A house on our street recently sold for $8 million to a buyer in his early 40s. Our mutual tradesperson had the scoop: the guy made his money in Bitcoin. This is his summer house; he lives in Hawaii. On closing, he installed lifts in the garage, stacked them with exotic cars, and put a $400,000 golf simulator in the basement. Wow. Congratulations.

I have some questions.

Did our new neighbour sell enough Bitcoin to pay for these things in cash, or did he sell just enough for downpayments and use loans and leases for financing? If so, how much are the payments on these?

The property taxes on this waterfront property would be around 50k a year, and then there are all the insurance premiums, utilities, upkeep, and maintenance of expensive things. How much does that add up to annually? Is he spending less than 30% of his annual income on carrying costs for his homes?

Does Mr. Bitcoin have active employment or business income, or is he living off withdrawals from his portfolio? Bitcoin produces no income. What percentage of his life savings is still in crypto? Does he have most of his net worth in a diversified portfolio providing capital security and income? How much income are his assets producing compared with how much he is spending? What is the cash flow and risk management plan for when crypto and other risk assets enter their next major loss cycle?

The trouble is that when people suddenly come into money, they often make poor financial choices. They commonly think they are winners due to smarts and financial acumen rather than good luck. They often quit their jobs and other efforts to earn active income.

They typically spend too much on consumption items, ratcheting up carrying costs. They often make downpayments and finance the rest. Rather than cash out, they frequently leave the bulk of their winnings in the asset that paid off (not wanting to sell and trigger tax is commonly cited as the rationale for this, along with the belief that the winning asset will keep doing more of the same).

People around the ‘new money’ often help perpetuate destructive choices. Those receiving sales, fees, commissions and other benefits from the association are incentivized to go along for the ride—friends, associates, consorts, and family, too.

Winning can be great fortune that sets one up for life—it’s rare but possible, so long as sober risk management and financial discipline drive the decision-making.

More often, however, big wins are a gateway to mental illness and destructive choices that leave scars for years thereafter. Yet, few talk about this reality. If they do, it is only after the fall when there is plenty of blame and finger-pointing to go around.

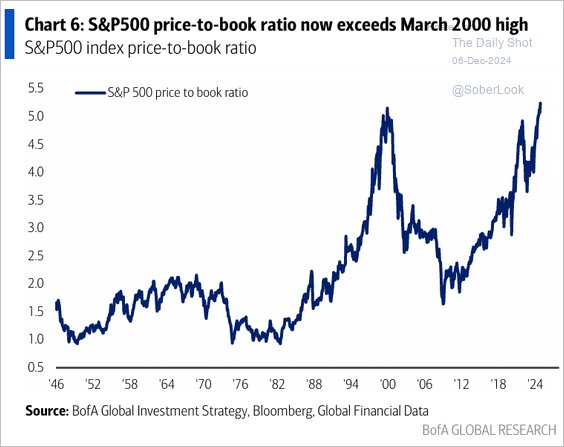

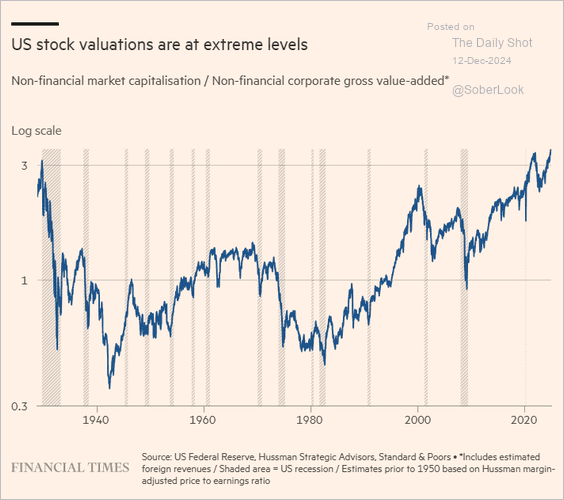

One of the surest signs that we are in a financial bubble is the growing complacency and belief that frothy valuations don’t matter, prices can only head higher, and ‘volatility’ is not a concern. This thinking is a reliable setup for pain in the human world of finite time horizons and daily cash needs. And it’s not just crypto-betters or precious metal lovers in danger here.

Bubble asset valuations and an impending or ongoing retirement can lead to hellish real-life outcomes. The Gl0be’s Ian McGugan connects the dots well in Some investors should worry about bubbles. Here’s a taste:

If you don’t need to touch your money for the next 30 years or so, stock market bubbles are just a passing annoyance. They can be safely ignored. Like any calamity, they tend to fade into the background once enough time has passed.

The problem, though, is what happens if you need to tap your portfolio for income over the next few years. In this case, a popping bubble can seriously disrupt your plans.

McGugan goes through some real-life numbers; the whole article is worth reading.