Canada’s economy is slumping, along with support for the federal government. So far, the Bank of Canada says it plans to ease policy rates at a slower pace in 2025. The Treasury market is not convinced. Through fits and starts, government bond prices have continued to rise on safety-seeking inflows (yields in a downtrend).

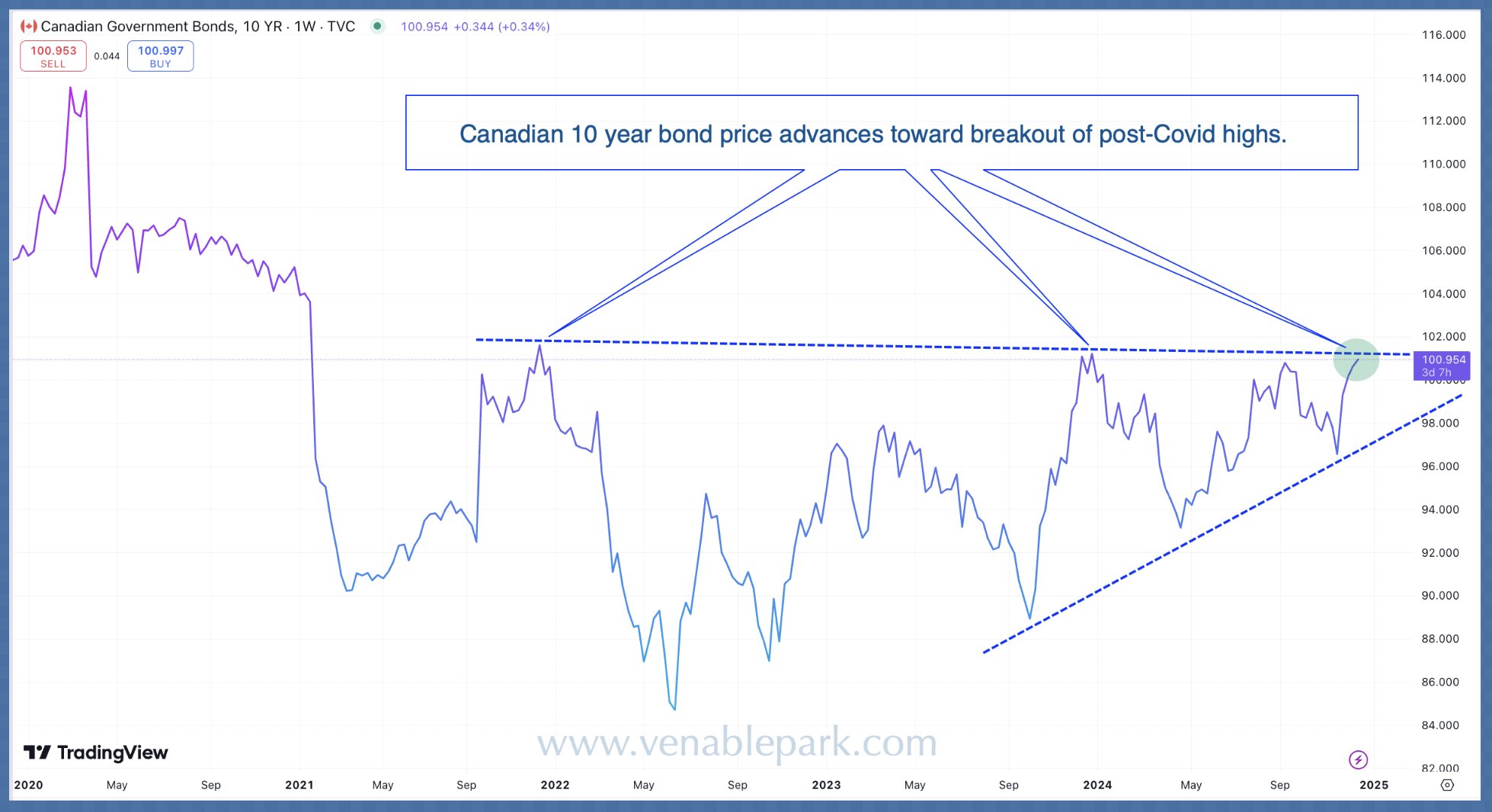

The 10-year Canada Treasury price at $100.80 is nearing the $101.20 high of December 2023 and the $101.60 high of December 2021 before that (below since 2020, courtesy of my partner Cory Venable). In the process, Canada’s 10-year yield is off 100 basis points from a 4.15% peak in the fourth quarter of 2023. Lower interest rates hurt savers but relieve indebted consumers, while pandemic-inflated prices and high debt levels remain a strain for most.

At the same time, the USD has broken through the 1.43 CAD level for the first time since spring 2003, nearly 22 years ago (see red line below, courtesy of Cory since 1971).

At the same time, the USD has broken through the 1.43 CAD level for the first time since spring 2003, nearly 22 years ago (see red line below, courtesy of Cory since 1971).

A weak loonie is needed if Canadian exports are to stay competitive. However, this much weakness, with the riskiest markets still near cycle highs, is unusual.

A weak loonie is needed if Canadian exports are to stay competitive. However, this much weakness, with the riskiest markets still near cycle highs, is unusual.

Historically, the commodity-centric Canadian dollar bottoms against the USD near the end of recessionary bear markets after the US Fed and Bank of Canada have been easing credit for several quarters, and the unemployment rate continues to rise.

The loonie bottomed in the spring of 2009, as the stock market completed a -50%, 3-year drubbing, and oil prices hovered near $30 a barrel. It also bottomed in the summer of 2002, as the stock market halved over two years and oil prices hovered around $25 a barrel.

Remarkably, the loonie is weaker today than the risk-off pandemic lows of March 2020, when the stock market plunged 37% in three weeks and oil prices went negative. So far, the stock market remains near all-time highs, and West Texas Crude is around $70.

Equity markets and oil prices are overdue for the next bear market cycle, and it would be unusual if the loonie did not weaken further as that happens.

Retesting the 2002 lows in the CAD 1.60 area is possible, and would suggest that the Bank of Canada is easing more aggressively than currently priced in. That scenario should further boost the price of government bonds while riskier assets mean revert. In the near term, anything can happen. However, with equity and credit markets offering zero prospective rewards and extreme capital risk, the USD and government bonds are more attractive places to hold retirement savings.