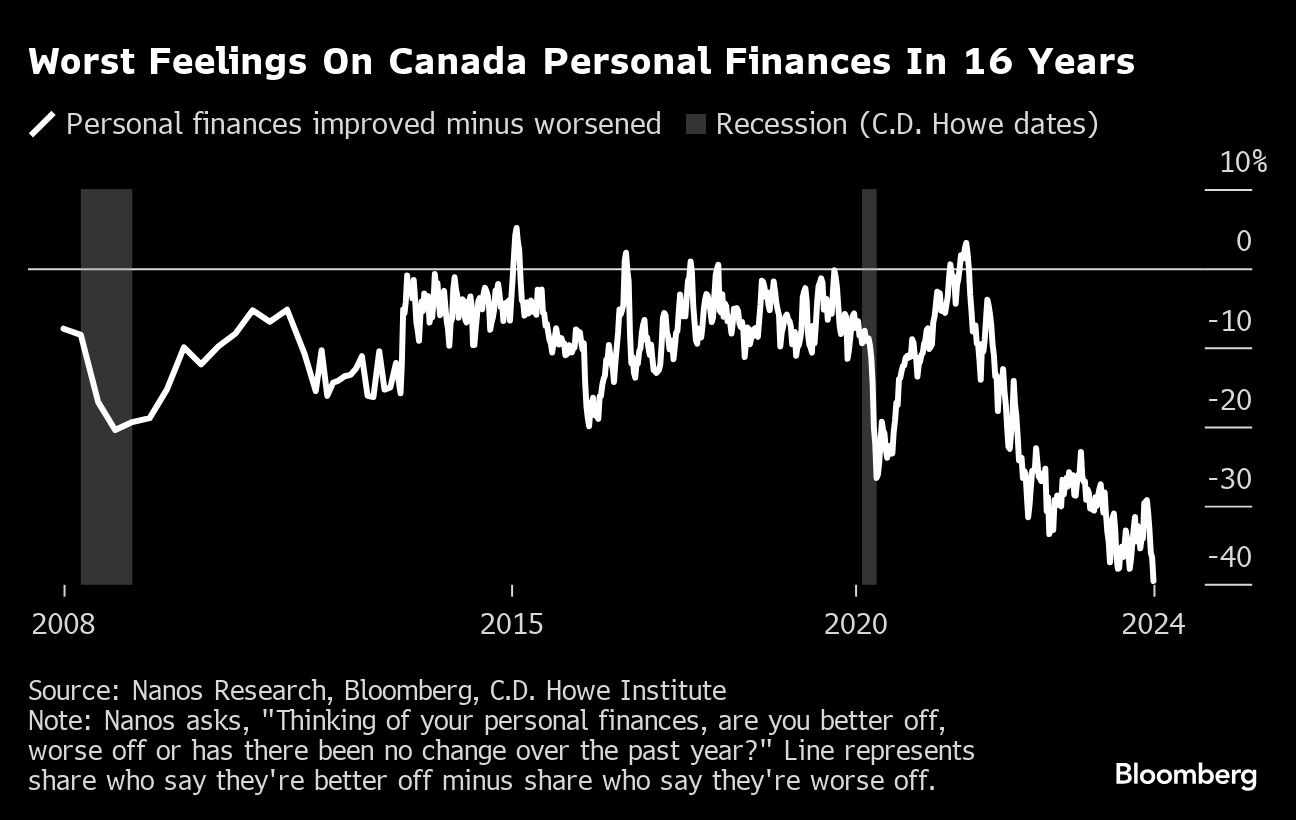

Fifty percent of respondents said that their finances had worsened in the past year compared with just 11% who said their finances had improved. This was the most negative spread in sentiment since the inception of the survey in 2008 (chart below). See: Canadians feel poorer in warning sign for the economy, Trudeau.

Youth unemployment (at 10.9% in March vs. 6.6% in December 2022) has risen about four times faster than unemployment for all age groups. Overall, the 1.1% increase in total unemployment, to 6.1% from 5.0% at the end of 2022, is above 2019 levels and the greatest increase among peer nations. See National Bank: How does Canada stack up globally? Not great.

Dour sentiment and deteriorating employment are contagious, especially in consumption-driven economies. Canada has so far avoided a confirmed recession thanks to lagged data and record immigration, but on a per-capita basis, the economy has shrunk by three percent since September 2022, is weaker than before the pandemic, and sporting the worst growth trend of developed economies (2023-2024 shown below, courtesy of National Bank). On the goods news front, Canadian core inflation (ex-food and energy at +2% year-over-year in March) was lower than most countries. This means that Canada has higher real rates than its peers (shown in red on the lower right) and opens more room for the Bank of Canada to ease financial conditions. Presently, just 60 basis points of 2024 cuts are priced into Canadian bond prices (versus 130 bps at the start of 2024; see bars on the lower left).

On the goods news front, Canadian core inflation (ex-food and energy at +2% year-over-year in March) was lower than most countries. This means that Canada has higher real rates than its peers (shown in red on the lower right) and opens more room for the Bank of Canada to ease financial conditions. Presently, just 60 basis points of 2024 cuts are priced into Canadian bond prices (versus 130 bps at the start of 2024; see bars on the lower left). With no quick economic boosts on the horizon, Canadian bond yields are retreating (bond prices rising) and are now back to where they were last November when Canada’s stock market (TSX) was some 15% below its current level. Disconnects like this are typically short-lived, usually with stocks capitulating to the bond market’s math-based assessments.

With no quick economic boosts on the horizon, Canadian bond yields are retreating (bond prices rising) and are now back to where they were last November when Canada’s stock market (TSX) was some 15% below its current level. Disconnects like this are typically short-lived, usually with stocks capitulating to the bond market’s math-based assessments.

All of this reminds us of similar conditions that we described in October 2008 as follows:

As we have said before, for the past couple of years, stock markets have been wildly over-priced and blindly optimistic about economic prospects in 2008 and 2009. The real estate markets have been correcting for a couple of years already, the credit markets have been in severe contraction for over a year. The stock markets of the world have been slow to get it and are now rather violently having to concede reality. Stock investors have been slow to wake up. There is an old saying in finance that the bond markets are driven by the brains, while the stock market is driven by hair brains. The adage is seemingly accurate this time again.

Like now, GDP growth rate estimates were positive across the board in the first half of 2008. It was not until early 2009 that backward-looking revisions began to reveal that the great recession had begun in December 2007. Negative 2008 GDP revisions continued for the next ten years to 2018.

The stock market did not bottom until March 2009, some 50% below the prior cycle peak. It then took six years of government support, near-zero interest rates, and central bank cash infusions for the stock market to recover its 2007 high. By then, many who had bought and held near the cycle top had long since liquidated in losses–a typical outcome.